Almost every decision we make, big or small, has a financial repercussion. Whether “should I go out for dinner or stay at home and cook “to locking in a mortgage, budgeting, or travelling. We are in a constant state of juggling all our financial choices. Join Financial Advisors Rob McClelland and Mike Connon as they take us through the landscape of financial decision-making.

“Key Points”

- Financial Decision Making

- Budgeting

- Travel

- Expense Control

- Mortgage and Loan Rates

Transcription

Rob (00:00): Hello, this is Rob and Mike from The McClelland Financial Group of Assante Capital Management. And this is Think Smart with TMFG. Today on Think Smart with TMFG Mike and I will discuss why we are always making financial decisions. Mike, I’ve met a lot of people that hate finances and money and money discussions and all of that. And yet what I find in the course of just living your life is that you’re always having to make financial decisions; even if you don’t want to be making financial decisions, you’re making financial decisions.

Mike (00:46): Big ones, little ones, but they’re always going to be decisions, and they’re going to affect your future in some way, right?

Rob (00:51): Well, you just came into my office, and you said, I’m not sure I should be buying used cars for my kids because I just got a $2,500, $3,000 repair bill. And it would’ve been better to lease a car for them for $500 a month.

Mike (01:05): Yeah. It’s funny. You start to always do the math afterwards, don’t you? It would’ve made more sense to do that math beforehand, but once I get the bill and it’s too late now, I’m reworking my math.

Rob (01:17): So it got me thinking, as many of our clients know, and if those who don’t, I have been rebuilding our family cottage. And so this summer we’ve been staying in our guest cabin so that’s been interesting and I decided to do this, it’s fairly expensive, and I didn’t want to sell any assets to pay for it. So I decided to pay for it out of cash flow over the next five years. So what I did is I thought I’ll take out mortgages over five years. Now, I didn’t need all the money at once because when you’re building, you sort of have to pay monthly for about a year. So, I decided I’d do the mortgages in incremental. So I decided with three mortgages. So I started with my first mortgage.

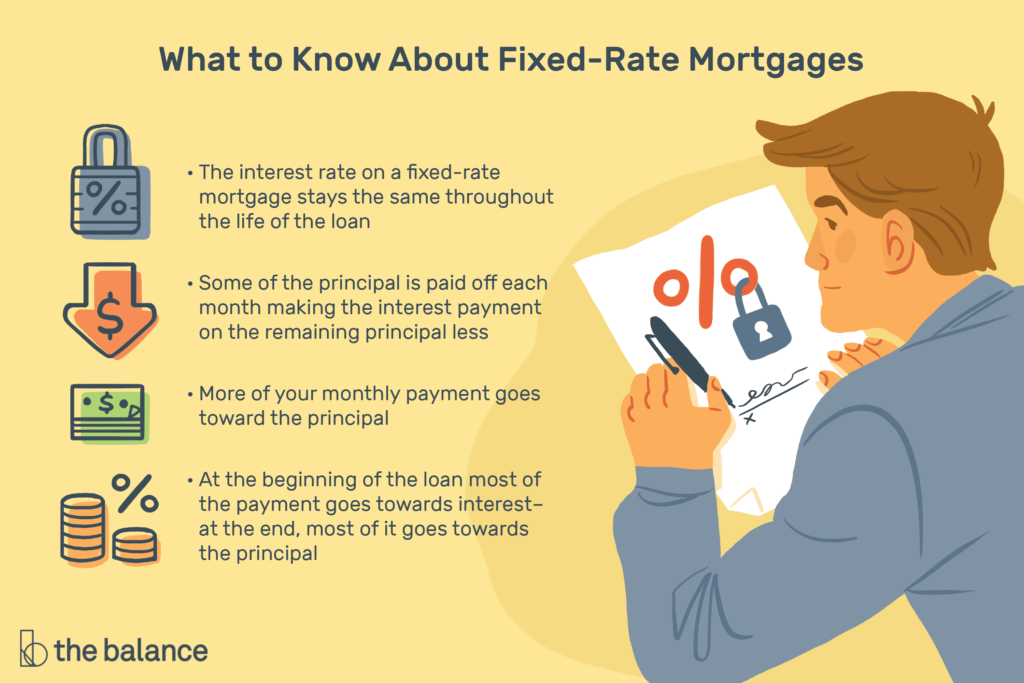

Rob (02:03): I decided to go variable. Interest rates were cheap when I took it out, I took it out in, I think it was November of 2021. So interest rates were still relatively cheap, I got probably the lowest rate you could get, but it’s variable. And what’s happened since then as interest rates have gone up. So, I sort of thought interest rates may go up, I thought there was that risk so I built into my calculation that interest rates may go up 2%. Well, we’re already past that. So I’ve got financial decisions to make now. Now I have three mortgages, they’re all variable, each rate is higher than the last one because the bank decided to charge me more. And now I’m deciding whether to lock in or not lock-in.

