|

|

| |

Our Two Cents

with TMFG

Your Monthly Update on Everything Going On in Your TMFG Financial World All in One Place. Ask TMFG videos, Our Podcast, Fun and Interesting Articles, Updates, Events and More.

|

|

| |

|

Announcements Announcements

A special message from the TMFG team

What's Keeping You

From Retiring?

Jun 20, 2022 - 12pm

Join the Ask TMFG team as they explore

"What's Keeping You From Retiring?"

Have plans to retire but are second-guessing them?

John and Carlo will walk through some of the factors that are scaring Canadians into working longer and avoiding retirement while exploring the validity of those concerns.

|

| |

|

FINANCE FINANCE

Light Read – Useful and Relevant

Finance

RESP Tax Planning Strategies

RESPs are a valuable tool for parents who are saving for their children’s post-secondary educational costs. Much is made about the grants that are payable by the government and the tax-deferred growth on the invested capital and grant. However, the tax implications upon withdrawal are often forgotten about or not considered at all. It’s important to know what these are to plan a tax-efficient withdrawal strategy when the time comes.

Firstly, we should distinguish the 3 components in an RESP:

- Invested Capital (contributions)

- Canada Education Savings Grant and other Bonds provided by the government

- Growth on the capital and grant/bonds

Withdrawals of the invested capital is not taxable. There is no deduction on contributions into an RESP, therefore there is no tax implication on the withdrawal of contributions. However, there are tax implications on the withdrawal of grant and growth.

The Educational Assistance Payment (“EAP”) is a withdrawal made while the beneficiary is enrolled in a qualified post-secondary educational institution. This is made up of grant and growth and is fully taxable in the hands of the beneficiary. Typically, this is of little concern given that most beneficiaries are not earning a significant amount of income when withdrawing from the RESP. The Basic Personal Amount tax credit and Tuition tax credit typically eliminate any taxes payable on the EAP income withdrawn.

The Accumulated Income Payment (“AIP”) is a withdrawal made when the beneficiary is no longer enrolled in a qualified post-secondary educational institution (i.e. graduated, withdrew, etc.). Similar to the EAP, it is made up of the grant and growth, but is taxable in the hands of the subscriber. Typically, the subscriber will be in a high marginal tax bracket, which would increase his/her tax liability. On top of the high marginal tax rate, there is a 20% penalty tax imposed on the AIP as well. Consequently, a subscriber in the highest marginal tax bracket (Ontario) may be taxed at 73.53% on the AIP. A subscriber could avoid the 20% penalty tax by transferring up to $50,000 of the AIP into his/her RRSP, provided they had the contribution room.

Knowing these tax rules will allow the subscriber to plan a tax-efficient RESP withdrawal plan. Speak with your advisor for further questions or clarification.

|

John Iaconetti B.A.S., Spec. Hons. Administrative Studies (Finance)

Financial Advisor

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

| |

|

Open an RESP Account or

Make a Contribution

Open an RESP

Contribute

|

| |

|

FINANCE FINANCE

Light Read – Useful and Relevant

Finance

Strategies to survive

the market crash of 2022

Time and time again, the market tests our faith and emotional resilience. We know the long-term strategy. We know what we are supposed to do, or more importantly, what we are not supposed to do, during times of market volatility. Yet, when portfolios drop in value, investors question their investment plan and in some cases, abandon them altogether.

Given the current market conditions, we thought it would be beneficial to give investors a reminder of things to do in times of market uncertainty.

- Stay invested. This is a simple concept, but incredibly difficult to follow when emotions get involved. The reality of pullbacks in the market is that units of funds, or shares of companies, are down in value. As an investor, you still own those shares, however, they just happen to be down in value, temporarily. The moment you sell any units or shares, you eliminate any possibility of participating in the recovery of those units or shares. Let’s relate it to real estate. Given the increasing interest rate environment, the values of properties are starting, or will start, to come down. If you own your property, then you probably aren’t thinking about selling it because the value has dropped from previous highs. The expectation is that the property will eventually start going back up in value once the interest rates have stopped increasing. If the time horizon is long, then just continue owning the asset. This applies to real estate and to the stock market.

