Today on ThinkSmart with TMFG Rob McClelland and Mike Connon review their recent discussions with the Advisor to Advisors, Nick Murray. Nick has been a financial services professional for more than 50 years and is among the industry’s most respected writers and speakers on all things financial.

Transcription

Rob (00:00):

Hello, this is Rob and Mike from The McClelland Financial Group of Assante Capital Management. And this is Think Smart with TMFG. Today on Think Smart with TMFG. Mike and I are going to be discussing the legendary Nick Murray and his thoughts on investing in great companies in the world.

Mike (00:26):

So who was Nick Murray, Rob?

Rob (00:28):

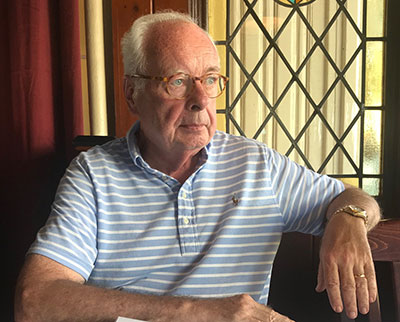

Well, Nick Murray was a financial advisor for many years. He retired from being a financial advisor and became almost a mentor to financial advisors. And so I’ve been following him since about 1995. Nick is now in his seventies and he just has the ability to put investing into a simple formula and perspective that is so different than most of the individuals in today’s marketplace.

(01:06):

I thought I had the chance recently with a couple of other advisors on the team to sit through an all day webinar with Nick from his home talking about the lessons that he’s learned about investing. And I thought it would be a great idea to share those with our audience.

(01:27):

One of his initial quotes talked about inflation and he actually called inflation financial cancer. And the big reason that it eats away at the purchasing power of your investments. What he talked about is that the key is not maintaining the amount of dollars you have. So if you have a million dollars, you don’t want to still have a million dollars 10 years from now. What you really want to do is maintain the purchasing power of that a million dollars. So you need to keep that money growing ahead of inflation after taxes and after inflation. And that’s not easy to do, but Nick was really helpful in saying, “Here’s how you do it.”

Mike (02:17):

Yeah, I remember when the dream was to be a millionaire, you thought all your troubles would be solved, right?

Rob (02:22):

Little did you realize your job was to be able to not only maintain that million dollars, but grow that million dollars. That’s truly creating wealth.

Mike (02:31):

Yeah. We realize there’s no fixed amount of money you really need. It’s going to be moving target and always moves in the upward direction.

Rob (02:38):

So Mike, help us with understanding. There’s two simple ways to invest your money. When you eliminate most of everything, what are the two simple ways to invest your money?

Mike (02:51):

There’s two things. You can either be, I guess we call it, you can either be a loaner or an owner and you can either loan money to companies and that would be in the form of own and bonds or some type of fixed income vehicle where you’re given money to a company to use or a government to use and you’ve negotiated ahead of time a fixed rate of return that you’re going to get for them using your money over that period of time. So it’s generally a fixed term and a fixed amount that you’re going to get. And it’s very safe. You know? The only risk you have really is that that company goes out of business or the government goes out of business, otherwise you’re pretty much promised your money back. As long as those companies are still business. They can’t pay anyone else until they pay you. You’re one of the debt owners.

(03:40):

The second thing is you can be an owner, which mean you actually own part of the business. And the great part about owning the business is there’s no limitations as to what you’re going to be paid back. It all depends on how the company does. There’s more risk involved of course because of the company that doesn’t do well, you won’t make as much money. But again, when the company does well, you’re going to make a lot more. You get all the excess of what the company makes. If you think about companies, companies are in business. They’re actually borrowing money, right? Most companies have large loans they take to expand their business. If they didn’t plan on making more money than they were going to pay on the interest that they borrowed, they would never borrow that money in the first place. So they always expect an excess rate of return.

Rob (04:25):

One thing about Nick is, when he talks about investing in companies, he doesn’t talk about investing in just one company. He’s always a big believer in investing in a large portfolio of diversified companies. And whether that’s through a mutual fund or an exchange traded fund, it’s always a large portfolio of big diversified companies.

