|

|

| |

Our Two Cents

with TMFG

Your Monthly Update on Everything Going On in Your TMFG Financial World All in One Place. Ask TMFG videos, Our Podcast, Fun and Interesting Articles, Updates, Events and More.

|

|

| |

|

Announcements Announcements

A special message from the TMFG team

China Unbound

May 16, 2022 12:00pm

China Unbound Prize-winning author/reporter Joanna Chiu joins us to discuss her discoveries across China in "China Unbound". The controversial topic of the West's mishandling of China's actions through the lens of very real experiences of the people on ground.

|

| |

|

LIFESTYLE LIFESTYLE

Light Read – Fun and Enjoyable!

Lifestyle

The 5-Hour Rule Used by Bill Gates, Jack Ma and Elon Musk

Entrepreneur.com:

"You just walked in the door from an exhausting day at work. You’re hungry and spent, just wanting to catch your breath for a minute. You grab something to eat and then veg out in front of the TV. The next thing you know, you've just binge-watched five episodes of the latest Netflix show. While that’s okay occasionally — we all need ways to decompress and shut down — this isn’t a healthy habit. That’s why the most successful people in the world spend their free time learning."

View Article

|

Michael Ams B.Com.

Strategic Associate

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

| |

|

RETIREMENT RETIREMENT

Medium Read – Interesting, useful and relevant finds by Rob McClelland.

Retirement

Which Country Would Canadians Most Like to Retire To?

WealthProfessional.ca:

"For many Canadians, retirement will be spent in Canada, possibly in the city in which they have spent their working lives.

But for others, the dream is to retire to another country and there’s one destination that stands out above others according to a new analysis of global Google search data by financial comparison site money.co.uk

Costa Rica is the most-searched-for retirement destination for Canadians thanks to its affordable cost of living, quality health services, friendly locals, and a rich biodiversity. Completing the top 5 were: Portugal, Mexico, Panama, and Thailand.

For Canadian retirees who do make the move to Costa Rica, retirement savings will certainly go further than if they stayed at home."

View Article

|

Rob McClelland RFP, CFP®, HBA

Senior Financial Advisor

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

| |

|

|

| |

|

FINANCE FINANCE

Light Read – Useful and Relevant

Finance

Am I Paying Taxes Twice?

It’s a question we are often asked when funds are withdrawn from registered accounts. The concept of withholding tax can be understandably confusing without having a basic understanding of the tax system. Before we distinguish withholding tax from taxes payable, let’s complete Tax 101.

What is income tax?

It is a tax that the federal and provincial governments levy on world-wide income earned by individual Canadian residents and is calculated on taxable income.

How is it calculated?

All sources of income are calculated to arrive at total income. Some examples of income are: employment, business, investment, CPP, OAS, other pensions, etc.

Reduce the total income by using allowable deductions. Some examples of allowable deductions are: RRSP contributions, carrying charges, child-care expenses, net capital losses, non-capital losses, etc. There are two levels of deductions on the T1 to arrive at the taxable income.

Income taxes payable is calculated on your taxable income using graduated rates. A graduated rate system ensures that you pay a higher rate of tax on additional income earned. For example, if you have taxable income of $100,000, then your maximum taxes payable is just under $23,000. This amount is considered your balance owing.

What is a balance owing?

Most employed people will not have a significant balance owing because portions of the income tax payable are paid up-front throughout the year in the form of withholding tax. Some examples of withholding tax are: taxes taken at source from your employment income, taxes taken at source from your CPP or OAS benefits, taxes taken at source from an RRSP or RRIF withdrawal, etc.

The difference between what you paid up-front in “withholding tax” and the actual “taxes payable” (calculated on your taxable income) is your “balance owing”.

You may also be in a position where you don’t have a balance owing, but instead a “refund”.

What is a refund?

Simply put, a refund is the result of paying more income tax up-front, than what is due after calculating your taxes payable on your taxable income. In other words, the CRA is paying you back for the excess income tax you paid to them up-front.

So, to simply answer the initial question, “am I paying taxes twice?” The answer is no. You are paying up-front for the eventual tax that will have to be paid on all your taxable income for the year.

Feel free to contact your TMFG advisor for clarification or for questions about your individual tax situation.

|

Carlo Cansino FMA, FCSI, CFP®

Senior Financial Planner

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

| |

|

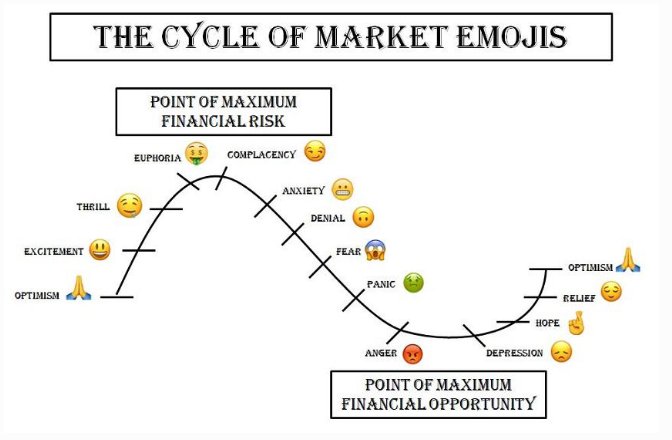

FUN CHARTS FUN CHARTS

Fun and inventive ways to see interesting ideas!

Fun Charts

View Enlarged Image

Source: StockTwits.com

|

| |

|

FINANCE FINANCE

Light Read – Useful and Relevant

Finance

Taming of the Housing Market

In April 2022, the Federal Government of Canada announced their budget for 2022. The top priority of the budget is the housing market in Canada. We have seen substantial growth in the housing market in the past 20+ years. This growth has made it difficult for many Canadians to own their own home. The Government of Canada is trying to change that, and the first step is in the 2022 Federal Budget. Below are a couple of the policies the Government will implement by 2023.