- Look for alternative income sources. If you are drawing income from your portfolio for living expenses, then you may want to temporarily stop the payments while the market is dropping. An emergency fund of cash in a bank account is an opportune place to temporarily withdraw from until the market has stabilized. A low-interest rate credit facility is another option for substituting your portfolio income. This can be in the form of a home equity secured line of credit. Typically, the interest rates are lower and the repayment options are more favourable versus unsecured debt facilities. Both options provide a temporary source of income to avoid having to sell out of the portfolio in a falling market.

- Rebalancing. Your balanced portfolio will have a target asset allocation. For example, 60% in the stock market and 40% in fixed income instruments (i.e. bonds). Because the market is dynamic, on any given day, the asset mix may have deviated from the target. When this occurs, it is important to execute the necessary trades to bring it back to the target asset mix. Simply put, to rebalance the portfolio you are selling a portion of the portfolio that had just done well and reinvesting the proceeds into the portion that had just dropped in value. Although this strategy sounds counter-intuitive, it is the best way to put your portfolio in the best position to benefit from the recovery. The concept of rebalancing is an unemotional way to “buy low and sell high”, which is the simplest way to earn a return in the market.

- Invest your cash. Every October, we see consumers get into unnecessarily long lines to take advantage of “Black Friday” shopping deals. The concept is sound – use your resources to buy goods at a discount. Consumers are making their dollars work harder for them by purchasing items for a lesser cost. However, the same concept does not apply when it comes to buying assets that produce income. The stock market dropping in value means that ownership in companies is cheaper than it was before. In fact, most investors adopt the opposite practice for investing in the market – investing their cash the moment companies get more expensive (go up in price). Buying high and selling low rarely equates to success in investing. Cash rarely earns enough to outpace inflation. The current inflationary environment should be reason enough to get your money working harder for you, especially if the time horizon is long (i.e. > 10 years).

These are simple concepts that will make your investment experience much more enjoyable. Speak with your advisor to discuss any or all of these in more detail.

* Borrowing to stay invested is not suitable for everyone. You should be fully aware of the risks and benefits associated with using borrowed money to stay invested since losses as well as gains may be magnified.

