|

|

|

|

|

|

|

|

Millennials»

Millennials:

Five Tips for Finding Your Financial Sweet Spot in 2017

Okay, we get it. When you were a student or had just entered the workforce, you probably had to live on a budget so tight that every dollar squeaked. Now that you've had a little time to get your career game going, you rightfully want to live a little – embark on a few adventures and maybe buy a nice thing or two. Isn't that why you're working so hard to begin with? Okay, we get it. When you were a student or had just entered the workforce, you probably had to live on a budget so tight that every dollar squeaked. Now that you've had a little time to get your career game going, you rightfully want to live a little – embark on a few adventures and maybe buy a nice thing or two. Isn't that why you're working so hard to begin with?

But then there's the future. You probably have lofty, and potentially costly goals there too.

Fortunately, financial planning doesn't have to be an all-or-nothing proposition. The sweet spot between spending some today and building a promising future is best reached by avoiding these five common millennial money traps you'll encounter along the way.

Trap #1: Not Paying Yourself FIRST

"Paying yourself first" means that, above all, you'll want to establish a disciplined process for setting aside at least 10 percent of your current paychecks for future spending. Paying yourself first is an essential rule for any generation, but it's especially important for millennials, because youthful savings grow more dramatically over time. If you commit to this golden rule, the rest of your paycheck can probably be spent on today's wants and needs.

If your work has a matching program for retirement savings, that's an ideal way to pay yourself first. Not only will the money come out before you have time to dig into it, but the matching dollars is free, extra money. Take advantage of it!

If you're on your own when it comes to your long-term saving, consider having that 10 percent still auto-withdrawn from your regular account directly into a place earmarked for the purpose. If you haven't started a monthly contribution, why wait? Start one TODAY!

Trap #2: Not Having an Emergency Fund

You may not know what emergencies may befall you or when they might occur, but odds are, they will. That's why one of your earliest priorities is setting aside enough to cover at least three months' worth of expenses at any time. That way, when (not if) those "surprises" happen, you're ready for them. Skip this step and you may be trapped into digging into your "pay yourself first" retirement savings. Trust us, it's a slippery slope from there, and you may never dig back out. Remember, the fewer assets you set aside early on for long-term growth, the steeper the savings climb will be once you do near retirement.

Trap #3: Too Much Debt!

When you turned 18, the banks probably jumped all over offering you your first credit card. Next, they were more than happy to extend you a student line of credit. Maybe the credit wheel kept turning when you landed your first full-time job and decided to take out a loan to buy a fancier car or a bigger house than you could really afford on your current salary.

Can you see the trap ahead? What seems like a good turn can become a nasty spiral.

Today …

- Establish a financial plan to manage any debt you've already got.

- Allocate discretionary dollars to paying off the highest-interest loans

(like credit cards).

- Think twice about how debt fits into your total plans before committing to

any more of it.

Trap #4: Not Having a Budget

Having a monthly budget helps you avoid the other traps we've described so far. It's simple math: Spend more than you're earning and you'll fall into the debt trap. Fail to budget for "paying yourself first," and setting aside emergency assets, and it will probably never happen. How much are you bringing in? How much are you spending? Here is a sample budget you can start using NOW to keep track of where your money is going.

Trap #5: Not Asking for Help

Last but not least, one of the best ways to avoid financial traps is to partner with a financial advisor who knows the course and is fully committed to helping you dodge them by serving your best interests. (Hint: That "best interest" part is as important as the first, if not more so!) In other words, you don't need to be a financial genius yourself if you're willing to heed best-interest advice from somebody who has the experience to guide you through both the basic and advanced logistics of building wealth.

At The McClelland Financial Group, we are here to help you establish that sweet spot between enjoying your life today and preparing for your future ambitions. We'll walk you through opening your first investment account, starting a monthly contribution, managing debt, filing taxes … and more. If you haven't had a meeting with your financial advisor lately because you don't have time or you think you don't have enough money – book one with us today! We even offer telephone appointments for convenience and would love to talk to you.

Chelsey Chartren,

B. Com. CSC, CPH

Financial Advisor

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

|

Carrick talks money»

VIDEO: Does renting make sense with

prices skyrocketing?