(04:49):

The best example he said, if companies are, as you said, if they’re borrowing money in the form of bonds from individuals, they have to earn a higher return from their company than the amount of money they’re paying out on borrowed bonds. Otherwise, they’re out of business. If they’re borrowing and having to pay the bond holder 6% and they’re only earning 3% on the value of their business, they’re quickly going to go bankrupt.

(05:19):

Let’s talk about great companies. We’re in a market correction, We’re in a bear market. What do great companies do when times are tough? What are some of the things that they need to do, Mike?

Mike (05:33):

A lot of times they have to make cuts. A good company has a budget and they see what’s going on. Whatever business you’re in, you’re going to see what’s going on in the market this year. You’re going to expect to have less sales going for the next year than you did the past year. People aren’t going to have as much money. The government has raised interest rates. People aren’t going to afford to borrow as much money. They’re not going to be able to afford as many luxury goods as they have in the past.

(06:00):

That being said, your business is not going to make as much and the only thing you really have control at that point is your expenses. With expenses, you begin to see very good companies. It seems horrible that when a company lays off people as you read the paper, you think that company’s in trouble. You see that news. This company laid off this amount of employees. It doesn’t mean the company’s in trouble. They’re just being very prudent in their financial decisions because they can see what’s happening in the future.

Rob (06:27):

So you might even say these great companies are opportunists because they want to survive. That’s their goal. They need to survive and if they set out to make whether it was a hundred million dollars in profits, they want to try and finish as close to that a hundred million as possible. So what they’re going to do is they’re going to cut expenses. So they take advantage of that knowledge and they start cutting expenses. They do everything they need to do to make that bottom line.

Mike (06:58):

It’s almost a cleansing process for a lot of companies that become overweight and there’s a lot of extra in these companies that they don’t really need. They go through this cleansing process and they come out much cleaner and much more efficient than went into the whole recessions.

Rob (07:14):

Almost like they go on a diet. You know? If you’ve been eating too much for a month, you cut back, right? If you’ve been drinking too much, you cut back. And that’s what great companies do.

(07:27):

Why is it, then, when we hit a market downturn and these great companies, their stock drops? And they’re on sale, no one wants to buy them. Why is that?

Mike (07:41):

Well, it was a Eugene Famo that always said to us that a company’s prices based on the expected future cash flows and why we’ve seen the stock market correction in the last six months to nine months is the stock market knew what was going to happen. The stock market always knows and they discount the price of these stocks because they knew the expected future cash flows of these companies would be lower than they were the year before. But that doesn’t go on forever.

(08:09):

As these companies make these cuts inside them, they start to cut down the amount of money they borrow. They start to cut down on their employee salaries. They start to cut down all the extra meat that’s on the company. They all of a sudden become much more fit companies and then the expected future cash flows that the company look a lot more positive than they did and that’s when you see markets bounce back up.

Rob (08:31):

So we have that expression that humans are flawed investors and the reason for that is when those great companies are on sale, no one wants to buy them. Whereas, most people, when something’s on sale, they want to buy it and buy more of it. But when great companies are on sale, we don’t. We want to run away. And that’s because people experience declining prices twice as much as they experience rising prices, so if your million dollars went up 50% versus your million dollars going down 50%, you would feel twice as much pain on the down 50% as the up 50%.

Mike (09:19):

Just human nature.

Rob (09:21):

Nick talked about the math of investing, so let’s help our audience better understanding the math of investing and why, in his view, it is relatively pretty straightforward as what your number one choice should be.

Mike (09:37):

We’ll just use simple numbers in here and just approximates. I mean, we go back on long term. The average trade off … and let’s just use the US as example, and these are just approximate numbers, but the US market is averaged about 10% and that’s going back to, I believe it’s 1926. Isn’t it?

Rob (09:57):

1924.

Mike (09:59):

- That’s been a pretty reasonable rate of return from the stock market. If you look over long term and you look at bonds, bonds have averaged somewhere around 6%. If you go and start to look at inflation over that period of time, inflation has been 3%.

(10:19):

Now, from a financial planning point of view, we always like to look at real rates of return. And what a real rate of return is, is the amount of return you get over top inflation because that’s what you’re going to get. That’s the extra money you need inflation just to survive, right? To have the same amount of money next year than you do today, unfortunately right now, you’re going to have to have an 8% rate of return. So hopefully that inflation number comes down. But when you have inflation, you have to do that to at least match your buying power of your money.