|

Carlo Cansino FMA, FCSI, CFP®

Senior Financial Planner

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

| |

|

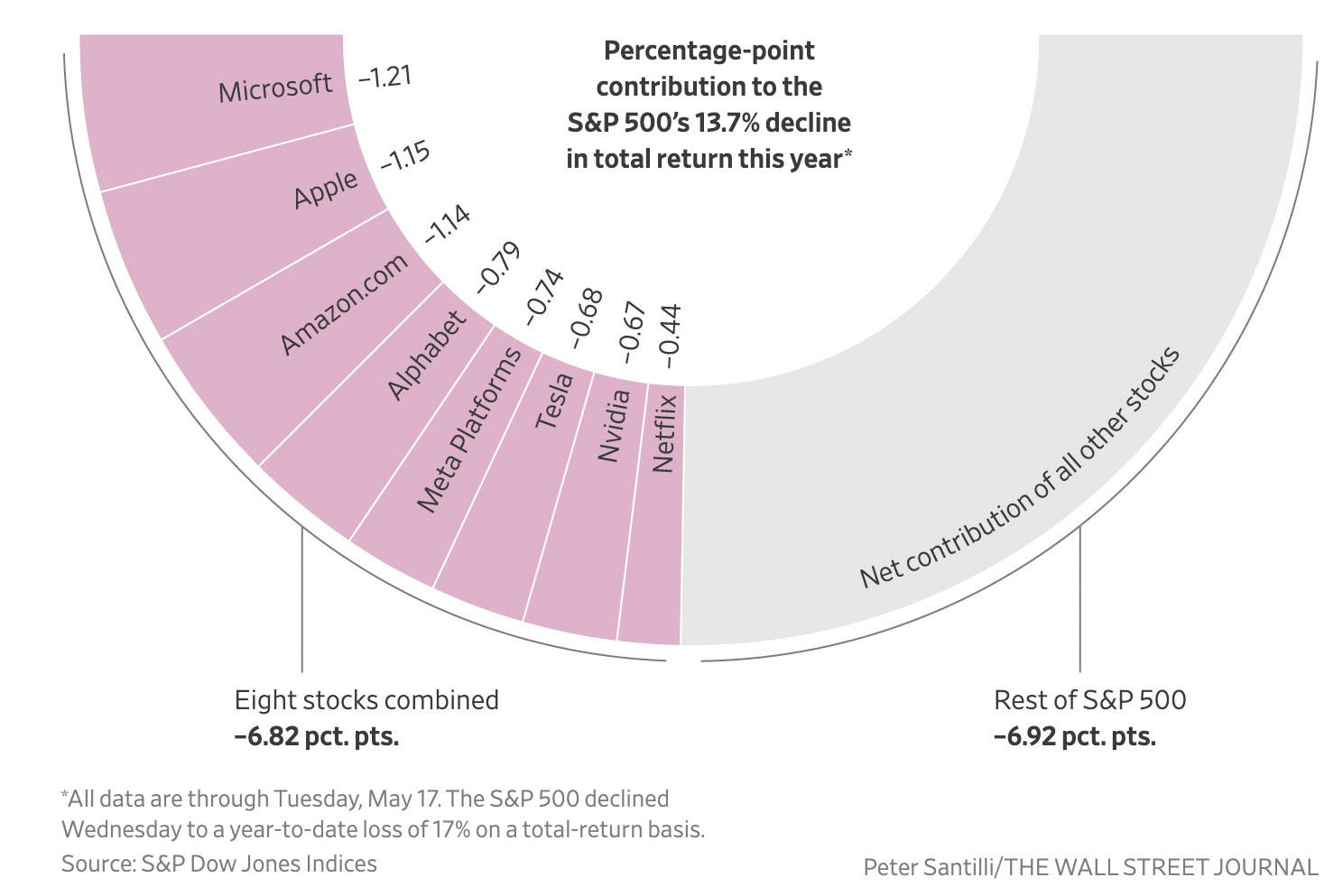

FUN CHARTS FUN CHARTS

Fun and inventive ways to see interesting ideas!

Fun Charts

View Enlarged Image

Source: The Wall Street Journal

|

| |

|

FINANCE FINANCE

Light Read – Useful and Relevant

Finance

What happens when you die

without a will?

I was reading an article on how many Canadians have a will in place. I was shocked to discover that over 50% of Canadians do not have a will. Being a natural skeptic, I figured the number included all Canadians and made inaccurate by the number of kids. The survey noted that those surveyed were over the age of 18. So, let’s start by excluding those under the age of 35. Why? Well, we all know how invincible we feel until we reach 35. Would you believe that 67.9% of Canadians surveyed over 35 years old do not have a will. Here is the real shocker -- 32.3% of Canadians over 55 and 28.3% of Canadians over 65 do not have a will in place. (source Number of Canadians without Wills significantly under-reported (legalwills.ca).

As a Financial Advisor you would think this would shock me, but in fact, it does not. What has always surprised me is the relationship between needing a will and creating a will. In my experience, the more necessary a will becomes, the less likely that it will get done. Why? The reason is that decisions become more difficult.

For example, take Sally and Henry. They are in a strong long-term marriage with two children that are both financially independent. In this case, their will would be relatively simple. Assets would go to the surviving spouse. When the surviving spouse passes, the assets get split between the kids. If either of the kids has passed away, their share would go to their kids. In the case where there were no grandchildren, the deceased child’s share would go to the surviving sibling. Wills 101. When you get into second marriages, disabled children, children with financial issues and even no children, the situation becomes more complex. Unfortunately, in these cases, many choose to avoid it by not creating a will.

