|

|

|

|

|

|

Office Update

Our office is now open for pick-ups and drop-offs from Monday-Thursday during normal office hours of 8:30 a.m. to 5:00 p.m. and on Friday from 8:30 a.m. to 1:00 p.m.

We will continue to do client meetings virtually via Zoom. However, if you prefer a face-to-face meeting please don’t hesitate to contact us directly and we will be in touch to make further arrangements.

|

|

|

|

DEEP DIVE DEEP DIVE

In Depth Article – Heavy on the facts and details definitely for the committed reader.

Rob's Read

4 Investment Lessons From

The COVID Crisis

From a market perspective, the COVID-19 crisis is no different from any other catalyst to market volatility. Here are 4 investment lessons to take from this current crisis and all subsequent crises going forward.

View Article

#Investing #Covid19 #Volatility #Lessons

|

Rob McClelland RFP, CFP, HBA

Vice President, Co-Branch Owner, Senior Financial Planning Advisor

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

|

|

|

OPINION OPINION

Light Read – Editorial

Opinion

Thank God, I am not that smart

Sometimes, being too smart can work to your detriment. For instance:

- If I knew how quickly the COVID-19 pandemic could shut down the economy and how many jobs would be lost, I would have cut my losses and taken all my money out of the market after the initial drop in late March.

- If I knew 20 years ago how the future of photography would be digital, I would have put all my money in the number 1 camera company, Kodak.

- If I realized that global dependence on oil would increase its demand and price, then all oil companies would be my commodity of choice, especially in Canada.

- If I realized telecommunications was going to change our ability to communicate, I would have had all my money in Nortel Networks.

- If I realized that after the turn of this century, that our communications and email would be through our cell phones, I would have put all my money into Research in Motion (turned Blackberry), the innovator of this technology.

- If I knew about the tech correction that came after the year 2000, I would have never touched a tech stock in my life.

- If I knew about the financial crisis that would affect all financial institutions, I would have avoided banks like the plague.

Thank God, I'm not that smart! I've invested in a globally diversified, balanced portfolio over the last 30 years and done very well. My portfolio has had every stock in the world (good ones and bad). For every Nortel Networks, there was an Amazon or Apple to make up for it. Point being, regardless of how smart you are, it is impossible to outsmart the collective minds around the world. The market’s reaction to the COVID-19 pandemic is just another reminder of why staying humble and disciplined is the smarter approach.

|

Michael Connon B.Sc, CFP

Senior Financial Planning Advisor, Co-Branch Manager

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

|

|

|

WHAT’S NEW?

WHAT’S NEW?

Light Read – Updates on need to know details for Assante clients on technology and industry changes

Working from home due to COVID? You may be entitled to some tax benefits…

For those who are fortunate enough to continue working, you’re likely doing so from home. Other than the benefits of gaining commuting time back to spend with the family and the savings in commuting costs (i.e. fuel, transit, parking, etc.), are you missing out on any other benefits?

According to the Canada Revenue Agency (“CRA”), you may be entitled to deduct certain expenses from your income while working from home.

In order to be eligible, your employer must complete a form (T2200) to confirm that you are personally paying expenses to perform the duties of your job from home. Now, start keeping track of expenses that relate to your work space. The most notable will be your utility bills (i.e. electricity, heating, etc.). However, you can also deduct property tax, maintenance (to the work space area) home insurance premiums and internet/communications costs. This is not an exhaustive list. I suggest referring to the CRA web-site for more details.

Remember, you can only deduct a percentage of these expenses, and it is prorated to the time that you were working from home. The percentage is based on the size of your work space relative to the size of your home.

For example, if your office/work space at home is 200 square feet and your home (finished area) is 2,000 square feet, then you can deduct 10% of the eligible expenses. As well, if you started working from home on April 1st, then you can only include 75% of this amount (i.e. April – December expenses). You can include 100% of this amount if you were working from home for the entire calendar year.

We know that the COVID will end in due time, so while we are in living in this pandemic, we ought to use the benefits that are available to us.

|

Carlo Cansino FMA, FCSI, CFP

Senior Financial Advisor

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

|

|

DEEP DIVE DEEP DIVE

In Depth Article – Heavy on the facts and details definitely for the committed reader.