Mike (02:50): It’s a tricky decision because, historically speaking, when you use the evidence variable generally beats locking in and you always want to go against that because you feel there’s a time. The interesting thing that I find though is what people forget to include; everyone thinks variable and locked in are the same rate. Variable’s a lot cheaper than locked in. So even if you go to lock in now, you’re paying a lot more than your variable rate. So you’re still going to discount by being the variable rate. Even the variable rates now aren’t much higher than locked-in rates you would’ve got a year ago because locked-in rates they were saying mortgage were something like 1.3%. But if you want to lock in mortgage, you weren’t get 1.3% anymore. They started a lot higher there too. So a lot of times, you just go off evidence, right?

Rob (03:32): Well, the variable rate at the time and the initial one was one and a half percent. The locked-in rate was closer to 3%. So I just thought I was fine. Now the variable rate’s almost 4%, and the locked-in rates are close to 6%.

Mike (03:48): But you saved one and a half percent over the last year and a half. Right?

Rob (03:51): I did. So you got to put that into the calculation as well. Other decisions. So, we’re going to get a new TV set, but we don’t need it until November or December. So do I buy it now? I went online, I went on Amazon there are some TVs on sale. Do I buy it now? But then I got to put it in storage. Well, storage is… Our storage rates just went up. We have three storage units for all our old furniture.

Mike (04:17): And you buy a new TV now, by the time you get out of storage, it’s going to be an old TV.

Rob (04:20): It could be an old TV.

Mike (04:21): With our technology changes.

Rob (04:23): And what do we do at these storage bins? They just increased the price of the storage units 30%.

Mike (04:28): I find when I go to Costco and look at TVs, it always blows me away. They all look the same. One’s $598, one is $3,000 and they look exactly the same to me.

Rob (04:37): They do. Which one do you buy?

Mike (04:40): I buy the $598 one.

Rob (04:41): I know you do. And you regret it later when you come over to my house and you see, I bought the $3,000 one. What else? I think of my wife’s due to get a new car. Our car’s five years old, we’re starting to get lots of repair issues, it’s expensive. Should we sell investments? Should we take out a loan? Should we lease it? Again, more financial decisions. We want to take a family trip at Christmas. Should we pre-book it now? Should we wait? Are prices going to come down? All these things are financial decisions. What about small decisions? What are some of the small decisions that we make every single day?

Mike (05:22): Oh, just eating out. Think about it you’re… Last night I was going to, I had all set to cook dinner and then I was out for a walk and the walk ended up talking to some people. And all of a sudden it became 7:30. And I thought, do i want to start cooking at 7:30 or I didn’t want to pay a little bit extra and just go have someone cook for me? And of course I chose to have someone cook for me. But they’re all financial decisions it’s going to cost you probably twice as much to eat out as to eat at home. But there is a bit of ease in life, too. So you’re willing to pay for that.

Rob (05:52): You mentioned to me today, Mike and I go to Tim Hortons, which is how these podcasts started way back when, and we were at Tim Hortons and we were ordering our lunch and you said you’ve decided to boycott Subway because it’s too expensive now because it’s gone over $12.

But you’re always making those decisions. So you made a decision there not to go to Subway anymore because it’s more expensive than Tim Horton’s. So you can just as easily go to Tim’s.

Mike (06:17): I remember 10, 15 years ago, you used to have that $5 rule for lunch. I hated to spend over $5 on my lunch and I’ve had to up that to $10. Tim’s is actually pretty reasonable. You can get out of Tim’s for about 6, 7 bucks, which is pretty good. But last time I was at Subway if you order a sub and a drink and you’re 12, $13 for lunch, that used to be my dinner price.

Rob (06:39): That’s inflation.

Mike (06:40): Yeah, it happens. Even, if we’re just talking about this, you go to the grocery store and just bags. When they originally come up with this idea and I know it’s good for the environment on doing bags, it was a 5 cent charge. I remember when they first did it, they gave you nice bags too, they gave you these good sturdy bags. And I thought, that’s not bad, but everything with time, of course it sets in. Now Walmart doesn’t have plastic bags anymore they only have these fabric ones, which seems to go against the purpose because they seem harder to get rid of than anything else.

