|

|

| |

Our Two Cents

with TMFG

Your Monthly Update on Everything Going On in Your TMFG Financial World All in One Place. Ask TMFG videos, Our Podcast, Fun and Interesting Articles, Updates, Events and More.

|

|

| |

|

FINANCE FINANCE

Light Read – Useful and Relevant

Finance

Why is it important to keep your meetings?

As a client of The McClelland Financial Group (“TMFG”), you have become accustomed to having our next meeting scheduled in the current one. This is an effective method of ensuring we maintain consistent contact. But, we understand life gets busy, and meetings get cancelled.

Given our past experience, cancelled meetings should be rescheduled immediately. Otherwise, life will continue to be busy and there will never be a convenient time to reschedule.

Here are 5 reasons why, it is important to keep your meeting or reschedule a cancelled one:

- Keep up with current market conditions. Volatility in the market can be a cause for concern for some clients. If there is not consistent contact from an objective voice, then there is more opportunity for bad behaviour. Keep your questions for your financial advisor, not your neighbours, family members, or friends.

- Busy schedule. Cancelling a meeting means you are giving up your dedicated time with your advisor. It may be difficult to reschedule a meeting soon after your cancelled meeting if your advisor’s schedule does not allow.

- Changes to your life. Life is dynamic and we know that it can change on a dime. Cancelling your meeting may not afford you the time to discuss these changes with your advisor so that it can be updated in your plan.

- Time with your advisor is limited. At TMFG, we dedicate a specific amount of time for your meetings (i.e. 90 minutes). If you meet with your advisor semi-annually, then you have 3 hours with your advisor for the year. If you cancel one meeting, you only have 90 minutes. This may not be enough time for all necessary updates.

- Have at least 1 in-person meeting. The pandemic showed us that we can all adapt to the environment around us. Even our least “techy” clients became zoom experts for our “virtual meetings”. That said, the convenience of virtual meetings should not deter you from meeting in-person at the office. At home, there are many opportunities to be distracted (i.e. barking dog; crying children; ringing doorbell; laundry to be done; etc.). It is a more effective meeting at the office where we can leverage the resources, technology, and manpower to provide a great experience.

Scheduling meetings has never been easier at TMFG. Your phone calls are always answered by a friendly voice and not a voice-prompt system. And, our online scheduling application (Calendly) is set up for your advisor’s schedule. Feel free to use either method to schedule or reschedule your meetings. We look forward to seeing you in the office.

|

Carlo Cansino FMA, FCSI, CFP®

Senior Financial Planner

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

| |

|

FINANCE FINANCE

Light Read – Useful and Relevant

Finance

Surviving an illness is likely,

but also expensive

The concept of insurance has always been difficult for people to accept. After all, nobody believes they will be sick. It is easier to understand that you will pass away at some point. This is why we have seen that life insurance is the most common policy. However, the statistics show a very different story.

Thanks to medical advancements, premature death before the age of 65 have become very rare. We continue to see people get cancer, heart attack or stroke. But thankfully, the mortality rates of these illnesses have dropped dramatically. Two out of five of us are expected to develop cancer. However, 63% of Canadians are expected to survive for five years after a cancer diagnosis. There are even better survival rates for Heart attack and stroke. More than 90% of Canadians who have a heart attack and more than 80% who have a stroke and make it to the hospital will survive.

It is excellent that medical science has developed to the point that survival rates in Canada are rising. But what’s also on the rise in the amount of financial difficulty that arises from these illnesses. People are protecting their families from premature death, but they are not protecting their finances when surviving a significant illness.

That is where critical illness insurance comes into the equation. Critical illness insurance will provide a tax-free benefit to those who have survived a major illness, providing the financial flexibility to fund their recovery. The more significant benefit is financing expensive treatments that OHIP cannot cover. So, you and your family can ensure you are getting the best health care and are financially stable, so you can focus on your recovery, which matters most.