(10:48):

So if we go back to what we said originally, we said that stocks average about 10%. If you minus off inflation, that brings you down to about a 7% real rate of return. If bonds have averaged 6% and you take off the 3% inflation, that gives you about a 3% rate of return. When you look at a difference, it doesn’t seem to be that much difference between 10 and six, but in real terms, you’re 7% on stocks and 3% on bonds. That’s two and one third times the return that you get on stocks than you do on bonds.

Rob (11:19):

So let’s talk about what Apple Computer just did recently. Apple Computer just went and borrowed 15 billion from investors at a relatively low rate of return. And what did they do with that money that they had, that 15 billion? They went and bought their own company stock. They bought it back because they realized that was one of the best investments they could do because they’re expecting to earn well beyond 10% for their stock and they’re borrowing money at less than 3%.

Mike (11:53):

It’s confidence.

Rob (11:54):

I think Nick talked about using another example and he’s always about … it’s not timing in the market. It’s time. And I think this is a great example of one.

(12:06):

He created an investor back in December of 1972. So let’s say you were born in 1972 and that was just before the bear market began in the US and around the globe. And that began on January the 11th, 1973, so 11 days after you were born, this bear market arrives. The US had gone off the gold standard. The war had started and the stock market dropped 48% from January 1973 to the end of 1974. So down 48%.

(12:50):

Between 2000, 2002, we were advisors at the time. The stock market dropped another 49%. And what was unique about that time period, a lot of investors were chasing those tech companies during the tech bubble and those companies dropped between 70% and 90%. Again, 2007 to 2009, that investor has another market correction. This one, a big one. 57%, the biggest drop since the Great Depression.

(13:28):

There was a time period that things were so rough. If you wanted to borrow money from anywhere a company needed to borrow, an individual needed to borrow money, you could not borrow money from anywhere, no banks, no one, regardless of how good your credit rating was.

(13:45):

And now, we’re in another bear market. So let’s look at how that investor has done, who started in 1972. At the time, the value of the S&P 500, which is the value of the biggest 500 companies in the US, was at 118. Earnings on the S&P, they were earning about $6 on that 118 and dividends are about half of that at $3 and 20 cents. The consumer price index or inflation was at 42.

(14:16):

So let’s go forward now to 2022. The S&P had gone from 118. Today it’s at roughly 4,200 or 35 times higher. The earnings on the S&P had reached 215 from $6.17 or roughly 35 times higher. Dividends again were $65, roughly 20 times higher. And inflation was seven times higher. Inflation’s only seven times higher, but the market’s gone up 35 times, even though you invested at one of the worst times to invest, the beginning of a 48% bear market.

Mike (15:05):

You always hear people talking about inflation and hedges toward inflation and they keep on talking about gold and some talk about real estate. The reality is I don’t think anything over the long period has been a better hedge against inflation than the stock market itself.

Rob (15:21):

So what are some of the lessons we can learn from that example? Nick put it in simple terms. He said stocks have the relentless ability to beat the living daylights out of inflation. Now that’s an expression my father used to say. The living daylights. I’m not sure where that came from, but that’s the truth. Stocks beat the living daylights out of inflation. What else can we learn from that, Mike?

Mike (15:48):

He said time, not timing, is a key to invest in equities. It always will be and always has been. So again, it’s that same idea of it’s time in the market. It’s not time in the market itself.

Rob (16:03):

His last quote I always think is interesting. He talked about if you experience a permanent loss when investing into a diversified portfolio of companies, it’s not a market error. It’s a human error. And he uses the expression, “We have met the enemy and he is us.” If you’re losing money over the long term in a diversified portfolio of stocks, you’re the one who’s made mistakes along the way. It’s not the market that’s done that. It’s human error. What about the economy? Can the economy be forecast? Can the market be forecast?

Mike (16:37):

He said the economy can never be forecast. You talked about recoveries. Recoveries for major corrections are never gradual. Everyone thinks it’s going to be gradual and says, “Well, over the next two years, the market should work its way back up 1/10th to 1% every day for the next two years.” It just doesn’t work like that. It happens in a few small days. The trick is, you got to be in the market for those few small days. When they happen, you’re going to see some 5% gain days and you don’t want to miss those gains.

