Investing represents a complex undertaking in which individuals and institutions allocate their money into certain funds to generate financial returns. Nevertheless, it’s essential to recognize that every investment opportunity carries a degree of risk. Central to the decision-making process in investments is the concept of the risk-return tradeoff, which revolves around the notion that higher returns are generally linked to increased levels of risk. Conversely, lower risk is associated with lower potential returns.

This article delves into the risk-return tradeoff, its significance and offers insights on how investors can effectively navigate this fundamental principle to make well-informed decisions.

Understanding Risk and Return

In investment terms, risk refers to the uncertainty of achieving expected returns. This uncertainty can stem from various factors, including market volatility, economic conditions, geopolitical events, and even the inherent characteristics of a particular investment. Conversely, returns represent the gains or losses generated from an investment over a given period.

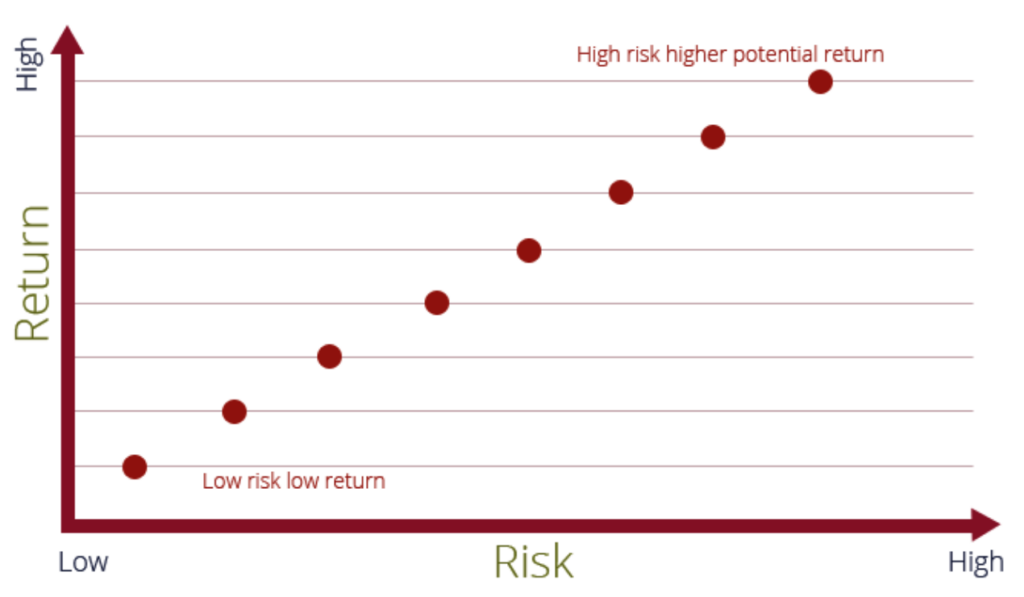

The risk-return tradeoff is often graphically represented as an upward-sloping curve. On this curve, investments with lower risk (e.g., government bonds) are on the left side and offer relatively lower returns. Conversely, investments with higher risk (e.g., stocks in emerging markets) are positioned on the right side and have the potential for higher returns.

Something important to remember is that it is unlikely to find an investment combination with low risk and high return. If an investment like this existed, rationally, it would be the only choice made by all investors, as who doesn’t want that combination?

Unfortunately, this does not exist. The more return you seek, the more risk it will come with. There are ways to avoid certain types of risk by using investment strategies like diversification, but at the end of the day, there is no way to eliminate all risk.

This is where understanding your risk tolerance comes into play. Everyone wants high returns, but how much risk are you willing to take on to get there? When choosing an investment portfolio, assessing a client’s risk is how Financial Advisors recommend an investment strategy that will work for them.

Conclusion

The risk-return tradeoff is an essential aspect of investment decision-making. When constructing their portfolios, investors must carefully weigh their risk tolerance, time horizon, and financial goals. By understanding the relationship between risk and return, people can make informed choices that align with their unique circumstances and objectives.

Ultimately, there is no one-size-fits-all approach to investing, as each investor’s risk-return tradeoff will differ. The key is to strike a balance that aligns with your financial aspirations while acknowledging and managing the inherent risks of pursuing returns. Understanding the risk-return tradeoff is essential for creating expectations of what the returns of your investments may look like in the future.