|

|

| |

Our Two Cents

with TMFG

Your Monthly Update on Everything Going On in Your TMFG Financial World All in One Place. Ask TMFG videos, Our Podcast, Fun and Interesting Articles, Updates, Events and More.

|

|

| |

|

| |

|

Announcements Announcements

A special message from the TMFG team

We are happy to announce we were nominated for the Wealth Professional Awards in three categories:

Advisor of the Year - Rob McClelland

Advisory Team of the Year

Holistic Advisory Team of the Year

|

| |

|

FINANCE FINANCE

Light Read – Useful and Relevant

Finance

Harnessing the Power of Compounding Interest: A Path to Wealth for Young Canadians

As a young Canadian embarking on your journey into the workforce, it's crucial to lay the foundation for your financial future. One of the most effective ways to secure financial well-being is understanding and leveraging the power of compounding interest. Starting early and investing consistently can unlock substantial benefits and pave the way to long-term wealth creation. This article explores the advantages of compounding interest and provides an illustrative example of how investing $2,500 per year for 40 years at an 8% return can yield impressive results.

The Magic of Compounding Interest:

Compounding Interest is a concept that allows your investments to grow exponentially over time, generating returns not only on your initial investment but also on the accumulated interest. The earlier you begin investing, the longer your money must compound, magnifying its potential growth.

For young Canadians entering the workforce, time is an asset. By starting early and maintaining a disciplined approach to investing, you can harness the full potential of compounding interest. Even small regular contributions can snowball into significant wealth over several decades, thanks to the power of compounding.

Example:

Let's take a concrete example to understand the impact of compounding interest. Suppose you invest $2,500 per year for the next 40 years, earning an average annual return of 8%. Here's how your investment could grow:

Year 10: $39,113.72

Year 20: $123,557.30

Year 30: $305,864.70

Year 40: $699,452.60

In this example, your total contributions over 40 years amount to $100,000 ($2,500 × 40). However, due to the compounding effect, your investment would grow to $699,452.60, an additional $599,452.60

For young Canadians entering the workforce, harnessing the power of compounding interest can be a game-changer. Understanding the concept and making consistent investments can accumulate significant wealth over time. Starting with as little as $2,500 annually and earning an 8% return, you can amass a substantial nest egg. So, seize the opportunity, be proactive, and embark on a path toward a prosperous financial future.

|

John Iaconetti BCom, CFP®

Financial Advisor

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

| |

|

FINANCE FINANCE

Light Read – Useful and Relevant

Finance

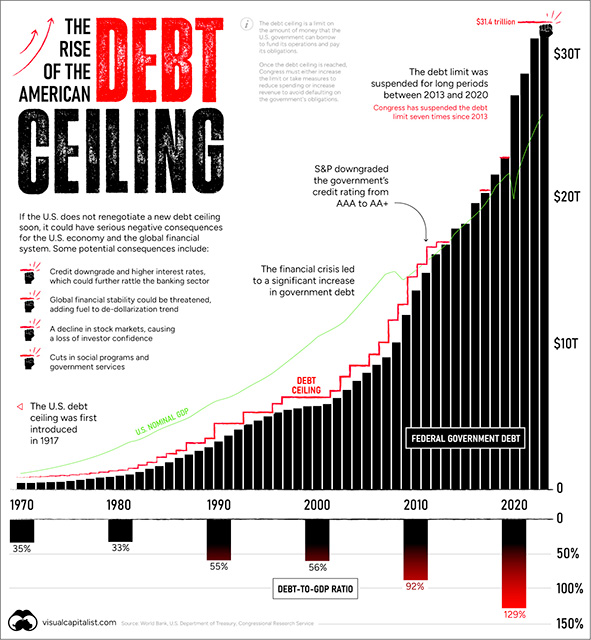

What is the US Debt Ceiling, and should I care?

The US Debt Ceiling is likely a concept that you’ve heard of or read headlines about within the last couple of months. It is starting to garner a little more attention given the proximity to the June 1st “X-date”.

