Scroll through any financial media and try not to find one article with a negative spin about the current market. Most articles you read will highlight the impending doom of our economy, financial markets crashing, and housing market corrections. By design, most media outlets get paid based on traffic and clicks on their sites. It’s simple; negative topics attract the most viewership.

While it may benefit the media outlets, these negative articles can harm Canadians’ mental health and stress levels.

Fortunately, our office has started to see a new, more positive trend emerge. We aren’t receiving as many phone calls about negative markets, we don’t see that stress in our clients in meetings, and most importantly, clients are not looking to sell out of their portfolios. It seems our efforts to educate our clients about market downturns and the cyclical nature of markets have worked. That, coupled with our highly diversified investment strategies has made for a winning combination. We have seen our clients “graduate” from student to master. During our meetings, clients can even finish our sentences when we begin to explain the market downturns. Now that is amazing!

Education has always been a big focus for our office, through client meetings, newsletters, lunch and learns, and more recently, podcasts and videos, and it’s terrific to see that our message is making it to our clients.

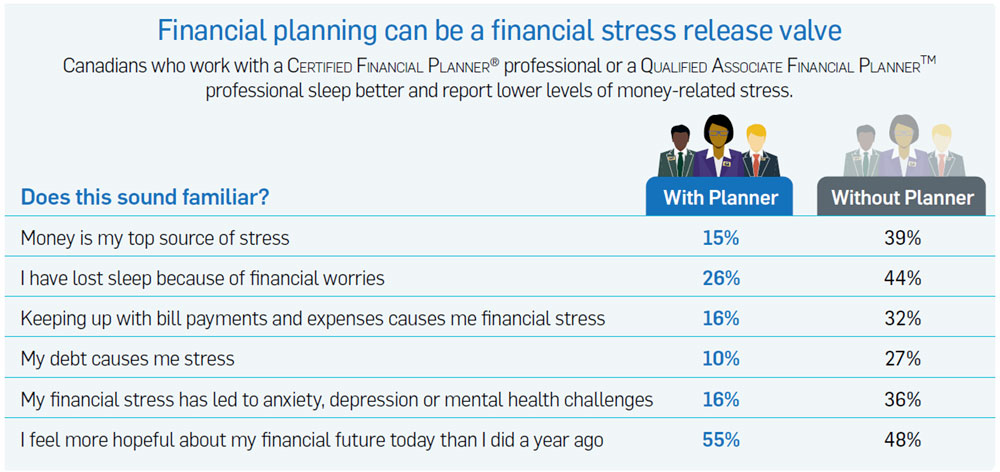

However, not every Canadian is in this position. A recent study from Financial Planner Canada called The Financial Stress Index illustrates how Canadians’ stress levels varied based on whether they had worked with a financial planner. The study found that those who worked with a Financial Planner were less likely to name finances as their number one cause of stress (15%) than those not working with a planner (39%). Also, those not working with a planner were nearly twice as likely to lose sleep over their finances, and that financial stress led them to increased anxiety or depression.

2022 FP Canada™ Financial Stress Index

An online survey of 2,001 Canadians was completed between April 12-April 20, 2022, using Leger’s online panel. A probability sample of the same size would yield a margin of error of plus or minus 2.2 %, 19 times out of 20.

Our goal as Financial Advisors is to help as many Canadians as possible navigate their way to a happy retirement. That is why we recommend that if you, or someone you know, who may be dealing with heightened anxiety due to the adverse market, get in touch with our office. We understand it may be difficult for people to make a change; transferring accounts can become expensive; for a limited time, our office will cover the cost of account transfers. We hope for improved financial literacy and fewer sleepless nights for all Canadians.