|

|

|

|

|

|

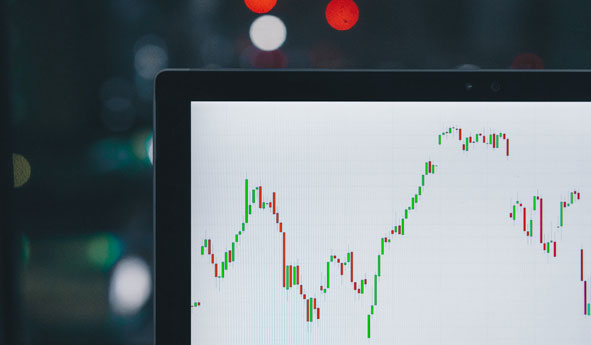

Black Friday Shopping/Fire sale/Deep Discounts/Friends and Family Sale

This just in, good companies at a 10% discount. Our office is staffed for the onslaught of bargain shoppers!!!

Wait, that is just a dream. We know that the exact opposite will occur. There will be people who want to sell their good companies at a 10% discount, only to buy them back at a 10% (or more) premium.

You’ve heard us talk the talk before. Let this extreme market volatility pass. It will. I’ll be the first to admit, I don’t know how far the market will drop. But, I’ll also say that I know it will make its way back to the previous highs and beyond.

Global companies may experience temporary slow-downs or even factory shut-downs. Supply chain concerns aside, they will not last forever. If some companies do halt operations, suffer insolvency or worst-case scenario, go bankrupt, your diversified portfolio will be fine.

Trust in your original investment strategy. The most successful and time-sensitive investment decision that you will make is the one to remain invested.

|

Carlo Cansino FMA, FCSI, CFP

Senior Financial Advisor

The McClelland Financial Group of Assante Capital Management Ltd. |

|

|

|

|

DEEP DIVE DEEP DIVE

In Depth Article – Heavy on the facts and details definitely for the committed reader.

Rob's Read

Retirement is life's financial anxiety peak says Schwab

Retirement is one of those milestones in life that many of us think about for decades – but 'think about' is not the same as 'plan'.

Often times lack of planning, especially financial planning makes approaching retirement a time of high anxiety. Read a bit more about this here.

|

Rob McClelland RFP, CFP, HBA

Vice President, Co-Branch Owner, Senior Financial Planning Advisor

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

|

|

|

OPINION OPINION

Light Read – Editorial

Opinion

Why Canada still belongs in your portfolio?

It’s funny to watch the love/hate relationship between the U.S. and Canada. It is easy to understand during hockey tournaments. Love Canada! Hate the U.S.! But, when you focus on capital markets and politics, it becomes a little less black and white. Many in the U.S. oppose how the leadership manages the country. That being the case, Canada’s leadership is leaning far in the opposite direction, which similar to our U.S. counterparts, many Canadians strongly oppose it as well. One point that is hard to deny is the U.S. economy has been very strong. The unemployment numbers are at record lows. The stock markets continue to grow pushed by new innovative companies that did not exist 20 years ago. Canada, in my opinion, has been mediocre at best. We are still a market that is built on banks and resource companies.

So, if this is the case, then why invest in Canada at all? We now have portfolios that provide global diversification and keep Canadian exposure to the 3%-4% range. This is a more accurate representation of Canada’s market size relative to the world market. There is a concept in investment management called “Home Bias”. Simply put, Home Bias occurs when you keep a percentage of your portfolio invested in your country of residence at a higher level than the country actually represents as a percentage of the world market. This often begs the question, “is this just a Canadian thing?” The answer is no. Home Bias exists in all markets - U.S., England, Australia, Japan, etc. Some benefits to employing Home Bias:

- No currency risk -- The investment incomes earned are paid in the domestic currency.

- Tax advantages -- In Canada, you may be eligible for a dividend tax credit. Many countries have tax laws that encourage you to invest domestically.

- Relative performance -- Your portfolio’s performance will be related to the country in which you will spend money. For example: If your own country’s economy is prosperous with cost of living increasing, and your portfolio is stagnant because you chose to have no Home Bias (minimal exposure to your domestic stock market), you will suffer relative to others who opted for a Home Bias. If your country’s economy is slowing and your portfolio performs in tandem, then you’ll have the same experience as most others. In this case, cost of living should stay manageable.

My final point: Canada is still a great place to invest!

- Very solid banking system -- Although, under heavy regulation that can stifle growth, the sector has proven to be very stable.

- Canada is cheap (relatively speaking) -- The S&P500 is currently trading at over 24 times earnings, which is deemed to be very expensive. The S&P/TSX composite (Canada’s main index) is trading at less than 18 times earnings. Bargain.

- Power of immigration -- Canada has historically high immigration numbers, as evidenced by the demand for property (increase in values) in the few metropolitan areas. Conversely, the U.S. is at its historic low for immigration. An increase in population means an increase in demand for goods and services country-wide. This has always been the roots to a successful country and economy over the long run.

|

Michael Connon B.Sc, CFP

Senior Financial Planning Advisor, Co-Branch Manager

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

|

|

|

DEEP DIVE DEEP DIVE

In Depth Article – Heavy on the facts and details definitely for the committed reader.

