|

|

| |

Our Two Cents

with TMFG

Your Monthly Update on Everything Going On in Your TMFG Financial World All in One Place. Ask TMFG videos, Our Podcast, Fun and Interesting Articles, Updates, Events and More.

|

|

| |

Review us on Google!

Please give us your Google review. Google reviews are critical for new potential clients to know that they are working with a trusted and well reviewed advisor. Thank you!

Look for this button at the bottom left:

|

| |

|

ROB'S READ ROB'S READ

Medium Read – Interesting, useful and relevant finds by Rob McClelland.

Rob's Read

35 Ideas from 2021

SafalNiveshak.com:

While we don't make predictions it’s sometimes good to have the discussion to prepare for the possibility of a bear market. I really liked this article by Safal Niveshak because it discusses 35 Ideas from 2021.

View Article

|

Rob McClelland RFP, CFP®, HBA

Vice President, Senior Financial Planner

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

| |

|

FINANCE FINANCE

Light Read – Useful and Relevant

Finance

2021 Real Estate Tax Tips

Tax season is upon us; this is a difficult time of the year for most people. But here at The McClelland Financial Group, our focus is on simplifying and enhancing the financial lives of Canadians. This past year was hectic for real estate investors, whether moving from your principal home, buying a rental property, or even renovating an existing property. There are some tax benefits available to you if you, like many others, invested in real estate in 2021.

Property Taxes (Owners) & Rental Payments (Tenants)

Landlords can claim property taxes for the period when a rental property was available for rent. Employed and self-employed tenants can claim partial rent payments as a home office expense if they use their home for employment or business purposes.

Home Buyers’ Amount

You could claim a $5,000 tax credit if you purchased your first home and did not live in another home you or your partner owned in the past four years.

GST/HST New Housing Rebate

You may qualify for the GST/HST New Housing Rebate if you did substantial renovations or purchased or built a new home. A similar provision exists for landlords under certain conditions.

Home Accessibility Tax Credit

If you renovate your home to make it more accessible to those with mobility issues, you could be eligible for the home accessibility tax credit. The renovations must be permanent, make the home more accessible or reduce the potential harm to the qualifying individual, and be completed by qualified professional tradespeople. You can save taxes on an eligible renovation costing up to $10,000.

Moving Expenses

If you moved at least 40 kilometres closer to your work, a new business, or post-secondary schooling, you could claim expenses from that move. Qualifying expenses include storage costs, travel expenses, temporary living expenses, the cost of cancelling a lease, and more.

As your lifestyle changes, new taxable benefits will be available to you. We hope one of these taxable benefits can help you this year. If there are any further questions, reach out to your advisor or speak with your accountant to see if you would be eligible.

|

John Iaconetti B.A.S., Spec. Hons. Administrative Studies (Finance)

Financial Advisor

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

| |

|

| |

|

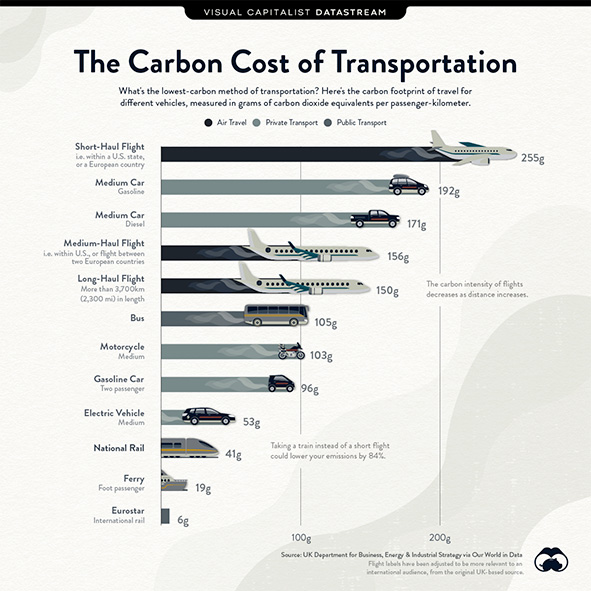

FUN CHARTS FUN CHARTS

Fun and inventive ways to see interesting ideas!

Fun Charts

View Enlarged Image

|

| |

|

Announcements Announcements

A special message from the TMFG team

Join the Create With Us Team

Monday March 14th from 1:00-2:30

As we take a crafting adventure with polymer clay. No special tools are required. Appropriate for all ages. RSVP your spot. Once you receive confirmation that we have your kit ready you may pick it up from our office.

RSVP

|

| |

|

LIFESTYLE LIFESTYLE

Light Read – Fun and Enjoyable!

Lifestyle

If you are a high-income senior whose Old Age Security would be fully clawed back, find out if you should still apply.

This article addresses a question about if you should apply for OAS even if you have high income.

View Article

#OAS #taxes #income #wealth #canada #ontario

|

Michael Ams B.Com.

Strategic Associate

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

| |

|

FINANCE FINANCE

Light Read – Useful and Relevant

Finance

The Retirement Dilemma (Part 1: Money)

I was leaving Shoppers Drug mart and looked at the magazine rack. It’s funny how there are far more Special Edition Guides, or “Best of” magazines versus regularly scheduled editions. And of course, the price of these “Special Editions” are closer to $20 rather than $7.99. One magazine in particular caught my eye. It was a “Guide to Retirement”. I thought this would be a good read and there may be some helpful pointers that I could pass on to our clients. However, as I read through, I realized that it only focused on one part of “retirement” – the financials.

