|

|

| |

Our Two Cents

with TMFG

Your Monthly Update on Everything Going On in Your TMFG Financial World All in One Place. Ask TMFG videos, Our Podcast, Fun and Interesting Articles, Updates, Events and More.

|

|

| |

|

Announcements Announcements

A special message from the TMFG team

The McClelland Financial Group

Holiday Toy Drive

We can make a difference.

Every year we collect over 400 gifts for kids.

There is nothing as rewarding as seeing a happy child during the holiday season. Please help us make a difference in our city this year.

Donate Any Unused Toy

or Monetary Amount

We will be collecting donations at our office and at our holiday event.

All donations will sent to CHUM on December 15th.

Tax receipts for any monetary gifts will be sent at the end of January and will come directly from the

CP24 CHUM CITY WISH FOUNDATION

Let's light up a few smiles

for the holidays!

|

| |

|

Announcements Announcements

A special message from the TMFG team

Rob McClelland has been named one of Canada's Top Financial Advisors 2022 by The Globe and Mail and Shook Research

|

| |

|

FINANCE FINANCE

Light Read – Useful and Relevant

Finance

How do the RRSP contribution carry forward rules work? What are the rules about RRSP carry forwards? Should you ever contribute the full amount?

MoneySense.ca:

"As soon as a taxpayer starts to earn income—like employment income, self-employment income, royalties, research grants or net rental income—they accumulate room for their registered retirement savings plan (RRSP). There are no age limits, so a teenager with a part-time job can start to build their RRSP room as long as they file a tax return to report their earned income."

View Article

|

Michael Ams B.Com.

Strategic Associate

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

| |

|

FINANCE FINANCE

Light Read – Useful and Relevant

Finance

TFSA 2023

It’s official – 2023 TFSA contribution room is $6,500! Be sure to make the adjustments to your pre-authorized contributions to utilize all the room.

Let’s take this time to remind ourselves of some of the benefits of the Tax Fee Savings Account.

In reality, the vehicle was misnamed from its inception. A more accurate name would have been the Tax Free Investment Account. In too many instances I have spoken with prospective clients who have their TFSAs in savings accounts (i.e. cash). I can’t blame them because the name suggests it.

TFSAs can hold most investments that are eligible in other registered accounts (i.e. stocks; bonds; mutual funds; ETFs; etc.). The tax-free growth available within the TFSA is better utilized with investments that provide higher growth and income potential.

As of January 1, 2023, the maximum that an individual can have invested since the inception of the TFSA (since 2009) is $88,000. In a 2-person household, it is $176,000 – a fairly significant amount of tax free growth opportunity.

TFSAs also provide liquidity opportunities because there is no tax implication upon withdrawal. In fact, you do not lose the contribution room if you were to withdraw any amount. You receive the withdrawal amount back as contribution room in the next calendar year.

For estate planning purposes, you can designate a beneficiary for your TFSA, similar to other registered accounts. In addition, a spouse receives the added benefit of the “successor annuitant” designation. This designation allows the surviving spouse to accept the deceased spouse’s TFSA into their own, regardless of contribution room available.

If you have the resources to use the contribution room, then you should. There is no downside to utilizing the TFSA. For more information please contact your TMFG advisor.

|

Carlo Cansino FMA, FCSI, CFP®

Senior Financial Planner

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

| |

|

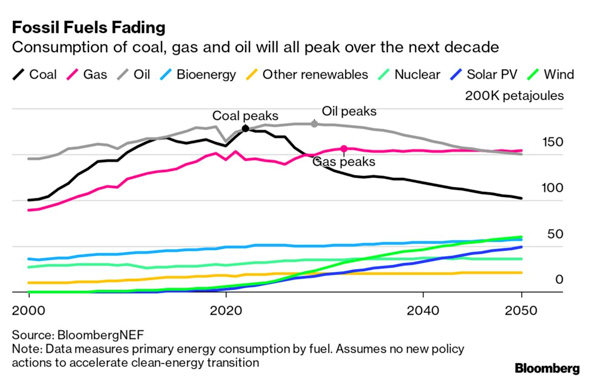

FUN CHARTS FUN CHARTS

Fun and inventive ways to see interesting ideas!

