|

|

| |

The McClelland Financial Group Newsletter

|

| |

|

Announcements Announcements

A special message from the TMFG team

TMFG News

We are happy to welcome Ryan Donovan!

Following graduating from the Smith School of Business at Queen’s University (B.Comm, Honours) with First Class Distinction, Ryan explored an opportunity in brand strategy at Lg2, the 2019 Canadian Agency of the Year. After serving clients across multiple sectors including CPG, athletic wear, alcohol and finance, Ryan was inspired to pursue a role in the financial services industry. He joins The McClelland Financial Group eager to learn and ready to make an impact. At Queen’s, Ryan was involved in many extracurricular commitments including the CUBE Mentorship program, the 2016 Orientation Week Leadership group, the Queen’s Real Estate Investment Conference, the Queen’s Global Innovation Conference, and various intramural sports. In his third year, Ryan participated in an exchange semester at the Cologne Business School in Köln, Germany. Ryan is an avid reader and writer, who is always listening to music and keeping up to date with the world of sport. In his down time, Ryan enjoys visiting art galleries, attending concerts and playing hockey, soccer and golf at any opportunity. A self-proclaimed sports pundit, he is always willing to discuss or debate any sports topic.

We are happy to welcome Anu Jayaraj!

With almost 15 years of experience in banking and investment industry, Anu brings with her unique skill set that includes client experience, knowledge, and training. Prior to joining The McClelland Financial Group, she was Client Experience Manager at Agora Dealer Services. Her experience was built through her roles at Franklin Templeton Investments, CIBC, and Scotia iTrade. She has received industry-wide recognition through Dalbar Award for service while at Franklin Templeton Investments. She is currently refreshing CSC her in order to become a licensed associate. She enjoys reading, music, yoga and meditation.

Our Jess got married!

Jessica Moniz was married to a very lucky Danny Vanelli on Saturday, October 24th, at the Doctor’s House in Kleinberg. Could there be a beautiful bride! Congratulations to both on their new life together.

|

| |

Review us on Google!

Google Reviews help local businesses stand out in a crowd. If you have a Google account please take a moment to go to our page and give us a review. Thank you!

Look for this button at the bottom left:

|

| |

Join Us For The TMFG

Virtual Holiday Cookie Baking Event

with Savannah Harrington of

Savannah Grace Bakes

- our local brilliant baker!

December 7th, 12-1:30pm

Join us from the comfort of your own home to bake along side this very talented expert baker.

Savannah, will walk us through baking a special holiday cookie and share tips and tricks on professional decorating.

Please feel free to extend the invite to your family, friends and colleagues.

At the end of the session there will be a draw for three amazing prizes.

A shopping list and virtual recipe card will be forthcoming.

Check her out at:

www.savannahgracebakes.ca

|

| |

|

DEEP DIVE DEEP DIVE

In Depth Article – Heavy on the facts and details definitely for the committed reader.

Rob's Read

How Much is $20 a Month Worth?

AWealthOfCommonSense.com:

"The hardest part about building wealth for the majority of the population has nothing to do with picking stocks or asset allocation or active vs. passive or the macroeconomy or any of the other stuff professional investors spend their time debating.

The hardest part about building wealth for most regular people is the process of saving their money on a consistent basis.

But it doesn’t take that much to make a big difference over time if you’re able to stick with a regular savings plan.

Even $20 a month could have an enormous impact if you give yourself a long enough runway.

The maximum contribution for an IRA in 2020 and 2021 is $6,000. That means maxing out your IRA would require you to save $500 a month."

View Article

|

Rob McClelland RFP, CFP, HBA

Vice President, Co-Branch Owner, Senior Financial Planning Advisor

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

| |

|

FINANCE FINANCE

Light Read – Useful and Relevant

Finance

Index Your Savings!

Starting in January 2021, you may notice that your pay is slightly lower than it was last year. This is due to the increase in your Canada Pension Plan (“CPP”) contribution rate.

Any employed person in Canada, with income greater than $3,500 (up to the Yearly Maximum Pensionable Earnings or “YMPE”), must contribute a portion of their gross pay to the CPP. The government has increased an employee’s contribution by 0.2% from 5.25% to 5.45%. The employer makes a matching contribution of 5.45% of the eligible income. Any self-employed individual must contribute both portions (10.9%) of the eligible income.

In 2021, the YMPE will increase to $61,600, thus an individual earning in excess of this amount will pay $3,166.45 for the year (($61,600 - $3,500) * 0.0545).

CPP contributions are the epitome of forced savings. Whether or not you are a disciplined saver, these contributions will help provide an income source in your retirement.

That said, I strongly suggest mimicking increased CPP contributions with your current investment savings plan. If you have a pre-authorized contribution plan into your investments, look to increase them with every increase to your gross income. Your spending will adjust and you will adapt. You’ve proven it is possible with your CPP contributions. Other investment programs are no different.

