|

|

| |

The McClelland Financial Group Newsletter

|

| |

Save The Date

October 30th Halloween Double Feature Drive in Movie at Stardust Cinemas

893 Mount Albert

(between East Gwillimbury & Holland Landing)

East Gwillimbury, ON

L0G 1V0

|

| |

|

We won silver for SIA Charts Digital Innovator Award and Silver for Advisory Team of the Year!

|

| |

|

DEEP DIVE DEEP DIVE

In Depth Article – Heavy on the facts and details definitely for the committed reader.

Rob's Read

The 2 Variables That Drive Stock Prices

AWealthOfCommonSense.com:

"If investing was a cocktail, it would essentially boil down to one part fundamentals and one part emotions. Fundamentals are easier than ever to capture because we now have access to more data in a single day than our ancestors would see in a lifetime.

The emotional component of investing will never be quantifiable because it’s impossible to predict how people will feel in the future.

The late Jack Bogle introduced this concept in his book Don’t Count On It by breaking down expected annual returns of the U.S. stock market into the following components:

Market Returns = Dividend Yield + Earnings Growth +/- Changes in the P/E Ratio

Dividends and earnings are the fundamental portion of stock market returns while the change in the price-to-earnings (P/E) ratio is the speculative portion of returns. The change in P/E represents how much people are willing to pay for corporate fundamentals and the reason it’s considered speculative is because it can vary widely over time."

View Article

|

Rob McClelland RFP, CFP, HBA

Vice President, Co-Branch Owner, Senior Financial Planning Advisor

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

| |

|

FINANCE FINANCE

Light Read – Useful and Relevant

Finance

Navigating job loss in COVID-19

Picture this, you’re in your peak earning years, have long-term plans or goals, and you are presented with a severance package. For some, it can be incredibly devastating news. For others closer to retirement, it could beviewed as a blessing in disguise. Regardless of your scenario, there are many factors to consider when you’ve been terminated, on top of dealing with the emotional impact.

During COVID-19, we have seen an increase in people losing their jobs due to company restructuring. It has become a conversation that we’ve had with many clients over the past 6 months.We recommend that clients consider the following:

- Review severance package and decide whether independent legal advice is necessary

- Review group benefits and determine what will be lost (i.e. health insurance; life insurance; investments; etc.)

- Create cash flow plan to ensure short term expenses are covered

- Review RRSP contribution room for tax saving opportunities

- Determine expected length of time for unemployment

- Review pension plan options and determine what is most advantageous for your scenario

This is not an exhaustive list, but it doespertain tothe important decisions that must be made in the short term. I strongly suggest speaking with your advisor prior to signing off on the package. It is of the utmost importance to review all options with a professional before making the decision.

|

Carlo Cansino FMA, FCSI, CFP

Senior Financial Advisor

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

| |

| |

|

OPINION OPINION

Light Read – Editorial

Opinion

What do I know

For the past 6 months, my living room T.V. has been held hostage by everyone in my house watching 90 Day Fiancee. I tried watching one episode and thought there must be something wrong with the water supply in my house. There is no way that anyone, not being poisoned, could watch this. So, I accepted that it may be a genetic error in my household. That said, as I am speaking with other people, they are all talking about the show. Even my favourite talk radio shows are discussing it! So obviously, I am wrong, at least for the short-term. But, will this last? Is 90 Day Fiancee the next 60 minutes or the next Simpsons? I doubt it.

This not only happens with TV shows, but with music too. I hear something and think “how is this getting air play?”. More often than not, these songs are usually short lived. After 6 months of play, they are off the air, never to be heard again – thank goodness. I understand, not every band will be the next Beatles, and there are great new musicians that will last. However, I can hear songs and know which ones will not make it and typically, they do not.

Now, we are in a situation where the stock market is going crazy with high priced, growth stocks. We have all seen this play before, and we know how it ends. At a certain time, common sense will prevail and people will realize that companies need to make money to survive. Paying 100 times earnings for a stock will not provide you with a good return, going forward. That being said, my TV still gets tuned into 90 Day Fiancee three days a week. So, what do I know?

|

Michael Connon B.Sc, CFP

Senior Financial Planning Advisor, Co-Branch Manager

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

| |

|

FINANCE FINANCE

Light Read – Useful and Relevant

Finance

Mortgage Deferral is ending? Now what?