I don’t know what to do with them after I bring them home, they charge you 35 cents a bag. They’re not that big, they don’t hold that much and they have no other options when you’re in the store. There’s no boxes to put them in and every time, because they’re branded with a big Walmart thing, I don’t feel like carrying them to other stores. So I don’t walk around with them in my car. So every time I go to Walmart, I have to buy more of these 35 cent bags and then throw them out in the garbage heap again.

Rob (07:35): It’s funny you say that, I always forget the bag and then I’m at the cashier, and we’ve checked some items in. She goes, “are you bringing your own bag or would you like bags?” And I’m like, I got to go to the car and I can go to the car, it’s probably only five minutes there and back, but then I’m leaving the cashier with the person behind me in line, what do I do? I run out, oh, it’s raining, just all those decisions, all those financial decisions you’re making all the time. People love the convenience of drive-throughs, but those are financial decisions. Why not have an extra coffee at home? Why are you going out to Tim’s to get your drive-through? Oh, because I’ll get a sandwich too. So suddenly that $2 coffee is no longer $2, it’s $8 or $10.

Mike (08:21): How many subscriptions are you on now?

Rob (08:23): With the movies, we have all of them. Well, not all of them. I guess the big four or five.

Mike (08:30): I’m Netflix, Amazon, and Disney. What else do you have?

Rob (08:35): We have Crave, Prime and yeah. So I guess we’ve got the four.

Rob (08:42): Well, plus at the cottage, we have a satellite, which is just useless. I’m beginning to think satellite’s useless now.

Mike (08:47): Yeah. I have two satellite heads at my home and my cottage and I don’t know why I have them. I never watch satellite. At the cottage every now and again, when the internet’s bad and I have to watch the hockey game, it’s nice to get CBC up there, but that’s about it.

Rob (09:01): So financial decisions, what about investing decisions? The odd time you want to buy a stock, you may want to buy it for fun. Should I sell something that I already own, or should I put new money in? Or should I take that money that I have in my bank account, and should I apply that to some debt that I have? Maybe, in my case, I put it towards the mortgage. Maybe it’s only $2,000, but that’ll help reduce my mortgage payment. Financial decisions as much as we would love to avoid making financial decisions, you have to figure out a method for making those decisions.

Mike (09:40): And you can’t fool yourself either. It was funny, I always talk with a good client I have, and we’re talking about doing RSP contributions. And she went and said, well, I’ll hold off, and I’ll move from my open account. And then I, all of a sudden, well you’re not saving are you? And she went and said, okay, you’re calling me out on it. And it’s one of those things, people think, well, I’ll just move that RSP over from my open account and then I’d done my RSPs. And in the back of my mind thinking I’d saved my RSP. No, you haven’t saved your RSP, now, you’ve just done a transfer between accounts. So it’s very easy to fool yourself because you want to fool yourself too because it gives you more cash flow to spend, it’s more fun. But the truth is if you want to save, it’s got to come from the fun money that you do to spend on other things that you enjoy. That’s the reality of what savings is.

Rob (10:25): How is it going, teaching your kids to make all these financial decisions? How’s that working out?

Mike (10:31): I’ll tell you once I give my son that $3,000 bill to fix his truck.

Rob (10:36): Do you think he will take that out of his McDonald’s savings?

Mike (10:38): I’m not sure there are many McDonald’s shifts to pay for that.

Rob (10:42): I guess the thing is in life, we have these decisions to make. I find I have to make decisions for clients or help them with decisions. I have to make decisions for myself and my wife has to help my kids with decisions. Daughter Georgia came to me today she’s getting a raise, but she doesn’t think it’s enough. So I said, well, do your research, present your case and go back to your boss and say, I appreciate the raise, but promoting me, plus you’re giving me a standard of living raise.

Mike (11:17): There are good websites out there that give you what you deserve now, too. There are a bunch of them that are available for you to do research on these positions. It’s funny, I was just even thinking, I’m a bit envious because you made that electric car decision at the right time. And now we all want electric cars, and there’s none available; we can’t get any right.

Rob (11:34): You can’t get them. You’d have to wait a year or two years.

Mike (11:37): Yeah. So every time I go anywhere, it costs me $150 in gas and there’s nothing you can do about it because of the wait. So, some of those decisions in hindsight, were great decisions. God, it was a great decision two years got to move to electric, who would’ve known, but it happened?

