|

|

| |

Our Two Cents

with TMFG

Your Monthly Update on Everything Going On in Your TMFG Financial World All in One Place. Ask TMFG videos, Our Podcast, Fun and Interesting Articles, Updates, Events and More.

|

|

| |

|

TMFG Scholarship Winner

We are pleased to announce Abigail Leu as winner of the 2022 The McClelland Financial Group Scholarship in the amount of $2,500.

A QUICK BIO FROM ABIGAIL:

My name is Abigail Leu, I’m a third year at Laurier University completing a Bachelor of Business Administration with a double minor in Economics and Education. For extracurriculars, I am part of my school’s case competition team and have represented Laurier in countries such as Canada, Australia, Thailand, and Norway. In terms of work experience, I have been working for the United Nations since 2021 and have helped on projects such as, “The Cookbook in Support of the United Nations: for People and Planet”. This past summer, I interned at Mawer Investment Management working in public equities and this winter I will be interning at Altas Partners and working in private equity. In the future, I hope to combine my previous work experience and extracurricular activities and pursue a career in the finance industry. In terms of my spare time, I enjoy going bouldering, to escape rooms, and playing cards (euchre is definitely a favorite)!

|

| |

|

LIFESTYLE LIFESTYLE

Light Read – Fun and Enjoyable!

Lifestyle

Why Your Brain Needs a Workout

PsychologyToday.com:

"As we grow older, we inevitably start to notice changes in cognitive function. This article has some great suggestions on how to keep your brain healthy."

View Article

|

Michael Ams B.Com.

Strategic Associate

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

| |

|

FINANCE FINANCE

Light Read – Useful and Relevant

Finance

Why You Should Not Rush Into GICs

2022 will be remembered as the year of rising interest rates in our economy. Canada has led the charge globally, increasing its interest rates at a torrid pace. The reason for this interest rate increase stems from our inflation issue. Inflation in Canada at its highest point was 8.1%, approximately 4X higher than it has been on average in recent history.

Inflationary issues originated with the pandemic, and our response to it, from quarantines and government benefits to supporting our population during this time. The supply of goods and services was low due to quarantines and the lack of a workforce to manufacture these goods. While at the same time demand for these goods was high because government benefits injected more money into the economy. When dealing with high demand and low supply, that is the perfect environment for inflation. How can we curb demand in our economy? We raise interest rates, so the average household may spend less on “wants” because more of their budget is allocated to debt repayment.

