|

|

| |

Our Two Cents

with TMFG

Your Monthly Update on Everything Going On in Your TMFG Financial World All in One Place. Ask TMFG videos, Our Podcast, Fun and Interesting Articles, Updates, Events and More.

|

|

| |

|

|

| |

What’s Keeping You from Retiring?

If you missed our last event watch it here:

|

| |

|

Open an RESP Account or

Make a Contribution

Open an RESP

Contribute

|

| |

|

LIFESTYLE LIFESTYLE

Light Read – Useful and Relevant

Lifestyle

July Gardening To-Do List

The Spruce is an all-around great blog. Although it is US based they still have a ton of insight and are a great group of professional gardeners and horticulturalists.

View Article

|

Amber Mazurkiewicz

Marketing Manager

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

| |

|

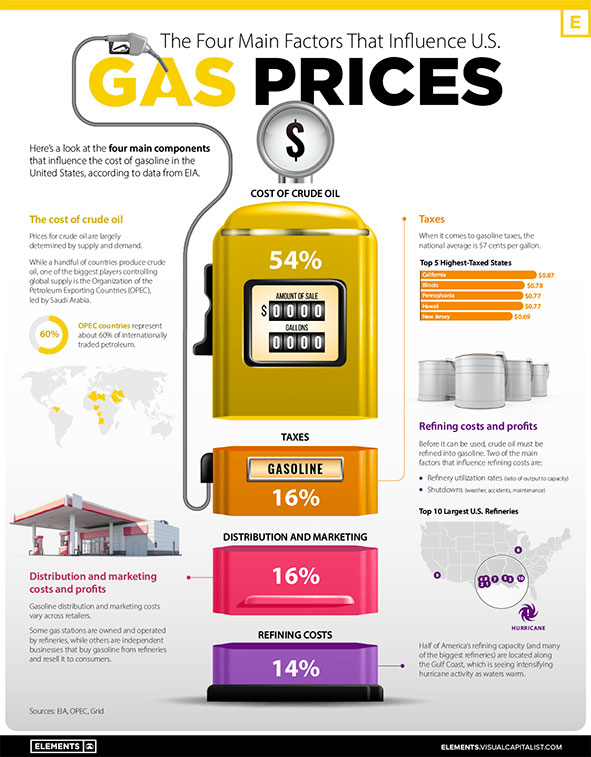

FUN CHARTS FUN CHARTS

Fun and inventive ways to see interesting ideas!

Fun Charts

View Enlarged Image

Source: VisualCapitalist.com

|

| |

|

FINANCE FINANCE

Light Read – Useful and Relevant

Finance

What’s keeping you from retiring?

Over the last couple of years, Canadians have been rethinking the target age of their retirement. Back in 2009, more Canadians preferred to retire at age 65 or earlier. That attitude has changed since the pandemic. In 2021, more Canadians are targeting a retirement age beyond 65.

Why the about-face?

In 2020, a global event occurred that initiated events that resulted in great uncertainty. Market volatility ensued, prices of goods and services sky-rocketed, and people began to rethink what was important to them.

A volatile stock market impacts people’s expectation for cashflow in retirement, thus striking fear in their ability to retire comfortably.

An increase in prices means that their money would no longer purchase as much as it once did.

And, major lifestyle changes prompt valuable introspection, which makes the decision to retire much more difficult.

There are things that can be done to help alleviate the above-mentioned fears:

- Trust in your investment plan and speak with your advisor about the fears that you may have.

- Reassess your budget and consider delaying big ticket purchases while inflation is high.

- Prepare for your change in lifestyle. Read books, make plans, and just try new things.

Delaying retirement can also result in many benefits:

- Increased government income

- Improved probability of success for retirement cash flow (i.e. less years relying on investments for income and more years to invest money to grow your portfolio)

- COVID-19 prompted the “Work From Home” phenomena. It gave people a taste and introduction to semi-retirement.

Although there are many benefits, delaying retirement doesn’t guarantee financial success. It requires guidance and the support of an objective financial professional. A survey conducted by the Canadian Institute of Financial Planners shows that pre-retirees and retirees with a plan are far more prepared for retirement financially, emotionally, socially, and physically, than those without one.