Rob (11:51): The funny thing is there are still a lot of haters out there. They, they don’t want to believe it. They have every excuse in the book as to why the electric car or sorry, the electric car is not going to work. It’s a bit like just driving a golf cart, it just… It’s great. It’s just so easy. I don’t have to think about gas stations; that’s so nice in my life.

Mike (12:10): The funny thing is after these podcasts, we sometimes get responses, the most responses that we’ve ever got is over electric cars and people that don’t like electric cars. And of course, we’re Financial advisors from Toronto, we can talk about finance all day. No one ever complains; as soon as you bring up an electric car, you get a list of complainers.

Rob (12:29): So let’s talk about rules. What do you think some good rules are about how to make all these financial decisions work?

Mike (12:40): The best thing you can do is have a preset savings plan. And from there it really controls everything else. It’s a top-down approach that really works rather than deciding how much you’re going to spend, which is very onerous and very painful. Just decide how much you’re going to save and then whatever’s left over is for spending. And then you don’t have to worry about the tight budgets you don’t have to worry about because you’ll naturally be controlled by your cash flow. So that’s the one thing you can do, which makes your life very easy.

Mike (13:09): That way you don’t have to go and keep budget programs, you don’t have to keep all these… You know how much money you have, you know when you become short of money, when you’re becoming short of money, you ease off your spending. But you got to make sure you have that savings plan in place. So if you’re making a hundred thousand dollars a year, you want to save 20%. That $20,000 is set up whatever it is on a monthly basis beforehand. And then you don’t have to think about budgeting anymore.

Rob (13:34): So you can decide based on what’s left over, whether you can go to Subway or you have to go to Tim Horton’s or you got to make your own lunch.

Mike (13:43): Yeah. If you’re getting tight, you’ll start to make your own lunch. You have your savings plan and all of a sudden things are getting tight, you’ll start to automatically adjust your budget to compensate for that.

Rob (13:52): It’s interesting, since I graduated from university, I’ve had an American Express card and the advantage to the American Express card and it’s not a promotion for American Express, but its biggest advantage is I had to pay it every month. So if I happen to put $3,000 on it, one month I had to pay it, I didn’t have a choice because the rates just go through the roof. So you learn to budget. And then you throw that in with the automatic savings plan, then you can learn how much you can afford. Ingrid will often say to me, well, can we afford it? Yeah, we can afford this. Can we afford that? No we can’t afford that.

Mike (14:31): When I was young, I was probably in my early twenties, I made the mistake of trying to buy a suit I couldn’t afford. And I always remember I put it on my credit card, I didn’t have the money to pay it off, and it lasted for, I think two years because once you get in that road, it’s very hard to get out of. And I think I was trying to impress a girlfriend by buying a suit and it turned up putting me in debt for two years. So I learned my lesson after that. I just, I prefer debit cards to credit cards. I’m okay with credit cards because it’s pretty easy to pay them off all the time. But I find when people have financial difficulty, the first thing I say, is move from a credit card to a debit card.

Rob (15:05): So get a specific set of rules. I remember when I was about 18 years old, my father told me that I should go up to the cottage and spend a few days with just myself and come up with some rules. And so I did that and I didn’t know what he was talking about, but I came up with some rules on just things I stood for. And it was easier said than done when you’re 18 years old; you think you’re, I don’t know… Whether you’re going to be the next prime minister or whatever. But it allowed you to devise some rules about what you believed in. Where do you stand with respect to religion? Where do you stand with respect to alcohol, drugs, you name it? You make some of those decisions. You can change those decisions over the course of your lifetime, but you’ve at least got a starting point, and the same is true with finances; come up with some basic rules for yourself.

Rob (16:01): That brings us to the end of another week. This is Rob and Mike with Think Smart from The McClelland Financial Group of Assante Capital Management, reminding you to live the life that makes you happy.

Assante Capital Management (16:36): You’ve been listening to The McClelland Financial Group of Assante Capital Management Limited. Assante Capital Management Limited is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. Insurance products and services are provided through Assante Estate And Insurance Services Incorporated. This material is provided for general information and is subject to change without notice. Every effort has been made to compile this material from reliable sources. However, no warranty can be made as to its accuracy or completeness. Before acting on any of the previous information. Please make sure to see a professional advisor for individual financial advice based on your personal circumstances. The opinions expressed are those of the authors and not necessarily those of Assante Estate Management Limited.