Like any Canadian who has a market-based investment portfolio, headlines in the media can make for a very anxious journey. Good and bad news alike, can cause emotional reactions and potentially invoke bad decision making.

Long-term investing does not have to be worrisome exercise. You can have a more enjoyable investment experience by subscribing to the 3 following “time-tested” investment principles:

1. Uncertainty is unavoidable

The last 3 years in the market have been arguably the most worry-inducing years as of late. We have gone through a global pandemic, a war in Ukraine, a meteoric rise in inflation, and ongoing recession fears. Although, this level of uncertainty seems unprecedented, there have been periods in the past where inflation has sky-rocketed (1973 – 1974), wars have occurred, and other global events inflicted the same level of volatility. That being said, the US market – as measured by the Russell 3000 (broad market cap weighted index of public US companies) – has had an annualized return of 11.79% (from February 28, 2020 to February 28, 2023). This is slightly above the index’ annualized return of 11.65% since inception in January 1979. Given all the uncertainty in the market in the last 3 years, I’m sure there aren’t many who would’ve guessed the US market would have returned over 11% per year over the last 3 years.

2. Market Timing is Futile

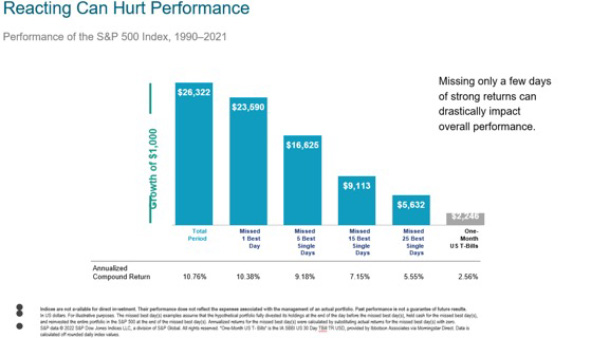

When the market is volatile and your portfolio is fluctuating, it is only natural to feel compelled to do “something”. However, as ongoing research has demonstrated, timing the market and making short-term changes rarely provide the desired outcome (i.e. outperforming the market).

In the 32 years from 1990 – 2021, there would be approx. 8,064 trading days. By missing 0.3% (25) of the best trading days, you would essentially cut your annual performance number in half. From another perspective, you would have to capture at least 99.7% of the best trading days to achieve half the annualized return that the market provided from 1990 – 2021. Just stay invested.

3. Diversification – spread your risk

By now, you should be quite familiar with the concept of diversification. It is a simple way to minimize the risk that any one company, asset class, sector, or country will have on your portfolio.

If we think of the crisis “du jour”, Silicon Valley Bank (“SIVB”) made headlines earlier this month. As of February 28, 2023, the company made up 0.04% of the Russell 3000 index. Regional banks similar to it made up 1.7% of the Russell 3000 index. For those investors with globally-diversified portfolios (geographic exposure outside of the US as well), the exposure to SIVB and other US regional banks would have been significantly smaller.

By following these investment principles, short-term crisis’ and the media’s subsequent headlines will be much more easily digested.