Lifestyle

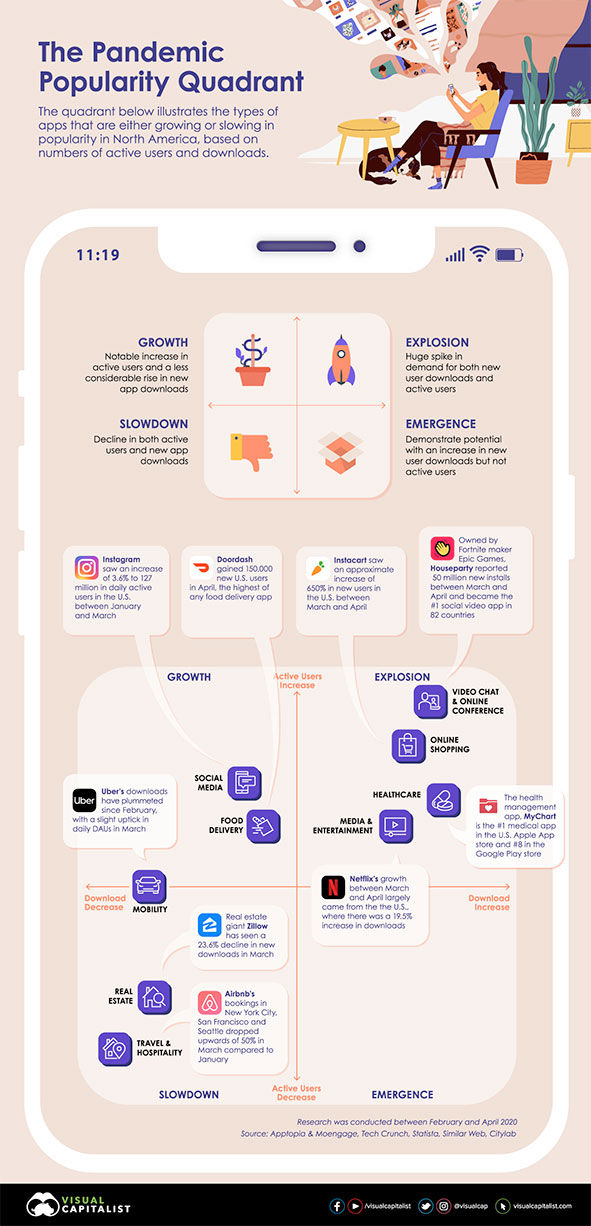

COVID-19's impact on the apps we use

With more time spent at home, we have seen more time spent on devices and apps. This chart by Visual Capitalist looks at what apps have seen an increase in users and which we have nearly stopped using entirely.

View Infographic

#COVID-19 #Apps #leisure #Technology

|

John Iaconetti B.A.S., Spec. Hons. Administrative Studies (Finance)

Financial Advisor

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

|

|

|

LIFESTYLE LIFESTYLE

Light Read – Fun and Enjoyable!

Lifestyle

"I'm Back"

Hello TMFG Family – I am back! A year sure goes by quickly – especially when you’re raising a little one. I didn’t get to do much relaxing (surprise!) but I am refreshed and ready to dive back in. Though I haven’t had much adult contact over the past year, I did learn quite a bit being a mother – having to juggle a million things at once – I have become a multitasking pro! Not to mention the time management, patience and adapting skills I have gained.

Being in the insurance industry, I have quickly realized how important insurance is when you have a family. Your children fully depend on you for two decades, if not more! From birth to when they move out or get a job of their own, they depend on you for food, shelter, clothing, education and so much more. It makes me think, heaven forbid, if anything were to happen to me or my husband – would my family be okay? Even if the unspeakable didn’t happen, but either or both of us became disabled or critically ill – would we have enough income to last? To give an example, for the average family with children we typically recommend $1M in life insurance on each parent (can vary for each individual scenario) – comparing this to what you currently have – are you underinsured?

Then there is the Registered Education Savings Plan (RESP) I needed to put in place for his post-secondary education and when we went on our first family vacation to Mexico, I had to make sure we had travel insurance in case any of us got sick or injured during our trip. These are all valid questions and topics that need to be discussed and addressed with a professional, such as your advisor.

