|

|

| |

Our Two Cents

with TMFG

Your Monthly Update on Everything Going On in Your TMFG Financial World All in One Place. Ask TMFG videos, Our Podcast, Fun and Interesting Articles, Updates, Events and More.

|

|

| |

Review us on Google!

Please give us your Google review. Google reviews are critical for new potential clients to know that they are working with a trusted and well reviewed advisor. Thank you!

Look for this button at the bottom left:

|

| |

|

ROB'S READ ROB'S READ

Medium Read – Interesting, useful and relevant finds by Rob McClelland.

Rob's Read

Web3 vs. The Metaverse: Which Is Bigger?

TheFinancialStar.com:

"The web is evolving. It is turning from “Web 2.0” into Web3.

And the next iteration is very different from what we have now.

It relies on new technologies and offers its users some rights and benefits that are not available now.

In this article, we will look at what Web3 is and how it compares to the metaverse, which is another “future internet” that gets a lot of coverage—and causes some confusion."

View Article

|

Rob McClelland RFP, CFP®, HBA

Vice President, Senior Financial Planner

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

| |

|

FINANCE FINANCE

Light Read – Useful and Relevant

Finance

Strategies to get the most out of your RRSP

It's that time of year again; it is RRSP season. While RRSPs have a negative reputation amongst some Canadians, it is an excellent investment tool that can help just about every Canadian reach their goals. RRSPs are a tax deferral investment, which means contributions you make today will save you tax, but withdrawals in the future will be taxable. This trade-off is beneficial for most Canadians as we are more likely to earn a higher income while working compared to when we are retired.

While most contribute to an RRSP, what can we do to get the most out of the strategy? Whether your retirement is five years away or twenty-five years away, the best method for achieving any goal is to have a plan. The following RRSP strategies can help get you started.

Maximize your contribution to Maximize tax savings

In a perfect world, we would be able to fully maximize our contributions each year, therefore saving us the most taxes possible. However, we know life gets in the way. However, if cash flow is tight for a given year, you can always move money "in-kind" from another account to the RRSP for a contribution.

Contribute Early

Setting up a regular bi-weekly or monthly contribution that coincides with your pay will help you budget throughout the year and not leave you scrambling at the end of the year to contribute.

Give your savings a raise

As your income increases over your career, your RRSP savings rate should also increase. Ensuring you save a more significant amount each paycheck to ensure that your hard-earned money is being invested in you instead of spent frivolously.

Reinvest your Refund

After the hard work of saving throughout the year, you file your taxes and get the reward of money back from your tax return. Your next step should be to reinvest that money into your RRSP or TFSA the following year. That is unlocking the true potential of an RRSP, having your "tax savings" invested into a tax-free environment.

If you follow these four steps consistently for your remaining working years, you will be well on your way to a successful retirement. As mentioned, the best strategy to achieve a goal is to have a plan; it is our job to ensure you keep on plan.

|

John Iaconetti B.A.S., Spec. Hons. Administrative Studies (Finance)

Financial Advisor

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

| |

|

LIFESTYLE LIFESTYLE

Light Read – Fun and Enjoyable!

Lifestyle

Top Canadian CEOs paid at second-highest level during pandemic

While the pandemic made a lot of Canadians struggle financially, the CEOs of these companies certainly did not. "On January 4th the average CEO of these companies would have already earned what the average Canadian worker will make all year."

View Article

#CEO #business #canada #work #jobs #wealth

|

Michael Ams B.Com.

Strategic Associate

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

| |

|

| |

|

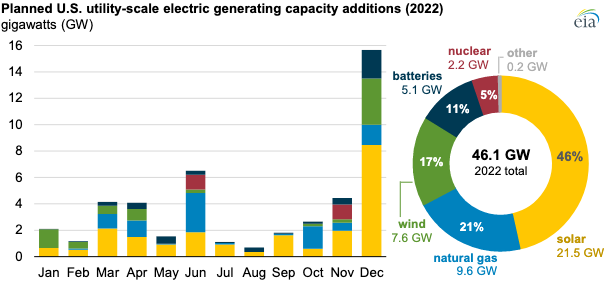

FUN CHARTS FUN CHARTS

Fun and inventive ways to see interesting ideas!

Fun Charts

View Enlarged Image

|

| |

|

Announcements Announcements

A special message from the TMFG team

Tax Talk 2022

February 22nd 12-1pm

Register Here

|

| |

|

FINANCE FINANCE

Light Read – Useful and Relevant

Finance

Practice What We Preach

As your financial planners, we consider everything that could impact your financial well-being. Two of those being unexpected death or illness. We call this, “risk management”. And, the most effective tool to manage risk is, duh duh duh, INSURANCE.