So, there are people who procrastinate with completing their will and then there are people just refuse to create them. So, it begs the question: What happens if you die without a will? This is called dying “Intestate”. In Ontario, the Succession Law Reform Act determines the order of distribution of assets for a person that dies “Intestate”.

Here are examples of the simplest scenarios:

- Person dies with a spouse (marriage or common-law) and no issues (children)

- All assets pass onto the surviving spouse

- Person dies with a spouse and issues

- The spouse is entitled to the first $350,000 of the estate

- If there is more than $350,000 in the estate and 1 child

- The spouse gets the first 350,000 and the remainder is split between the spouse and the child.

- If there is more than 1 child

- The spouse gets the first 350,000 and one-third of the amount over that. The remaining two-thirds above the 350,000 is split between the remaining children

- Person dies with no spouse and no children

- If the parents are alive (or one parent) they will inherit all.

- If the parents are not alive and the person has siblings

- The estate will be split equally between the siblings

- If one sibling has predeceased the person that dies and has children

- Their portion will go to their children.

- Beyond that if there are no parents and no siblings no nieces of nephew it will follow a “Next of Kin” chart.

You may ask, “if the intestate distribution is how I would like my assets split, then why do I need a will?”

A couple of reasons:

- Somebody needs to apply to be the executor which can be a long process.

- It makes the process more difficult than necessary. All financial institutions request a will to relinquish the deceased’s assets. Without the will, there could be delays in gaining access to funds to pay for timely bills and other expenses.

When someone dies intestate, it opens up a whole new can of worms that adds additional work for the executor. Do your survivors a favour and make life easy for them when you are gone. If you don’t have a will, make it a priority.

|

Michael Connon B.Sc, CFP®

Senior Financial Planner

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

| |

Apply Today - Deadline July 30th 2022

|

| |

|

THINK SMART

THINK SMART

Podcast – Listen to Mike and Rob and their latest thoughts and industry insights

Think Smart

LISTEN TO THE LATEST PODCAST

|

| |

Ask TMFG

Watch The Latest Videos

|

| |

How Can I Tell People About TMFG?

|

| |

Review us on Google!

Please give us your Google review. Google reviews are critical for new potential clients to know that they are working with a trusted and well reviewed advisor. Thank you!

Look for this button at the bottom left:

|

| |

|

|

|

Assante Capital Management Ltd. is a Member of the Canadian Investor Protection Fund and Investment Industry Regulatory Organization of Canada. This material is provided for general information and is subject to change without

notice. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please make sure to see me for individual

financial advice based on your personal circumstances. Insurance products and services are provided through Assante Estate and Insurance Services Inc.

Commissions, trailing commissions, management fees and expenses, may all be associated with mutual fund investments. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Please read the Fund Facts and consult your Assante Advisor before investing.

Certain employees of (TMFG Tax Service) maintain a relationship with Assante Capital Management Ltd. ("Assante") through which they sell investment products. The relationship that they have with Assante does not include tax preparation

services which (TMFG Tax Service) is solely responsible. (TMFG Tax Service) is not associated in any way with Assante, and Assante has no responsibility for the tax preparation services offered by (TMFG Tax Service).

*Please note that a live recording may be conducted at our workshops. Consent will be obtained, should you be captured in the video.

**All personal information will only be used in accordance with your consent, and in compliance with Assante's Privacy Policy.

Let's keep communicating. We value our relationship with you and want to stay in touch, whether it's regarding events or newsletters. In brief, The McClelland Financial Group aims to provide you with information

that is relevant to you. As you are likely aware, on July 1, 2014 Canada's Anti-Spam Legislation (CASL) came into force which requires your consent to receive electronic communications.

If we do not receive an unsubscribe email from you we will continue e-communications under the implied consent provisions under CASL. **

|

|

|