Back in March, people had the option to defer there mortgage payments due to the COVID-19 pandemic. Now that deferral is over what are the strategies you need to implement to assist you in this difficult financial time.

View Article

#Mortgagedeferral #COVID #Moneysense #Personalfinance

|

John Iaconetti B.A.S., Spec. Hons. Administrative Studies (Finance)

Financial Advisor

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

| |

|

LIFESTYLE LIFESTYLE

Light Read – Fun and Enjoyable!

Lifestyle

How to Keep Healthy This Fall

With the change in seasons, comes cooler temperatures. We all have high hopes to keep healthy throughout the Fall and Winter months, especially now with COVID-19 lingering with threats of a second wave. There are some things we can do however, to increase our odds of remaining healthy throughout the next several months.

- Take a vitamin D supplement or some other form of immunity booster, even vitamin C would do you good – whether it be in pill form or adding some extra oranges to your diet.

- To encourage your immune system even more, make sure you’re eating a balanced diet full of fruits, veggies and protein. Drink plenty of water throughout the day as well.

- Make sure you’re getting enough sleep and take some time for yourself. Your body needs enough sleep to be able to fight off those nasty bugs so this might mean squeezing in a nap or two when you can. You may also want to try going to bed an hour or two earlier for the week leading up to Daylight Savings Time (November 1st) so you’re not playing catch up afterwards.

- With the colder weather we tend to keep indoors more, however it is still just as important to keep active during the winter months. Get out for some snowboarding/skiing, a leisurely Fall/Winter walk on a trail or working out in your new home-gym – thanks COVID!

- I’m sure it has been instilled in our brains to wash our hands by now, but it is one simple thing you can do throughout the day to stay flu-free.

- And with washing hands and dry weather comes dry skin! Make sure you’re stocked up on moisturizer because you’ll be needing it (maybe moisturizer will be the next thing to go on rations instead of toilet paper).

- Lastly, if you’re a believer in the flu shot, make sure you book your appointment! Flu shots come available in October.

Hopefully you can take-away at least a few of these tips and implement them into your daily routine to have a happy and healthy Fall/Winter. As always, stay safe!

|

Chelsey Chartren B.Comm.