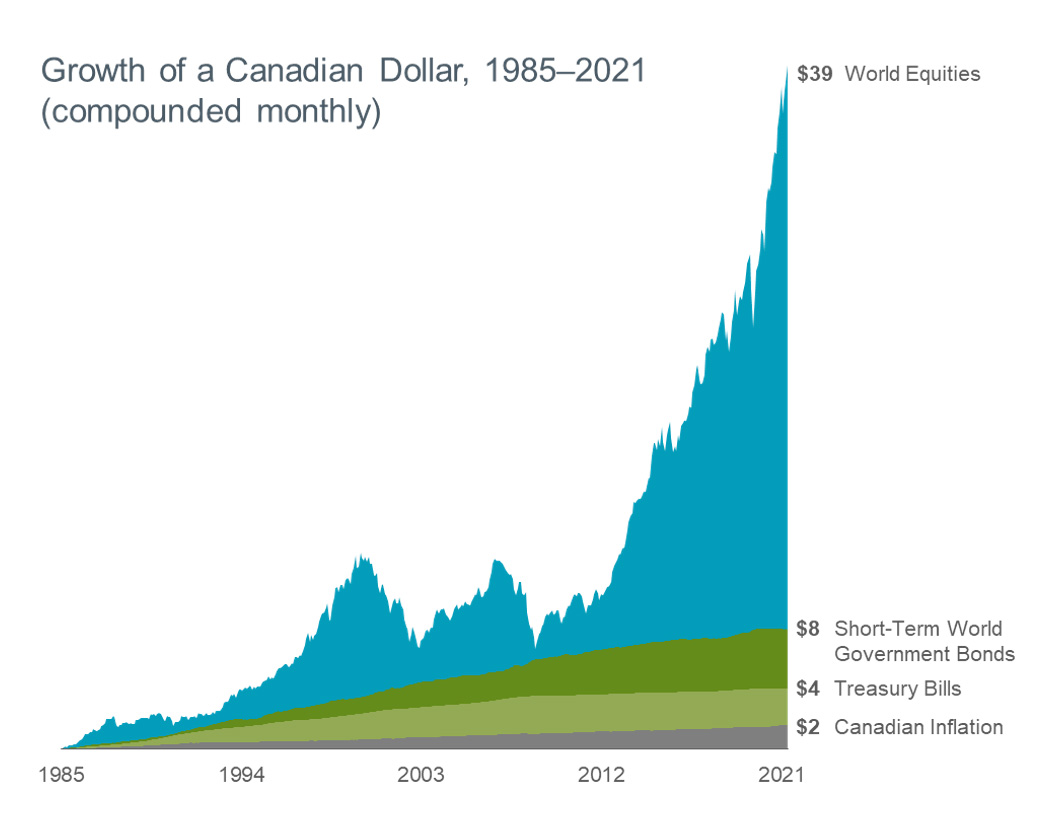

With interest rates on the rise, major stock markets worldwide are experiencing negative returns, but what has begun to be more attractive to investors is fixed-term investments like GICs. GICs pay based on the available interest rates, so their projected returns are higher than we have seen in recent history. So those who have been nervous about stock market volatility may think they can find comfort in a GIC investment. That would be a mistake. When investing, our goal is not just getting the highest return possible but choosing the investment that will exceed inflation in the long term. That has always been investing in the stock market.

We have experienced market downturns today should not be seen as the wrong time to invest. Instead, it has been the exact opposite. Basic financial principles have always told us we want to buy low and sell high; when stock markets are down like they are, that will make it the ideal time to invest. Our history tells us these periods of negative markets do not last long, so therefore this opportunity will not present itself forever. The recovery will happen; it is just a matter of “when” if you are invested in a globally diversified portfolio.

Investing in a globally diversified portfolio, made up of thousands of companies in different countries and industries worldwide, is the only way to guarantee we will stay ahead of inflation. Choosing the correct investment is not difficult; however, staying disciplined during the stock market swings is. That is why you work with professionals like us. We look beyond the headlines and the fears of the day-to-day but instead stay focused on your long-term goals.

|

John Iaconetti B.A.S., Spec. Hons. Administrative Studies (Finance)

Financial Advisor

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

| |

|

FINANCE FINANCE

Light Read – Useful and Relevant

Finance

Get Off The Sidelines

and Invest Your Money

With interest rates on the rise, why would anyone take market risk and invest their money? Great questions, but I have 3 important reasons why:

1. Take care of your future self

2. Preserve your money against inflation

3. Replace your human capital with financial capital

The common theme to all these reasons is that you are taking care of the future, not the present.

Taking care of your future self

As hard as it may be to imagine, we will all get to an age where we cannot work or continue to earn income in the same way we did in our working years. Without our ability to work to earn income, we need to have a pool or other source to draw from, for our living expenses. The only way to do that is to set aside a portion of what we are earning now, to create the pool.

Preserve your money against inflation

Over the last 3 months, inflation has become more and more relevant to the day-to-day for Canadians. Rising prices are eating into Canadians’ income -- making it more difficult to purchase the same amount of goods/services than previous years. If income is not increasing at the same rate as the price of groceries, fuel, utilities, and other things, then your family will have to learn to survive on less.

At 3% inflation, it will take approximately 23 years for prices to double. At 4% inflation, it will take approximately 17 years for prices to double. The Bank of Canada targets long-term inflation at 2 – 3%. Not protecting your income against inflation will drastically affect your quality of life. For example, if you retire at age 60 and have a life expectancy to age 95, then you should be ready to cut your expenses in half at 2/3 of the way through your retirement. This will be increasingly difficult given that expenses could go up due to medical costs in that period.

Historically, stock markets have outperformed inflation over the long-term. Thus, providing the protection a retiree’s income needs.

Replace your human capital with financial capital

We discussed earlier that investing gives you the opportunity to take care of your future self. As a working individual, your biggest asset is your ability to earn income. You have skills, knowledge, and time, which make up your human capital. As you age, you don’t lose skills or knowledge, but you will lose time. You need to build up financial capital to replace the time lost due to aging.