While the financial component is important, there is one issue that most don’t realize. By the time most start thinking seriously about retirement, it is too late to have a significant financial impact on their retirement cashflow. Most people start planning for their retirement within 5 years of their target retirement date. A 5 year period will have less of an impact than a 20 year planning period. Within 5 years of retirement, the majority of your retirement cashflow has already been determined with your current portfolio. 5 years is insufficient to drastically increase your expected retirement cashflow.

In those few years prior to retiring, the financial component that is best to focus on is spending habits. When you are earning employment income, you can spend freely. It feels as though you are spending someone else’s money. When you are retired there is no question, you are spending YOUR money. The more you spend, the less you will have. For some, it is a very difficult concept to wrap their head around. To prepare people for retirement, I often recommend they execute a virtual retirement.

A virtual retirement entails setting your expected retirement lifestyle budget (likely to be less than your current lifestyle budget. Once done, set a pre-authorized savings plan for any cashflow over and above the set retirement lifestyle budget. Then, try to live and see how it feels. Either it is going to be comfortable and you are building a nice addition to your retirement nest-egg. Or, you may discover a potential issue. Many people do this and realize they may have underestimated their spending habits. It is not as if people are willing to have eaten their last steak on the day they retire. They also may not be ready to go from driving a Lexus to a Ford.

Essentially, you are providing your financial planner with better data. As financial planners, we are already estimating rates of return, inflation, life expectancy, etc. If we can at least have a handle on your spending habits, we are in a better position to build a good plan. I’ve only ever had issues with financial plans not working well when people have unrealistic expectations of how much they will spend in retirement. So, help your financial planner build a successful plan for you by completing a Virtual Retirement. It may make the difference of how you spend the rest of your life.

|

Michael Connon B.Sc, CFP®

Senior Financial Planner

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

| |

|

FINANCE FINANCE

Light Read – Useful and Relevant

Finance

How To Avoid Being A Victim Of Fraud

Have you ever had a phone call or received an email that made you think twice about its legitimacy? Perhaps a threatening tone if you didn’t comply or promises of a monetary prize that you can collect?

All too often we hear of situations where people have been defrauded out of thousands of dollars due to their compliance with the fraudulent caller.

We can help reduce these examples if people are better informed of how to be aware of fraudulent communication and how to avoid being communicated to.

Here are four signs that the caller/emailer may be attempting a fraud:

- He/she may claim to be representing a legitimate business or organization (i.e. government, CRA, utility company, tech company, charity, etc.)

- He/she is likely to indicate that there is an issue that you must address. For example, you owe money to the CRA, you are in trouble with the law, you have a virus on your computer, etc. Or, he/she may indicate that you are the winner of a significant lottery or monetary prize.

- He/she may pressure you to make a decision immediately or act quickly. The fraudster doesn’t want you to have the time to research or look into his/her request. Threatening language may also be used. For example, they may threaten to arrest you or threaten to compromise your computer.

- He/she may request payment in a very specific way. For example, putting funds on a gift card or paying through a money transfer service. They will be very untraditional methods to pay for legitimate services.

If you suspect any of these 4 signs, then I suggest you hang up or request a phone number that you can call back.

Here are some actions that you can take to avoid being put into a potentially fraudulent situation:

- Block phone numbers from unwanted callers or texters.

- Don’t give personal or financial information to someone if it is an unexpected request.

- Don’t click on any links in an email that is unexpected.

- Don’t make decisions quickly nor succumb to any high-pressure tactics.

- Talk to a trusted family member, friend, neighbour, or professional before acting.

Being aware of the signs and doing things to avoid fraudulent activity will help keep you and your loved ones from being victims of fraud.

|

Carlo Cansino FMA, FCSI, CFP®

Senior Financial Planner

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

| |

|

THINK SMART

THINK SMART

Podcast – Listen to Mike and Rob and their latest thoughts and industry insights

Think Smart

|

| |

Ask TMFG

Watch The Latest Videos

|

| |

|

|

|

Assante Capital Management Ltd. is a Member of the Canadian Investor Protection Fund and Investment Industry Regulatory Organization of Canada. This material is provided for general information and is subject to change without

notice. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please make sure to see me for individual

financial advice based on your personal circumstances. Insurance products and services are provided through Assante Estate and Insurance Services Inc.

Commissions, trailing commissions, management fees and expenses, may all be associated with mutual fund investments. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Please read the Fund Facts and consult your Assante Advisor before investing.

Certain employees of (TMFG Tax Service) maintain a relationship with Assante Capital Management Ltd. ("Assante") through which they sell investment products. The relationship that they have with Assante does not include tax preparation

services which (TMFG Tax Service) is solely responsible. (TMFG Tax Service) is not associated in any way with Assante, and Assante has no responsibility for the tax preparation services offered by (TMFG Tax Service).

*Please note that a live recording may be conducted at our workshops. Consent will be obtained, should you be captured in the video.

**All personal information will only be used in accordance with your consent, and in compliance with Assante's Privacy Policy.

Let's keep communicating. We value our relationship with you and want to stay in touch, whether it's regarding events or newsletters. In brief, The McClelland Financial Group aims to provide you with information

that is relevant to you. As you are likely aware, on July 1, 2014 Canada's Anti-Spam Legislation (CASL) came into force which requires your consent to receive electronic communications.

If we do not receive an unsubscribe email from you we will continue e-communications under the implied consent provisions under CASL. **

|

|

|