Rob Carrick discusses the increasing prices of rental properties and whether it

makes more sense to buy a home instead of renting. CLICK HERE

|

|

|

National Debt»

$20,000,000,000,000 US National Debt

As Mike Myers said, with pinky to mouth, in 1997's Austin Powers: International Man of Mystery, "one hundred billion dollars". It was at that time, one hundred billion dollars was an unfathomable amount of money. Fast forward 20 years to 2017, and one hundred billion dollars is still a significant number. However, it pales in comparison to the number of the US National Debt. As Mike Myers said, with pinky to mouth, in 1997's Austin Powers: International Man of Mystery, "one hundred billion dollars". It was at that time, one hundred billion dollars was an unfathomable amount of money. Fast forward 20 years to 2017, and one hundred billion dollars is still a significant number. However, it pales in comparison to the number of the US National Debt.

As Donald Trump takes over as the 45th President of the United Stated, one of the major issues looming over his head is the $20,000,000,000,000 US National Debt. This massive debt has been accumulating over many decades, most aggressively over the past 5 presidents' terms. Twenty trillion is a huge number and is almost incomprehensible for many people. To give you some perspective and context of this massive number, see the linked graphic.

- The US National Debt is greater than the total value of all 500 companies listed on the S&P500 stock market index. If you were to liquidate all 500 companies, the proceeds would be approximately $1 trillion dollars shy of the National Debt ($19 trillion).

- The US National Debt is greater than the total value of Assets under Management of the top 7 money managers in the world. Donald would still need just over $1 trillion to pay off the National Debt after using all the assets from these money managers.

- The US National Debt is more than 25 times the value of all oil exported in a year from the 10 largest oil exporting countries in the world. The top 10 make up $535 billion and the other remaining countries make up $250 billion.

- The US National Debt would be paid off in 155 years if it took the value of all gold mined, every year. Each year, the world collectively mines approximately $3,000 tonnes of gold, which equates to approximately $125 billion worth.

- The US National Debt is greater than all physical cash, gold, silver, bitcoin and other crypto-currencies, combined ($13 trillion). All the dollars, yen, euro, pound, yuan and other global currencies add up to approximately $5 trillion. Gold and silver make up approximately $7 trillion.

In his campaign, Trump had indicated that he could pay off the debt in 8 years. However, this may prove to be unlikely given his planned $1 trillion in infrastructure spending and $5 trillion in tax cuts.

Carlo Cansino,

FMA, FCSI, CFP

Senior Financial Advisor

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

|

Forecasting-Barry Ritholtz»

Let's put forecasting in its final resting place

Despite all of the earlier discussions about the folly of forecasts, I find myself once again compelled to bring up this subject. Blame it on the time of year, when all of the forecasts for 2017 are being rolled out, while the old ones that were so-often wrong are forgotten instead of being reviewed. Despite all of the earlier discussions about the folly of forecasts, I find myself once again compelled to bring up this subject. Blame it on the time of year, when all of the forecasts for 2017 are being rolled out, while the old ones that were so-often wrong are forgotten instead of being reviewed.

So please consider this column a public service. Here is a round-up of some of 2016's forecasts, and a look at why they didn't quite work out as expected.

CLICK HERE TO READ MORE...

|

|

|

Financial Planning »

Are your retirement goals a dream or a reality?

CLICK HERE TO WATCH 2 MIN VIDEO CLICK HERE TO WATCH 2 MIN VIDEO

Creating a financial plan is the first step in securing a successful retirement. Similar to constructing a home, the end result is achieved when a blueprint is created and followed to completion. Your retirement is no different. Start with determining what you want retirement to look like, create the plan and then follow the steps to get there.