In order to replace your human capital, you need to quantify it. Your first step is to determine the present value of your future earnings. For example, if you earn $50,000 year and work for 40 years, the future value of your human capital is $2,000,000. In order to determine the present value, you must use a discount rate between 1 – 3% (rate used by personal injury lawyers). At a discount rate of 3% (target inflation), the present value of your human capital is $1,200,000. Therefore, your financial capital equivalent is the same.

The goal should be to accumulate the present value of your human capital through investing. For example, if you save 10% of your income ($5,000/month) for 40 years, your investments need to earn 7.7% to accumulate $1,200,000. The rate of return is 4.7% above the inflation rate.

Keeping money on the sidelines, not earning an inflation-protected rate of return, makes for a comfortable life in present time. The longer you feel comfortable in the present, makes it a worse lifestyle for your future self.

|

Carlo Cansino FMA, FCSI, CFP®

Senior Financial Planner

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

| |

|

FUN CHARTS FUN CHARTS

Fun and inventive ways to see interesting ideas!

Fun Charts

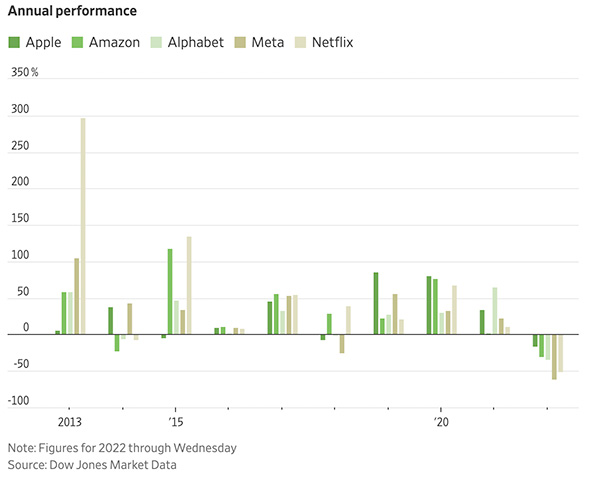

View Enlarged Image

Source: Dow Jones Market Data

|

| |

|

| |

|

THINK SMART

THINK SMART

Podcast – Listen to Mike and Rob and their latest thoughts and industry insights

Think Smart

Dramatic Investment Losses in 2022

This is truly a raging bear market. Personal investment portfolios have fallen 44% in the US from January to October of this year. How is that affecting Canadian investments? How did the indexes fare? What is stopping growth stocks from growing?

Join Senior Financial Advisors Rob McClelland and Mike Connon to hear the answers to these concerning questions and more.

LISTEN TO THE LATEST PODCAST

|

| |

Ask TMFG

The Value Premium Is Back

Watch The Latest Videos

|

| |

|

|

|

Assante Capital Management Ltd. is a Member of the Canadian Investor Protection Fund and Investment Industry Regulatory Organization of Canada. This material is provided for general information and is subject to change without

notice. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please make sure to see me for individual

financial advice based on your personal circumstances. Insurance products and services are provided through Assante Estate and Insurance Services Inc.

Commissions, trailing commissions, management fees and expenses, may all be associated with mutual fund investments. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Please read the Fund Facts and consult your Assante Advisor before investing.

Certain employees of (TMFG Tax Service) maintain a relationship with Assante Capital Management Ltd. ("Assante") through which they sell investment products. The relationship that they have with Assante does not include tax preparation

services which (TMFG Tax Service) is solely responsible. (TMFG Tax Service) is not associated in any way with Assante, and Assante has no responsibility for the tax preparation services offered by (TMFG Tax Service).

*Please note that a live recording may be conducted at our workshops. Consent will be obtained, should you be captured in the video.

**All personal information will only be used in accordance with your consent, and in compliance with Assante's Privacy Policy.

Let's keep communicating. We value our relationship with you and want to stay in touch, whether it's regarding events or newsletters. In brief, The McClelland Financial Group aims to provide you with information

that is relevant to you. As you are likely aware, on July 1, 2014 Canada's Anti-Spam Legislation (CASL) came into force which requires your consent to receive electronic communications.

If we do not receive an unsubscribe email from you we will continue e-communications under the implied consent provisions under CASL. **

|

|

|