If you are a pre-retiree or retiree without a plan, then I urge you to reach out to our office to speak with one of our financial planners at The McClelland Financial Group. Short of that, I invite you to our website. You will find a recording of our virtual seminar on the same topic. Familiarize yourself to us through the recording and contact us after for a deeper discussion.

|

Carlo Cansino FMA, FCSI, CFP®

Senior Financial Planner

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

| |

|

FINANCE FINANCE

Light Read – Useful and Relevant

Finance

Can young people afford to live in the city anymore?

Making the move from your hometown to a bigger city in search of higher education, career advancement or independence can feel like a rite of passage. But moving to the city can come with significant costs—especially in 2022. In fact, you might actually lose money doing it. According to the Youthful Cities Real Affordability Index, young people are losing $750 a month, on average, by living in cities across Canada.

View Article

|

John Iaconetti B.A.S., Spec. Hons. Administrative Studies (Finance)

Financial Advisor

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

| |

|

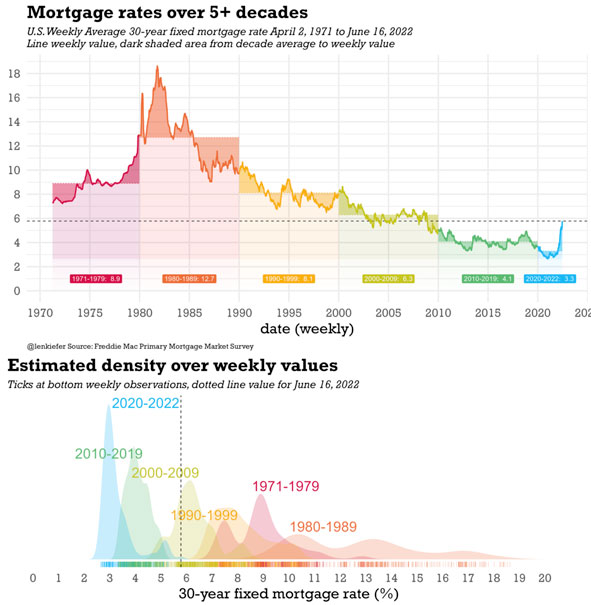

FUN CHARTS FUN CHARTS

Fun and inventive ways to see interesting ideas!

Fun Charts

View Enlarged Image

Source: @lenkiefer Freddie Mac Primary Mortgage Market Survey

|

| |

Apply Today - Deadline July 30th 2022

|

| |

|

THINK SMART

THINK SMART

Podcast – Listen to Mike and Rob and their latest thoughts and industry insights

Think Smart

Bonds Are Getting Hammered

Bonds getting hammered is a pretty unusual occurrence. It seems that we are exiting a 30-year bull market on bonds. So what’s going on in the market to cause this to happen? And what are governments doing to counteract global inflation? Today on ThinkSmart Senior Financial Advisors Rob McClelland and Mike Connon examine what is happening in the markets worldwide to cause these typically stable investments to behave so poorly.

LISTEN TO THE LATEST PODCAST

|

| |

Ask TMFG

Watch The Latest Videos

|

| |

|

|

|

Assante Capital Management Ltd. is a Member of the Canadian Investor Protection Fund and Investment Industry Regulatory Organization of Canada. This material is provided for general information and is subject to change without

notice. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please make sure to see me for individual

financial advice based on your personal circumstances. Insurance products and services are provided through Assante Estate and Insurance Services Inc.

Commissions, trailing commissions, management fees and expenses, may all be associated with mutual fund investments. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Please read the Fund Facts and consult your Assante Advisor before investing.

Certain employees of (TMFG Tax Service) maintain a relationship with Assante Capital Management Ltd. ("Assante") through which they sell investment products. The relationship that they have with Assante does not include tax preparation

services which (TMFG Tax Service) is solely responsible. (TMFG Tax Service) is not associated in any way with Assante, and Assante has no responsibility for the tax preparation services offered by (TMFG Tax Service).

*Please note that a live recording may be conducted at our workshops. Consent will be obtained, should you be captured in the video.

**All personal information will only be used in accordance with your consent, and in compliance with Assante's Privacy Policy.

Let's keep communicating. We value our relationship with you and want to stay in touch, whether it's regarding events or newsletters. In brief, The McClelland Financial Group aims to provide you with information

that is relevant to you. As you are likely aware, on July 1, 2014 Canada's Anti-Spam Legislation (CASL) came into force which requires your consent to receive electronic communications.

If we do not receive an unsubscribe email from you we will continue e-communications under the implied consent provisions under CASL. **

|

|

|