Tax-Free First Home Savings Account

Budget 2022 proposes to create the Tax-Free First Home Savings Account (FHSA), a newly registered account to help individuals save for their first home. Contributions to an FHSA would be deductible, and income earned in an FHSA would not be subject to tax. Qualifying withdrawals from an FHSA made to purchase a first home would be non-taxable.

To open an FHSA, an individual must be a resident of Canada and at least 18 years of age. In addition, the individual must not have lived in a home that they owned either:

▪ at any time in the year the account is opened, or

▪ during the preceding four calendar years.

The lifetime limit on contributions would be $40,000, subject to an annual contribution limit of $8,000. The annual contribution limit would be available starting in 2023. Unused contribution room cannot be carried forward, meaning that an individual contributing less than $8,000 in a given year would still face an annual limit of $8,000 in subsequent years.

Amounts are withdrawn to make a qualifying first home purchase and would not be subject to tax. Amounts withdrawn for other purposes would be taxable. Individuals would be limited to making non-taxable withdrawals with respect to a single property in their lifetime.

Home Buyers’ Tax Credit

First-time homebuyers who acquire a qualifying home can obtain up to $750 in tax relief by claiming the First-Time Home Buyers’ Tax Credit (HBTC). Any unused portion of the HBTC may be claimed by an individual’s spouse or common-law partner if the combined total does not exceed $750 in tax relief.

Budget 2022 proposes to double the HBTC amount to $10,000, which would provide up to $1,500 in tax relief to eligible homebuyers. Spouses or common-law partners would continue to be able to split the value of the credit if the combined total does not exceed $1,500 in tax relief. This measure will apply to acquisitions of a qualifying home made on or after January 1, 2022.

Residential property flipping rule

Property flipping involves purchasing real estate to resell the property in a short period to realize a profit. Profits from flipping properties are fully taxable as business income, meaning they are not eligible for the 50% capital gains inclusion rate or the Principal Residence Exemption.

The Government is concerned that specific individuals who flip residential real estate are not properly reporting their profits as business income. Instead, these individuals may be improperly reporting their profits as capital gains and, in some cases, claiming the Principal Residence Exemption.

Budget 2022 proposes introducing a new deeming rule to ensure profits from flipping residential real estate are always subject to full taxation. Specifically, profits arising from dispositions of residential property, including a rental property that was owned for less than 12 months, would be deemed business income. The new deeming rule will not apply if the disposition of property is in relation to death, household addition (e.g., the birth of a child, adoption, care of an elderly parent), separation, personal safety, disability or illness, employment change, insolvency or involuntary disposition.

A ban on foreign investment in Canadian housing

To ensure that Canadians, instead of foreign investors own housing, Budget 2022 announces the Government’s intention to propose restrictions prohibiting foreign commercial enterprises and people who are not Canadian citizens or permanent residents from acquiring non-recreational residential property in Canada for two years (with certain exceptions). The Government will continue to monitor the impact that foreign money is having on housing costs across Canada and may come forward with additional measures to strengthen the enforcement of the proposed ban, if necessary.

The housing market in Canada will not be a quick fix. Also, when dealing with many heavily indebted Canadians, it would be wise not to make quick, rash decisions that can affect the market. However, the 2022 Federal Budget is a step toward making homeownership more affordable for Canadians. Now time will tell to see if the measures being put in place will work.

|

John Iaconetti B.A.S., Spec. Hons. Administrative Studies (Finance)

Financial Advisor

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

| |

|

THINK SMART

THINK SMART

Podcast – Listen to Mike and Rob and their latest thoughts and industry insights

Think Smart

LISTEN TO THE LATEST PODCAST

|

| |

Ask TMFG

Watch The Latest Videos

|

| |

How Can I Tell People About TMFG?

|

| |

Review us on Google!

Please give us your Google review. Google reviews are critical for new potential clients to know that they are working with a trusted and well reviewed advisor. Thank you!

Look for this button at the bottom left:

|

| |

|

|

|

Assante Capital Management Ltd. is a Member of the Canadian Investor Protection Fund and Investment Industry Regulatory Organization of Canada. This material is provided for general information and is subject to change without

notice. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please make sure to see me for individual

financial advice based on your personal circumstances. Insurance products and services are provided through Assante Estate and Insurance Services Inc.

Commissions, trailing commissions, management fees and expenses, may all be associated with mutual fund investments. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Please read the Fund Facts and consult your Assante Advisor before investing.

Certain employees of (TMFG Tax Service) maintain a relationship with Assante Capital Management Ltd. ("Assante") through which they sell investment products. The relationship that they have with Assante does not include tax preparation

services which (TMFG Tax Service) is solely responsible. (TMFG Tax Service) is not associated in any way with Assante, and Assante has no responsibility for the tax preparation services offered by (TMFG Tax Service).

*Please note that a live recording may be conducted at our workshops. Consent will be obtained, should you be captured in the video.

**All personal information will only be used in accordance with your consent, and in compliance with Assante's Privacy Policy.

Let's keep communicating. We value our relationship with you and want to stay in touch, whether it's regarding events or newsletters. In brief, The McClelland Financial Group aims to provide you with information

that is relevant to you. As you are likely aware, on July 1, 2014 Canada's Anti-Spam Legislation (CASL) came into force which requires your consent to receive electronic communications.

If we do not receive an unsubscribe email from you we will continue e-communications under the implied consent provisions under CASL. **

|

|

|