Contact us now to discuss how we can start indexing your pre-authorized contributions plans.

|

Carlo Cansino FMA, FCSI, CFP

Senior Financial Advisor

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

| |

|

RETIREMENT RETIREMENT

Helping you towards a modern retirement.

Retirement

Early Retirement: Boring

Finumus.com:

"Doubtless nobody’s noticed, but my blogging output has dropped off a bit. Just the normal fading of initial enthusiasm? Somewhat, but mostly, it’s because I’ve been busy at work.

Clearly I have a bit of explaining to do. As a proponent of the idle rich lifestyle, what do I think I’m doing getting a job? How did this happen anyway?

I’m fairly sure that when I was saving hard in my 20’s I had the vague idea that my future multi-millionaire self would be spending his days lounging around on his private sun-bleached Caribbean island draped in nubile dusky maidens, or perhaps heli-skiing with super-models in the Alps. What wasn’t in mind: doing the grocery shop, popping some washing on, un-packing the dish-washer, and then picking my daughter up from hockey club. Sure - these are all things that need doing, but they aren't very exciting, are they? This is more house-husband than super-rich. "

View Article

|

Rob McClelland RFP, CFP, HBA

Vice President, Co-Branch Owner, Senior Financial Planning Advisor

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

| |

| |

|

OPINION OPINION

Light Read – Editorial

Opinion

Pandemic - The Y2K Of 2020

Remember back in the year 1999? The world was in a panic over what would happen when the calendar switched over to 2000. If you recall, the big issue was computers designed in the past kept track of dates using only two digits rather than four. The fear was that any program that had any relation to dates would malfunction as the calendars changed over. In the short term, this created a lot of havoc globally. Over the long term, it turned out to be one of the most significant advancements in technology to date. Prior to Y2K issues, computer software companies dealt with resistance from people refusing to upgrade their computers. The result was the programs they were designing had to be compatible with old technology, thus limiting their ability to create more advanced software. Because of the changes implemented due to Y2K, everybody now possessed modern computers. This provided technology companies the opportunity to advance faster than they could in the past. All the legacy issues of old computers were solved in one fell swoop.

Fast forward to 2020 and we are in the middle of a global pandemic. In the present, it is a horrible situation that feels like there in no end in sight. However, in the very near future, there will be a vaccine, and the world will move forward. As disastrous as the pandemic was/is, it forced us to make adjustments as to how we live life and do business. We were able to push through the wall of resistance that people have put up and now truly understand how technology can make our life easier. For example, we have had Zoom available for years but never realized how much it could simplify business. We understood some efficiencies can be gained by having staff members work from home, but we were always afraid to embrace this new way of doing business. This not only can change how people live their lives, it can also affect the future value of stock prices. Remember, a stock price is heavily related to the future expected cash-flows of that company. Lower expenses moving forward, mean higher profitability. This can lead to better cash-flow and higher stock market valuations.

We’re often told about the silver lining, and we can all agree 2020 has been a horrible year in both business, health and enjoyment. The sacrifices that everyone has made throughout this year may lead to a better life in the future. We may have more time to spend with our families. We may be able to travel more and no longer be tied to a physical office. We may become closer to people who are geographically distanced. These are examples of the Silver Linings we can take forward after 2020. It is too bad these lessons had to come at such a cost.

|

Michael Connon B.Sc, CFP

Senior Financial Planning Advisor, Co-Branch Manager

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

| |

|

DEEP DIVE DEEP DIVE

In Depth Article – Heavy on the facts and details definitely for the committed reader.

Deep Dive

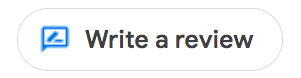

The Biggest Threats To The Earth's Biodiversity

COVID-19 has taken the focus away from climate change and the troubles our earth faces. However it is still prevelant. Biodiversity is at risk on the earth and that leads to further complications to our planet. The following article looks at our biggest threats to biodiversity.

View Infographic

#biodiversity #climatechange #greenearth

|

John Iaconetti B.A.S., Spec. Hons. Administrative Studies (Finance)

Financial Advisor

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

| |

|

LUMEN LUMEN

A snippet of need to know tips and tricks for your financial life.

LUMEN

Not All Fees Are Created Equal

|

| |

|

DEEP DIVE DEEP DIVE

In Depth Article – Heavy on the facts and details definitely for the committed reader.