Statistics say there is a good chance we will get diagnosed with cancer, heart attack, or stroke during our working lives. So why not invest in an insurance policy that will help you and your family be protected during these times? If you are working, you should have a critical illness policy.

Statistics source: Myth vs. reality: Critical illness statistics in Canada

|

John Iaconetti B.A.S., Spec. Hons. Administrative Studies (Finance)

Financial Advisor

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

| |

|

LIFESTYLE LIFESTYLE

Light Read – Useful and Relevant

Lifestyle

10 Fall Gardening Tasks to Make Your Garden Sing Next Spring

"It’s not time to hang up your rake until the last gardening tasks of the season are complete. Here are ten essential fall tasks to finish before the snow flies to ensure your garden will shine next spring."

View Article

|

Amber Mazurkiewicz

Marketing Manager

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

| |

|

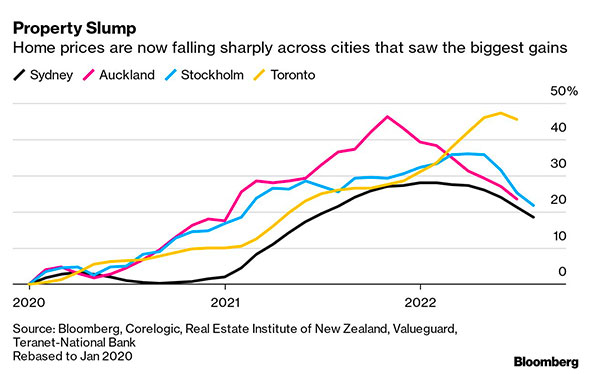

FUN CHARTS FUN CHARTS

Fun and inventive ways to see interesting ideas!

Fun Charts

View Enlarged Image

Source: Bloomberg.com

|

| |

|

| |

|

THINK SMART

THINK SMART

Podcast – Listen to Mike and Rob and their latest thoughts and industry insights

Think Smart

How to Teach Your Children About Money

As children go through the various stages of life it’s important to teach them about the value of money. Whether it’s saving wages from their Summer job, collecting an allowance, or setting out on a new career path as a recent university graduate. Whichever stage they are at it’s important to include them in financial discussions so they can make educated decisions about their finances.

Join Senior Financial Advisors Rob McClelland and Mike Connon as they discuss some healthy financial habits you might want to teach to your children.

LISTEN TO THE LATEST PODCAST

|

| |

Ask TMFG

Navigating an Uncertain Market

Watch The Latest Videos

|

| |

|

|

|

Assante Capital Management Ltd. is a Member of the Canadian Investor Protection Fund and Investment Industry Regulatory Organization of Canada. This material is provided for general information and is subject to change without

notice. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please make sure to see me for individual

financial advice based on your personal circumstances. Insurance products and services are provided through Assante Estate and Insurance Services Inc.

Commissions, trailing commissions, management fees and expenses, may all be associated with mutual fund investments. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Please read the Fund Facts and consult your Assante Advisor before investing.

Certain employees of (TMFG Tax Service) maintain a relationship with Assante Capital Management Ltd. ("Assante") through which they sell investment products. The relationship that they have with Assante does not include tax preparation

services which (TMFG Tax Service) is solely responsible. (TMFG Tax Service) is not associated in any way with Assante, and Assante has no responsibility for the tax preparation services offered by (TMFG Tax Service).

*Please note that a live recording may be conducted at our workshops. Consent will be obtained, should you be captured in the video.

**All personal information will only be used in accordance with your consent, and in compliance with Assante's Privacy Policy.

Let's keep communicating. We value our relationship with you and want to stay in touch, whether it's regarding events or newsletters. In brief, The McClelland Financial Group aims to provide you with information

that is relevant to you. As you are likely aware, on July 1, 2014 Canada's Anti-Spam Legislation (CASL) came into force which requires your consent to receive electronic communications.

If we do not receive an unsubscribe email from you we will continue e-communications under the implied consent provisions under CASL. **

|

|

|