AWealthOfCommonSense.com:

“Stock market valuations may not make sense to a lot of people right now but valuations often don’t matter much in the short run.

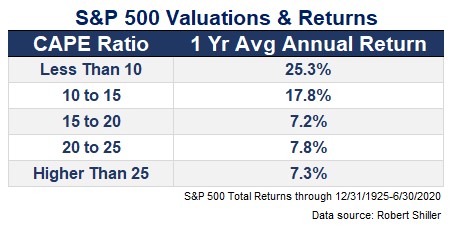

Take a look at the average one-year returns for the S&P 500 from various starting CAPE ratios going back to 1926:

Lower than average valuations show substantially higher average returns but the average one-year returns are actually better for the higher than 25 and 20 to 25 levels than the 15 to 20 subset for long-term PE ratios.

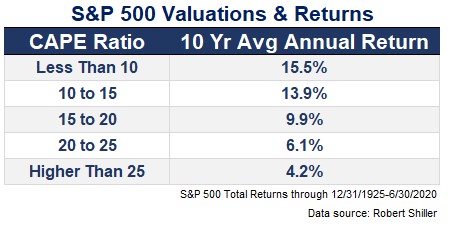

In the short run the stock market is a voting machine while in the long run it’s a weighing machine, as Benjamin Graham so eloquently put it. If we go out even further you can see the weighing machine takes over:

Now the relationship is clear as day — higher starting valuations lead to subpar long-term returns while lower starting valuations lead to above average returns.

With a current CAPE ratio approaching 30x yet again (it only got as low as 24x in March) investors should definitely expect lower long-term returns from current levels…right?

It depends.”