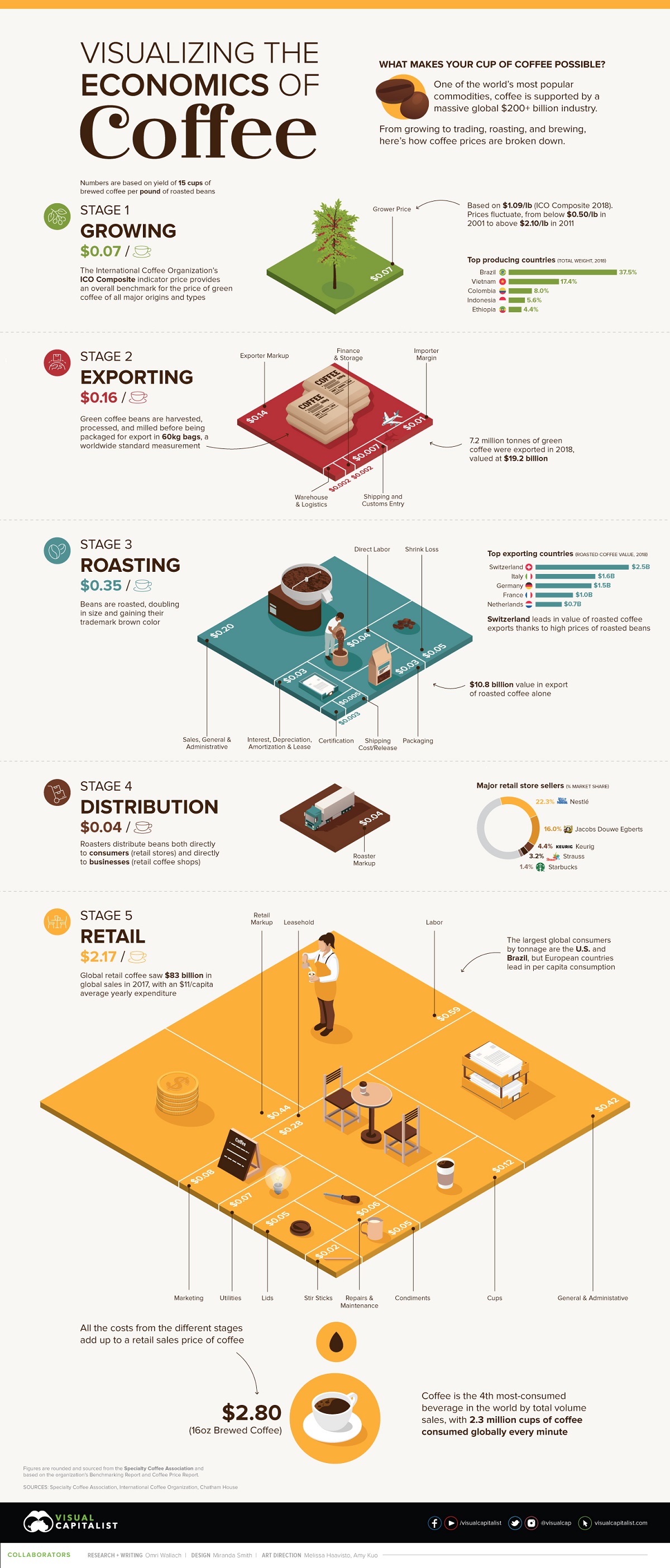

Deep Dive

The Economics Of Coffee In One Chart

At some point all of us have had coffee and some can't go a day without having one, but how does it go from a coffee bean grown somewhere to in your cup? This article covers that and details the costs along the way.

View Infographic

#Coffee #Economics #Trade #Global

|

Michael Ams B.Com.

Strategic Associate

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

| |

Ask TMFG

End of Year RRIF Withdrawals

Watch The Video

|

| |

|

THINK SMART

THINK SMART

Podcast – Listen to Mike and Rob and their latest thoughts and industry insights

Think Smart

|

| |

|

|

|

Assante Capital Management Ltd. is a Member of the Canadian Investor Protection Fund and Investment Industry Regulatory Organization of Canada. This material is provided for general information and is subject to change without

notice. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please make sure to see me for individual

financial advice based on your personal circumstances. Insurance products and services are provided through Assante Estate and Insurance Services Inc.

Commissions, trailing commissions, management fees and expenses, may all be associated with mutual fund investments. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Please read the Fund Facts and consult your Assante Advisor before investing.

Certain employees of (TMFG Tax Service) maintain a relationship with Assante Capital Management Ltd. ("Assante") through which they sell investment products. The relationship that they have with Assante does not include tax preparation

services which (TMFG Tax Service) is solely responsible. (TMFG Tax Service) is not associated in any way with Assante, and Assante has no responsibility for the tax preparation services offered by (TMFG Tax Service).

*Please note that a live recording may be conducted at our workshops. Consent will be obtained, should you be captured in the video.

**All personal information will only be used in accordance with your consent, and in compliance with Assante's Privacy Policy.

Let's keep communicating. We value our relationship with you and want to stay in touch, whether it's regarding events or newsletters. In brief, The McClelland Financial Group aims to provide you with information

that is relevant to you. As you are likely aware, on July 1, 2014 Canada's Anti-Spam Legislation (CASL) came into force which requires your consent to receive electronic communications.

If we do not receive an unsubscribe email from you we will continue e-communications under the implied consent provisions under CASL. **

|

|

|