Financial Advisor

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

| |

|

MARKET MARKET

Light Read – Useful and Relevant

MARKET

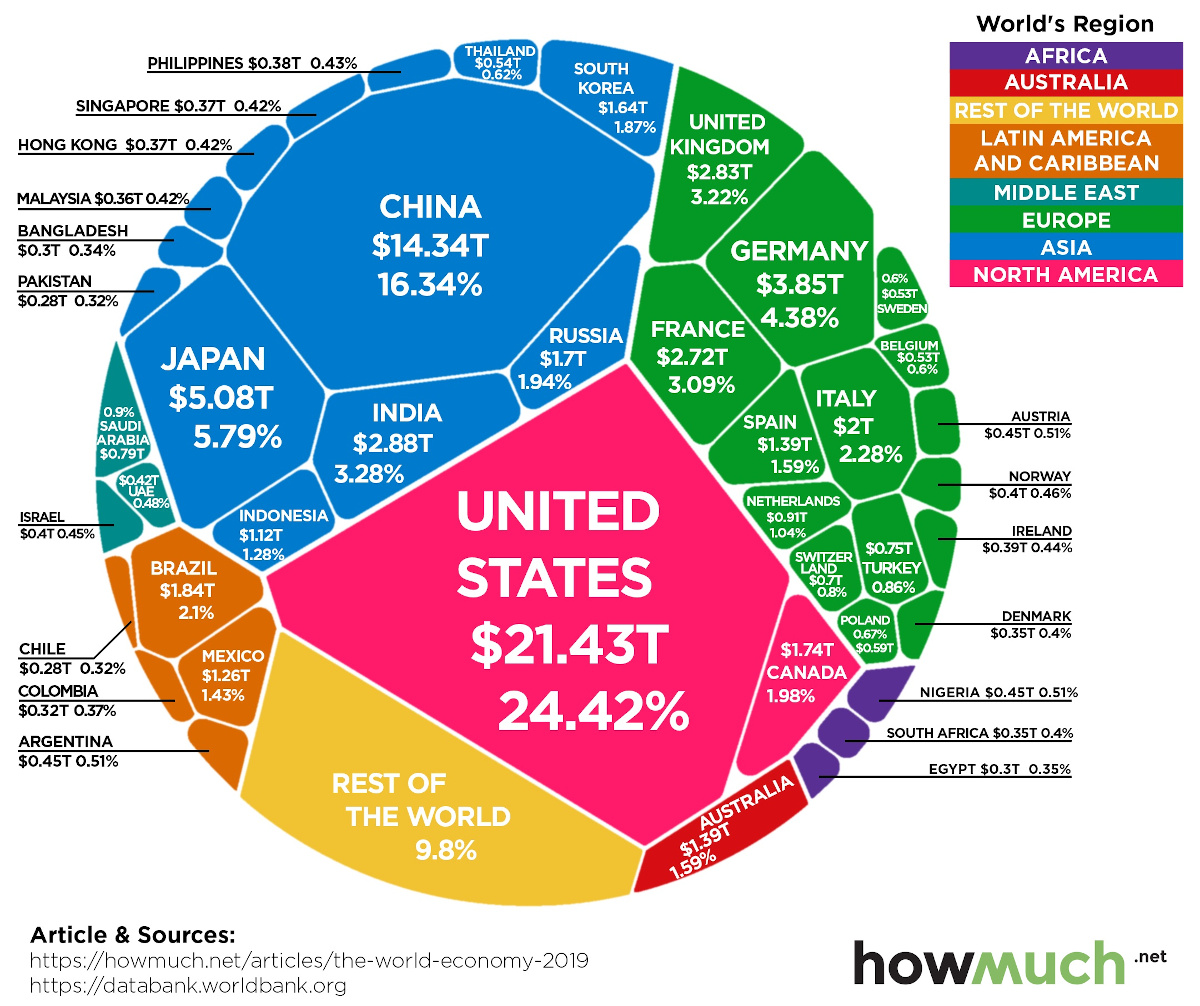

The $88 Trillion World Economy in One Chart

Visual Capitalist does a great job showing the breakdown of the World Economy per countries GDP. It's interesting to see how over 40% of the World Economy stems from 2 countries.

View Infographic

#economy #world #GDP #country

|

Michael Ams B.Com.

Strategic Associate

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

| |

Ask TMFG

Trusts

Watch The Video

|

| |

|

|

|

Assante Capital Management Ltd. is a Member of the Canadian Investor Protection Fund and Investment Industry Regulatory Organization of Canada. This material is provided for general information and is subject to change without

notice. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please make sure to see me for individual

financial advice based on your personal circumstances. Insurance products and services are provided through Assante Estate and Insurance Services Inc.

Commissions, trailing commissions, management fees and expenses, may all be associated with mutual fund investments. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Please read the Fund Facts and consult your Assante Advisor before investing.

Certain employees of (TMFG Tax Service) maintain a relationship with Assante Capital Management Ltd. ("Assante") through which they sell investment products. The relationship that they have with Assante does not include tax preparation

services which (TMFG Tax Service) is solely responsible. (TMFG Tax Service) is not associated in any way with Assante, and Assante has no responsibility for the tax preparation services offered by (TMFG Tax Service).

*Please note that a live recording may be conducted at our workshops. Consent will be obtained, should you be captured in the video.

**All personal information will only be used in accordance with your consent, and in compliance with Assante's Privacy Policy.

Let's keep communicating. We value our relationship with you and want to stay in touch, whether it's regarding events or newsletters. In brief, The McClelland Financial Group aims to provide you with information

that is relevant to you. As you are likely aware, on July 1, 2014 Canada's Anti-Spam Legislation (CASL) came into force which requires your consent to receive electronic communications.

If we do not receive an unsubscribe email from you we will continue e-communications under the implied consent provisions under CASL. **

|

|

|