In short, the debt ceiling is a restriction imposed by the US Congress on the amount of debt outstanding the Federal Government can have. The purpose of a ceiling is to ensure that the federal government doesn’t increase its debt load to the point that it cannot pay its obligations and maintain future investments.

Every year that there is a budgetary deficit (i.e. revenue from federal tax is less than current government spending), the national debt increases. The federal government must borrow from the US Treasury to pay for services and programs for the well-being of all US citizens. The US Treasury raises money by selling marketable securities to outside investors (i.e. foreign governments; institutional investors; etc.).

Is this the first time the debt ceiling has ever been reached? The answer is a resounding no. Over the past 60 years, the debt ceiling has increased 89 times. Money is borrowed, obligations get paid, and the economy continues to tick along.

Should investors use this information to change their investment strategy? I would suggest no. This same scenario has occurred 89 times before, and the market has continued to provide long-term growth. Long-term investors need not worry. Short-term investors should already have their money in a suitable portfolio that will limit their exposure to the inevitable short-term volatility.

|

Carlo Cansino FMA, FCSI, CFP®

Senior Financial Planner

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

| |

|

FUN CHARTS FUN CHARTS

Fun and inventive ways to see interesting ideas!

Charting the Rise of America’s Debt Ceiling

View Enlarged Image

Source: VisualCapitalist.com

|

| |

|

| |

|

Riley Moynes

4 Phases of Retirement

If you missed the Riley Moynes presentation in May please see the recording here. If you registered you will also receive your book in the mail.

|

| |

|

THINK SMART

THINK SMART

Podcast – Listen to Mike and Rob and their latest thoughts and industry insights

Think Smart

Increasing Your Earnings in Retirement

Who wouldn’t like a little more cash flow in their retirement plan? Today on ThinkSmart Senior Financial Advisors Rob McClelland and Mike Connon take you through the various portfolio strategies; increasing either growth or equities in your portfolio to increase your overall returns.

Key points:

(01:03): What is the Monte Carlo analysis?

(01:41): What is the makeup of different investment portfolios?

(03:35): 60/40 investment portfolio

(04:47): The 50/50 investment portfolio

(07:11): Let’s look at the 70/30 portfolio

(08:21): The 80/20 portfolio can be a bit volatile

(10:00): The 90/10 investment portfolio

(11:09): Cash cushion

(12:03): The bond market

LISTEN TO THE LATEST PODCAST

|

| |

Ask TMFG

Stocks vs Bonds - What Should I Invest In?

Watch The Latest Videos

|

| |

|

|

|

Assante Capital Management Ltd. is a Member of the Canadian Investor Protection Fund and Investment Industry Regulatory Organization of Canada. This material is provided for general information and is subject to change without

notice. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please make sure to see me for individual

financial advice based on your personal circumstances. Insurance products and services are provided through Assante Estate and Insurance Services Inc.

Commissions, trailing commissions, management fees and expenses, may all be associated with mutual fund investments. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Please read the Fund Facts and consult your Assante Advisor before investing.

Certain employees of (TMFG Tax Service) maintain a relationship with Assante Capital Management Ltd. ("Assante") through which they sell investment products. The relationship that they have with Assante does not include tax preparation

services which (TMFG Tax Service) is solely responsible. (TMFG Tax Service) is not associated in any way with Assante, and Assante has no responsibility for the tax preparation services offered by (TMFG Tax Service).

*Please note that a live recording may be conducted at our workshops. Consent will be obtained, should you be captured in the video.

**All personal information will only be used in accordance with your consent, and in compliance with Assante's Privacy Policy.

Let's keep communicating. We value our relationship with you and want to stay in touch, whether it's regarding events or newsletters. In brief, The McClelland Financial Group aims to provide you with information

that is relevant to you. As you are likely aware, on July 1, 2014 Canada's Anti-Spam Legislation (CASL) came into force which requires your consent to receive electronic communications.

If we do not receive an unsubscribe email from you we will continue e-communications under the implied consent provisions under CASL. **

|

|

|