Speak with one of our

Certified Financial Planners today

by contacting Michelle Moniz at [email protected] or

calling 905 771 5200. |

|

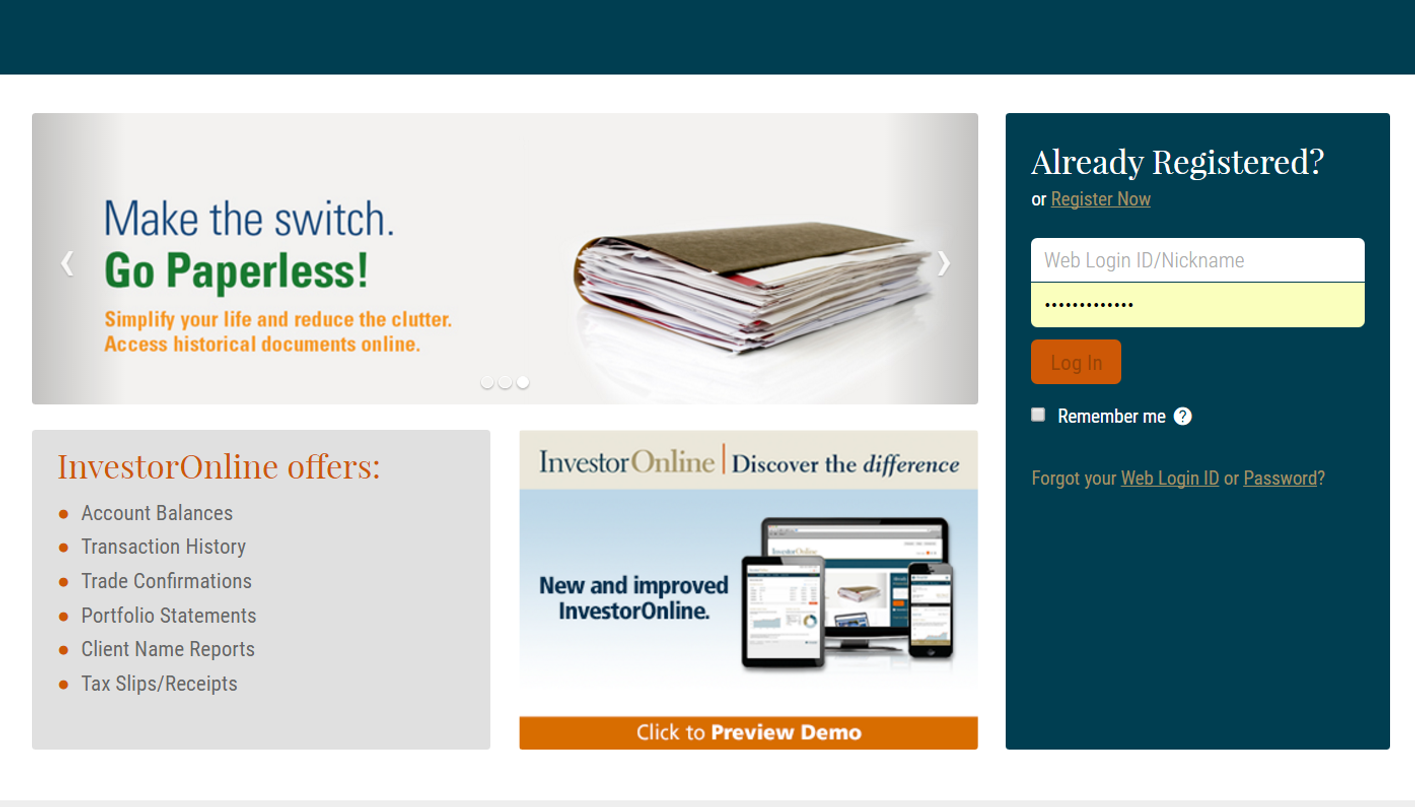

Assante Investor Online»

Get your

documents online...

CLICK HERE TO READ MORE... CLICK HERE TO READ MORE...

InvestorOnline offers:

- Account Balances

- Transaction History

- Trade Confirmations

- Portfolio Statements

- Client Name Reports

- Tax Slips/Receipts

Socheata Chea

905 771 5200.

|

|

|

|

Financial Advice »

The Value Of

Financial Advice

Why should you hire a financial planner? What makes The McClelland Financial Group stand out from the crowd?

Co-owners of The McClelland Financial Group, Rob McClelland and Mike Connon, outline why our clients hire us, continue to work with us and the environment we create for them.

Not a client of

The McClelland

Financial Group?

|

|

Tax Free Savings Account»

2017 Contribution

limit is $5,500

Contribute to your Tax Free Savings Account early to thrive from tax free growth

Click here to learn how you can contribute.

Michelle Moniz

905 771 5200.

|

|

|

|

|

|

|

Assante Capital Management Ltd. is a member of the Canadian Investor Protection Fund and is registered with the Investment Industry Regulatory Organization of Canada. This material is provided for general information and is subject to change without notice. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please make sure to see me for individual financial advice based on your personal circumstances. Insurance products and services are provided through Assante Estate and Insurance Services Inc.

Commissions, trailing commissions, management fees and expenses, may all be associated with mutual fund investments. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. Please read the Fund Facts and consult your Assante Advisor before investing.

*Please note that a live recording may be conducted at our workshops. Consent will be obtained, should you be captured in the video.

**All personal information will only be used in accordance with your consent, and in compliance with Assante's Privacy Policy.

Let's keep communicating. We value our relationship with you and want to stay in touch, whether it's regarding events or newsletters. In brief, The McClelland Financial Group aims to provide you with information that is relevant to you. As you are likely aware, on July 1, 2014 Canada's Anti-Spam Legislation (CASL) came into force which requires your consent to receive electronic communications.

If we do not receive an unsubscribe email from you we will continue e-communications under the implied consent provisions under CASL. **

|

|