Fun Charts

View Enlarged Image

Source: BloombergNEF

|

| |

|

| |

|

THINK SMART

THINK SMART

Podcast – Listen to Mike and Rob and their latest thoughts and industry insights

Think Smart

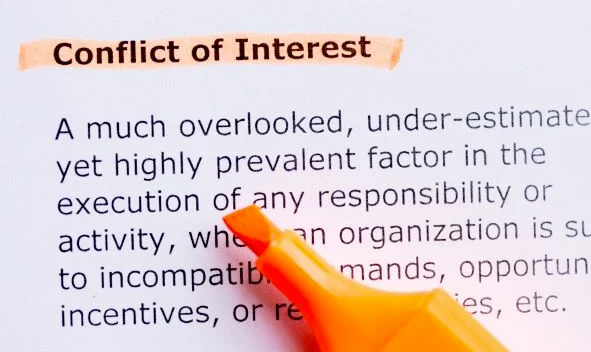

Conflicts of Interest That Impact Your Investments

Conflicts of interest exist everywhere in the marketplace. They may be hidden in places you would never suspect. Join Senior Financial Advisors Rob McClelland and Mike Connon as they discuss George Athanassakos‘s article on conflicts of interest in the investing world. How they affect portfolio managers, analysts, rating agencies, and even the financial media.

LISTEN TO THE LATEST PODCAST

|

| |

Ask TMFG

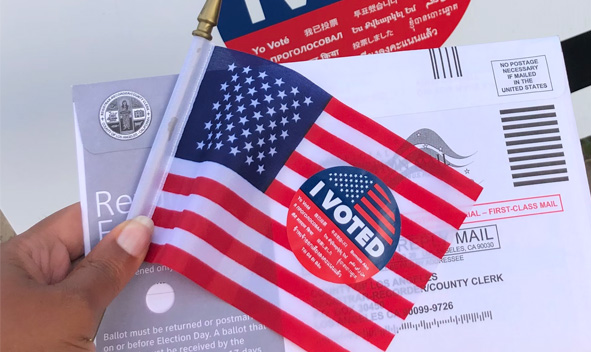

Does the US Election Impact the Markets?

Watch The Latest Videos

|

| |

|

|

|

Assante Capital Management Ltd. is a Member of the Canadian Investor Protection Fund and Investment Industry Regulatory Organization of Canada. This material is provided for general information and is subject to change without

notice. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please make sure to see me for individual

financial advice based on your personal circumstances. Insurance products and services are provided through Assante Estate and Insurance Services Inc.

Commissions, trailing commissions, management fees and expenses, may all be associated with mutual fund investments. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Please read the Fund Facts and consult your Assante Advisor before investing.

Certain employees of (TMFG Tax Service) maintain a relationship with Assante Capital Management Ltd. ("Assante") through which they sell investment products. The relationship that they have with Assante does not include tax preparation

services which (TMFG Tax Service) is solely responsible. (TMFG Tax Service) is not associated in any way with Assante, and Assante has no responsibility for the tax preparation services offered by (TMFG Tax Service).

*Please note that a live recording may be conducted at our workshops. Consent will be obtained, should you be captured in the video.

**All personal information will only be used in accordance with your consent, and in compliance with Assante's Privacy Policy.

Let's keep communicating. We value our relationship with you and want to stay in touch, whether it's regarding events or newsletters. In brief, The McClelland Financial Group aims to provide you with information

that is relevant to you. As you are likely aware, on July 1, 2014 Canada's Anti-Spam Legislation (CASL) came into force which requires your consent to receive electronic communications.

If we do not receive an unsubscribe email from you we will continue e-communications under the implied consent provisions under CASL. **

|

|

|