Rob (17:09):

How many times have you and I in our career heard investors tell us, “Well I’d like to get this money working for me, Rob, but let’s wait until things settle down a bit and the volatility of the market settles down a bit and then we’ll put it to work.” What’s the problem with that?

Mike (17:26):

All of a sudden the market would take off and it’s too late, then your second guess and whether you want it in anymore because you feel the market’s too high.

Rob (17:35):

And it moves very quickly. And Nick talked about, and I think this is an interesting observation, if you’ve been through a very fast market correction like we did in 2020 when COVID first hit, the recovery is often just as fast. This market correction we’re in right now, we’re sort of in about eight months of a market correction. That may be as long as that recovery takes to come back, depending whether we’ve hit bottom yet or not.

Mike (18:06):

So what do the long term numbers look like, Rob? Over time, are the odds in your favor to be in the stock market? Are the odds against you? If you were in Vegas, what would you say?

Rob (18:15):

Well, it’s interesting. If you look at the stock market, it has been positive 75% of the time, and so negative 25% of the time, so the odds are in favor of you being successful three to one. If you went to Vegas and you were successful, you’d win $3 for every dollar you bet, or you’d only lose 25% of the time, Vegas wouldn’t exist because all the people who went to Vegas would be walking home with all the money.

(18:50):

Over three years, that success rate goes even higher. So that was over one year, over three years. That success rate goes to 84% of the time. So the opposite is 16% of the time. Once we get to five years, we get up to 88% of the time, 10 years, it’s 94% of the time, and over 15 years, it’s 99.9% of the time that you’re going to have positive returns and be ahead of T-bills and inflation.

Mike (19:24):

The problem I find is when you look at the flip side of these, the only time you ever get questioned on how the market’s doing is the five year. It outperforms. It outperforms 88% of the time. It’s that 12% of the time that comes up where everyone’s questioning the strategy. No one questions it the other 88% of the time when it’s right.

Rob (19:43):

And the problem is that 12% is often together. Right? So it might go on for 14 months or 12 months and that’s the period when everyone doubts that the strategy is sound. And it’s tough to go through it. Market corrections are very tough. We never said it was easy.

Mike (20:01):

And media’s not helping at that point either.

Rob (20:03):

Nick shared two final quotes that I think are very important there. Actually, three. Number one, “There should be no portfolio without a plan. Don’t start investing unless you have a plan,” so that’s number one.

(20:16):

Number two is, “Never do anything to your portfolio based on what’s going on in the economy or the markets.” Now that’s a tough one for most people, because most people want to do something to their portfolio based on what’s going on in the markets or what’s going on or maybe going on in the economy.

Mike (20:35):

Something’s wrong. Let’s fix it.

Rob (20:36):

Absolutely. And the other one, and this just speaks to diversification, “You should never own too much of one stock that would allow you to get killed by it.” And so, over the years, we’ve had lots of investors that have had one company in their portfolio. They work for that company and often that position is more than 50% or more of their wealth. Sometimes those companies get killed, and we saw that with Nortel. We’ve seen it with a lot of the tech companies over the years and that literally takes someone from being a multimillionaire to having less than half a million dollars left once the thing corrects.

Mike (21:21):

All you have to do is take a look at the Dow Jones from a hundred years ago and see what was in it. Until recently, I think General Electric was the last original company that was left in there, and I think that’s no longer on it.

Rob (21:35):

Maybe you and I should do a podcast talking about the original 500 and what’s left and how did the other ones disappear and when.

Mike (21:44):

Yep.

Rob (21:46):

That brings us to the end of another week. Thank you for joining us. This is Rob and Mike with Think Smart from The McClelland Financial Group of Assante Capital Management reminding you to live the life that makes you happy.

Assante Wealth Management (22:20):

You’ve been listening to The McClelland Financial Group of Assante Capital Management Limited. Assante Capital Management Limited is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory organization of Canada. Insurance Products and services are provided through Assante Estate and Insurance Services Incorporated. This material is provided for general information and is subject to change without notice. Every effort has been made to compile this material from reliable sources. However, no warranty can be made as to its accuracy or completeness. Before acting on any of the previous information, please make sure to see a professional advisor for individual financial advice based on your personal circumstances. The opinions expressed are those of the authors and not necessarily those of Assante Capital Management Limited.