I wanted to kick off the year by discussing what I have in the way of insurance. Before I do that, here are a few points to note:

- We believe insurance should be used to cover certain financial obligations.

- You can be over-insured.

- All situations are different. Sometimes insurance is unnecessary.

I am 45 years old, married and have 3 children. I have people dependent on me to help pay bills, pay debts, save for my children’s education and save for retirement. The moment my ability to earn income is gone, my family will suffer. Therefore, I need to replace my income if I unexpectedly pass away or become ill. Certain types of insurance can address these issues.

I have a Term Life insurance policy to pay for my mortgage and replace my income if I pass away. The amount of the death benefit was the balance of the mortgage at application time, plus the funds necessary to cover the annual after-tax expenses, indexed to inflation, for my family to maintain the same lifestyle, until the youngest finished her undergrad. I reduced this amount by my spouse’s after-tax income annually, indexed to inflation, until the youngest finished undergrad. I chose term insurance because there was a finite amount of time for the coverage and the premiums were astronomically cheaper than a permanent policy for the same amount of coverage.

I do have a Permanent Life insurance policy to pay for my final expenses at my passing. Because, I am unsure of my “expiry date”, I chose a permanent policy so that it would be in force at that time. The death benefit amount was nominal as it has only one financial obligation.

I have Group Disability coverage through my employer. A percentage of my income (60%) will be provided on a monthly basis until I can resume work or until retirement time, whichever comes first. I chose not to top this coverage up, instead opting for a Critical Illness coverage policy.

The Critical Illness differs from the Group Disability in that it pays a lump sum at one-time, upon diagnosis. There is no clawback of the benefit amount should I “recover” from the illness. I chose a benefit amount of 1.5 times our after-tax annual expenses. This amount made sense given the nature of the policy. If I were diagnosed with one of the covered conditions, my thought is that I would recover within 12 – 18 months and would resume working. If I did not, then the group disability coverage would continue. I also opted for the “return of premium” option on the Critical Illness policy. If I did not make a claim on the policy within the first 15 years, then I would be eligible to cancel the policy and receive all premiums back. Thus, the policy acted as a forced savings strategy. And, it would be a win-win – all of my premiums would be returned and, most importantly, I was not diagnosed with a covered condition.

Again, these insurance tools made sense at the time of application and for my specific situation. However, for people in similar situations to myself, you may want to review your coverage and the types of policies you have in place. There may be opportunity to enhance or reduce your coverage.

Reach out to myself, or any of our financial planners, for a more detailed conversation.

|

Carlo Cansino FMA, FCSI, CFP®

Senior Financial Planner

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

| |

Ask TMFG

Watch The Latest Videos

|

| |

|

THINK SMART

THINK SMART

Podcast – Listen to Mike and Rob and their latest thoughts and industry insights

Think Smart

|

| |

|

|

|

Assante Capital Management Ltd. is a Member of the Canadian Investor Protection Fund and Investment Industry Regulatory Organization of Canada. This material is provided for general information and is subject to change without

notice. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please make sure to see me for individual

financial advice based on your personal circumstances. Insurance products and services are provided through Assante Estate and Insurance Services Inc.

Commissions, trailing commissions, management fees and expenses, may all be associated with mutual fund investments. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Please read the Fund Facts and consult your Assante Advisor before investing.

Certain employees of (TMFG Tax Service) maintain a relationship with Assante Capital Management Ltd. ("Assante") through which they sell investment products. The relationship that they have with Assante does not include tax preparation

services which (TMFG Tax Service) is solely responsible. (TMFG Tax Service) is not associated in any way with Assante, and Assante has no responsibility for the tax preparation services offered by (TMFG Tax Service).

*Please note that a live recording may be conducted at our workshops. Consent will be obtained, should you be captured in the video.

**All personal information will only be used in accordance with your consent, and in compliance with Assante's Privacy Policy.

Let's keep communicating. We value our relationship with you and want to stay in touch, whether it's regarding events or newsletters. In brief, The McClelland Financial Group aims to provide you with information

that is relevant to you. As you are likely aware, on July 1, 2014 Canada's Anti-Spam Legislation (CASL) came into force which requires your consent to receive electronic communications.

If we do not receive an unsubscribe email from you we will continue e-communications under the implied consent provisions under CASL. **

|

|

|