While I am back to work, my role here is changing somewhat. Prior to maternity leave, many of you knew me as the Junior Advisor and insurance go-to. Going forward, I will be the resource for all your insurance needs (i.e. travel, life, disability, critical illness and health insurances). If you have a simple question, need to apply for a policy or have questions about a current policy – please don’t hesitate to reach out. I look forward to seeing our wonderful TMFG Family very soon, hopefully!

With Warm Regards,

Chelsey

|

Chelsey Chartren B.Comm.

Financial Advisor

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

|

|

|

LIFESTYLE LIFESTYLE

Light Read – Fun and Enjoyable!

Lifestyle

Should you delay your retirement because of COVID-19?

This article from MoneySense discusses the idea of delaying retirement and the implications of doing so.

View Article

#COVID19 #Retirement #Income #Stocks #Bonds #Market

|

Michael Ams B.Com.

Strategic Associate

The McClelland Financial Group of Assante Capital Management Ltd. |

|

|

|

|

THINK SMART

THINK SMART

Podcast – Listen to Mike and Rob and their latest thoughts and industry insights

Think Smart

COVID-19 Has Changed Retirement Forever for The Foreseeable and Maybe Forever

As difficult as things are right now the future is truly bright. There are so many new and emerging technologies that can help you through these taxing times. We all need to be embracing new ways of interacting and coping with some of our basic necessities. Today, we highlight some of our best practices to stay social, connected, happy and healthy. This and more Today on ThinkSmart.

LISTEN TO THIS PODCAST

|

|

|

Ask TMFG

Investing in Stocks vs

a Balanced Mutual Fund

The recent market volatility could be an opportunity for some investors. However, while the potential for opportunity is there, there also comes a large degree of risk. Financial Advisors John Iaconetti and Carlo Cansino discuss how to invest in stocks while avoiding that added risk by using balanced portfolios.

|

|

|

Don’t forget our referral webinar on June 4th

10 Steps to Take the Emotion Out of Emotionally-Driven Financial Decisions

Followed by 30 minutes of Q&A

June 4th Webinar

12:00-12:30 pm

Join one of Canada's Top Advisory Teams, The McClelland Financial Group and advisors, John Iaconetti and Carlo Cansino, as they share with you the best practical financial solutions to get you through these unparalleled times.

You will learn to:

- Construct your portfolio and investment plan

- Build good financial habits

- Remove emotion and bias from your decisions

This webinar is perfect to share with a friend, colleague or family member that you think could benefit from this advice. It's also a great way to introduce us to anyone you may have mentioned us to. If you are already a client of the McClelland Financial Group you may find you have heard some of this before.

Register Today

|

|

|

|

|

|

Assante Capital Management Ltd. is a Member of the Canadian Investor Protection Fund and Investment Industry Regulatory Organization of Canada. This material is provided for general information and is subject to change without notice. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please make sure to see me for individual financial advice based on your personal circumstances. Insurance products and services are provided through Assante Estate and Insurance Services Inc.

Commissions, trailing commissions, management fees and expenses, may all be associated with mutual fund investments. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. Please read the Fund Facts and consult your Assante Advisor before investing.

Certain employees of (TMFG Tax Service) maintain a relationship with Assante Capital Management Ltd. (“Assante”) through which they sell investment products. The relationship that they have with Assante does not include tax preparation services which (TMFG Tax Service) is solely responsible. (TMFG Tax Service) is not associated in any way with Assante, and Assante has no responsibility for the tax preparation services offered by (TMFG Tax Service).

*Please note that a live recording may be conducted at our workshops. Consent will be obtained, should you be captured in the video.

**All personal information will only be used in accordance with your consent, and in compliance with Assante's Privacy Policy.

Let's keep communicating. We value our relationship with you and want to stay in touch, whether it's regarding events or newsletters. In brief, The McClelland Financial Group aims to provide you with information that is relevant to you. As you are likely aware, on July 1, 2014 Canada's Anti-Spam Legislation (CASL) came into force which requires your consent to receive electronic communications.

If we do not receive an unsubscribe email from you we will continue e-communications under the implied consent provisions under CASL. **

|

|

|