|

|

| |

Our Two Cents

with TMFG

Your Monthly Update on Everything Going On in Your TMFG Financial World All in One Place. Ask TMFG videos, Our Podcast, Fun and Interesting Articles, Updates, Events and More.

|

|

| |

March Break Ceramics Event

What a fun event! It was great to see so many families come out for the March Break Ceramics Event. We had a blast. Ceramics will be ready for pickup in the next few weeks. There will be an email to you know when they are available. Wishing you all a great week and a happy long weekend. If you are celebrating all the best of the Spring season.

|

| |

|

FINANCE FINANCE

Light Read – Useful and Relevant

Finance

Silicon Valley Bank Explained

Who is Silicon Valley Bank?

Silicon Valley Bank largely banked start-ups and venture companies and was never a big lender. The start-up would get its seed capital and put it into Silicon Valley Bank. Silicon Valley Bank would take the deposits and largely invest in securities like Treasuries to capture a yield. If held, these don’t impact the bank’s capital and liquidity, as the unrealized losses go away as the bonds mature. Problems arise when assets in the investment portfolio must be sold because it then crystallizes the loss, impairing capital.

What went wrong?

As venture activity slowed last year, the start-ups, not getting additional financing, had to draw on their deposits faster. They were causing the Silicon Valley Bank to act on their bonds and term deposits before maturity realizing losses. This causes some concern for investors in Silicon Valley Bank, Causing a Bank run.

The banking system is highly dependent on customer confidence. All bank deposits in the U.S. are insured by the Federal Deposit Insurance Corporation (FDIC), but only up to $250,000 (a similar insurance system exists in Canada under the CDIC). Deposits above that cap are uninsured. Bank customers have no upside of staying with a bank that is rumoured to have problems, especially if their deposits at the bank are above the FDIC cap. This creates a strong incentive for depositors to move their capital to an institution that is perceived as safer, which amplifies the problems of the institution they are departing from.

Will other banks be affected?

Silicon Valley Bank’s client base and operations differed from other U.S. banks, including smaller regional banks. Because most of its accounts were venture capitalists and tech startups, over 90% of its deposit accounts were above the FDIC cap. Moreover, Silicon Valley Bank had one of the biggest investment portfolios relative to its capital base. All this makes it likely that the bank’s problems are localized.

What does this mean going forward?

Stress appearing in the banking system is unsuitable for risk sentiment, even if it is limited solely to Silicon Valley Bank. On the flip side, it will appear on the Fed’s radar as they consider the next step on the monetary policy front and probably reduces the likelihood that they will aggressively hike rates from here. That is what makes markets difficult: there are a lot of intertwined dynamics. The best way to account for risk is to invest in a Globally diversified approach. Therefore, you are not overly exposed to risk in one individual industry or country.

|

John Iaconetti BCom, CFP®

Financial Advisor

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

| |

|

FINANCE FINANCE

Light Read – Useful and Relevant

Finance

Three Investment Principles To Minimize Headlines-Induced Anxiety

Like any Canadian who has a market-based investment portfolio, headlines in the media can make for a very anxious journey. Good and bad news alike, can cause emotional reactions and potentially invoke bad decision making.

Long-term investing does not have to be worrisome exercise. You can have a more enjoyable investment experience by subscribing to the 3 following “time-tested” investment principles:

1. Uncertainty is unavoidable

The last 3 years in the market have been arguably the most worry-inducing years as of late. We have gone through a global pandemic, a war in Ukraine, a meteoric rise in inflation, and ongoing recession fears. Although, this level of uncertainty seems unprecedented, there have been periods in the past where inflation has sky-rocketed (1973 – 1974), wars have occurred, and other global events inflicted the same level of volatility. That being said, the US market – as measured by the Russell 3000 (broad market cap weighted index of public US companies) – has had an annualized return of 11.79% (from February 28, 2020 to February 28, 2023). This is slightly above the index’ annualized return of 11.65% since inception in January 1979. Given all the uncertainty in the market in the last 3 years, I’m sure there aren’t many who would’ve guessed the US market would have returned over 11% per year over the last 3 years.

2. Market Timing is Futile

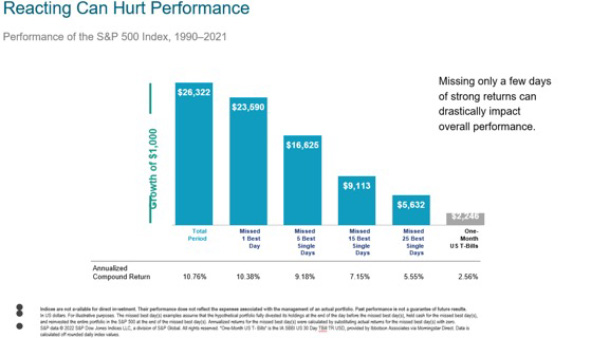

When the market is volatile and your portfolio is fluctuating, it is only natural to feel compelled to do “something”. However, as ongoing research has demonstrated, timing the market and making short-term changes rarely provide the desired outcome (i.e. outperforming the market).

View Enlarged Chart

In the 32 years from 1990 – 2021, there would be approx. 8,064 trading days. By missing 0.3% (25) of the best trading days, you would essentially cut your annual performance number in half. From another perspective, you would have to capture at least 99.7% of the best trading days to achieve half the annualized return that the market provided from 1990 – 2021. Just stay invested.

3. Diversification – spread your risk

By now, you should be quite familiar with the concept of diversification. It is a simple way to minimize the risk that any one company, asset class, sector, or country will have on your portfolio.

If we think of the crisis “du jour”, Silicon Valley Bank (“SIVB”) made headlines earlier this month. As of February 28, 2023, the company made up 0.04% of the Russell 3000 index. Regional banks similar to it made up 1.7% of the Russell 3000 index. For those investors with globally-diversified portfolios (geographic exposure outside of the US as well), the exposure to SIVB and other US regional banks would have been significantly smaller.

By following these investment principles, short-term crisis’ and the media’s subsequent headlines will be much more easily digested.

|

Carlo Cansino FMA, FCSI, CFP®

Senior Financial Planner

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

| |

|

FUN CHARTS FUN CHARTS

Fun and inventive ways to see interesting ideas!

The Western Advantage

View Enlarged Image

Source: IMF (GDP); OECD (expenditure on R&D)

|

| |

|

FINANCE FINANCE

Light Read – Useful and Relevant

Finance

Inflation surges 5.7% as prices spike most since 1991

BNNBloomberg.ca:

"Canadian consumer price inflation jumped to a new three-decade high in February, cementing expectations the Bank of Canada will aggressively hike interest rates in coming months to rein in price pressures.

Annual inflation was 5.7 per cent last month, up from 5.1 per cent in January, Statistics Canada reported Wednesday in Ottawa. That’s the highest since August 1991 and exceeds the median estimate of 5.5 per cent in a Bloomberg survey of economists."

View Article

|

Michael Ams B.Com.

Strategic Associate

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

| |

|

Please give us your Google review. Google reviews are critical for new potential clients to know that they are working with a trusted and well reviewed advisor.

|

| |

|

THINK SMART

THINK SMART

Podcast – Listen to Mike and Rob and their latest thoughts and industry insights

Think Smart

Relentless Negativity In Journalism is Harming Our View of the World

Why does the press persist in flogging the negative? Today we take a look at some recent stories in the press that while attention-grabbing may be pretty far from the truth. Is our obsession with getting the next “click” taking over our common sense?

Key Points from this Episode:

(01:27): Predictions vs. reality in the job market.

(02:48): Stocks in the headlines.

(03:41): Markets in the headlines.

(05:56): Stories are supporting these outlandish headlines.

(08:23): What is driving modern media in this sensational direction?

(13:29): What’s really going on out there?

LISTEN TO THE LATEST PODCAST

|

| |

Ask TMFG

What happened to Silicon Valley Bank?

Watch The Latest Videos

|

| |

|

|

|

Assante Capital Management Ltd. is a Member of the Canadian Investor Protection Fund and Investment Industry Regulatory Organization of Canada. This material is provided for general information and is subject to change without

notice. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please make sure to see me for individual

financial advice based on your personal circumstances. Insurance products and services are provided through Assante Estate and Insurance Services Inc.

Commissions, trailing commissions, management fees and expenses, may all be associated with mutual fund investments. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Please read the Fund Facts and consult your Assante Advisor before investing.

Certain employees of (TMFG Tax Service) maintain a relationship with Assante Capital Management Ltd. ("Assante") through which they sell investment products. The relationship that they have with Assante does not include tax preparation

services which (TMFG Tax Service) is solely responsible. (TMFG Tax Service) is not associated in any way with Assante, and Assante has no responsibility for the tax preparation services offered by (TMFG Tax Service).

*Please note that a live recording may be conducted at our workshops. Consent will be obtained, should you be captured in the video.

**All personal information will only be used in accordance with your consent, and in compliance with Assante's Privacy Policy.

Let's keep communicating. We value our relationship with you and want to stay in touch, whether it's regarding events or newsletters. In brief, The McClelland Financial Group aims to provide you with information

that is relevant to you. As you are likely aware, on July 1, 2014 Canada's Anti-Spam Legislation (CASL) came into force which requires your consent to receive electronic communications.

If we do not receive an unsubscribe email from you we will continue e-communications under the implied consent provisions under CASL. **

|

|

|