Lifestyle

CNBC: "Wall Street braces for more volatility ahead: 'It could go up huge or it could go down huge'"

Really? Stocks could go up huge or go down huge?!?! Thanks for the sage investment advice,

CNBC.

It floors me to know that there are still people out there who rely on fear-mongering articles,

such as this, to help guide their investment decisions.

There is literally no new information in this article. Yes, there is a US presidential election

occurring in 2020. Yes, Bernie Sanders is gaining ground in the race for the Democratic Party

Presidential candidacy. Yes, numbers for people infected with the coronavirus is increasing.

Yes, the UK has officially left the EU. Currently, these “headlines” are dominating people’s

inboxes or their notifications are blowing up people’s cell phones. So, how should you react?

Ask yourself, did your initial investment strategy ever call for knee-jerk reactions in the case that

any one of the above-mentioned events occur? I highly doubt it.

My suggestion for the impending “extreme volatility”: grab a coffee or tea, find a chair, open your

favourite book and enjoy! Sleep, wake up and repeat. Trust in the fact that your investment

strategy of a globally, diversified portfolio will perform much better if left untouched, especially

during the very profound, aforementioned market outlook.

|

Carlo Cansino FMA, FCSI, CFP

Senior Financial Advisor

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

|

|

Millennial MOMENT Millennial MOMENT

Light Read – Need to know information for the Millennial in you

Millennial Moment

How technology is shaping the future of our education system

Technology continues to change the way we live. Soon it will be changing the way our children learn. This article from visual capitalist shows how education is becoming tailored to fit the need of technology to prepare children for the 'real world'. Read a bit more about this here.

|

John Iaconetti B.A.S., Spec. Hons. Administrative Studies (Finance)

Financial Advisor

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

|

|

|

LIFESTYLE LIFESTYLE

Light Read – Fun and Enjoyable!

Lifestyle

RRSP or TFSA?

Which is best for at your age?

It's often hard enough to save, but now you need to figure out which account is best for you. This is a handy article which explains which would be best for you depending on a few personal factors. Read a bit more about this here.

|

Michael Ams B.Com.

Strategic Associate

The McClelland Financial Group of Assante Capital Management Ltd. |

|

|

|

This Tax Season

Let Us Do the Heavy Lifting

TMFG Tax Service

TMFG TAX SERVICE

Personal............................................... $199

Self -Employed.................................... $249

Estate................................................... $249

Corporate .......................................... $499

Student.................................................. $99

* Student - full time student no investments

* Adjustment, Rental Property, HST, Tax Return Review, Refiling are subject

to additional fees.

Contact Michelle Moniz @ 905-771-5200 ext. 223 or email [email protected]

New to Our Tax Service?

Tax Preparation Checklist

Certain employees of The McClelland Financial Group maintain a relationship with Assante Capital Management Ltd. (“Assante”) through which they sell investment products. The relationship that they have with Assante does not include tax preparation services which The McClelland Financial Group is solely responsible. The McClelland Financial Group is not associated in any way with Assante, and Assante has no responsibility for the tax preparation services offered by The McClelland Financial Group.

|

|

|

|

THINK SMART

THINK SMART

Podcast – Listen to Mike and Rob and their latest thoughts and industry insights

Think Smart

Coronavirus Correction:

Where Does It Leave You?

The stock market is down 15%. We’re seeing the effects of Coronavirus and supply chain disruption. What do the markets look like during this time? Will we finally go into a recession? This and more today on ThinkSmart

LISTEN TO THIS PODCAST |

|

|

Ask TMFG

What's The Difference Between A Tax Free Savings Account And A Tax Free Investment Account

|

|

|

Reduce your 2020 taxable income!

Contribute to your RSP

before March 2nd 2020

|

|

|

|

|

|

Assante Capital Management Ltd. is a Member of the Canadian Investor Protection Fund and Investment Industry Regulatory Organization of Canada. This material is provided for general information and is subject to change without notice. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please make sure to see me for individual financial advice based on your personal circumstances. Insurance products and services are provided through Assante Estate and Insurance Services Inc.

Commissions, trailing commissions, management fees and expenses, may all be associated with mutual fund investments. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. Please read the Fund Facts and consult your Assante Advisor before investing.

Certain employees of (TMFG Tax Service) maintain a relationship with Assante Capital Management Ltd. (“Assante”) through which they sell investment products. The relationship that they have with Assante does not include tax preparation services which (TMFG Tax Service) is solely responsible. (TMFG Tax Service) is not associated in any way with Assante, and Assante has no responsibility for the tax preparation services offered by (TMFG Tax Service).

*Please note that a live recording may be conducted at our workshops. Consent will be obtained, should you be captured in the video.

**All personal information will only be used in accordance with your consent, and in compliance with Assante's Privacy Policy.

Let's keep communicating. We value our relationship with you and want to stay in touch, whether it's regarding events or newsletters. In brief, The McClelland Financial Group aims to provide you with information that is relevant to you. As you are likely aware, on July 1, 2014 Canada's Anti-Spam Legislation (CASL) came into force which requires your consent to receive electronic communications.

If we do not receive an unsubscribe email from you we will continue e-communications under the implied consent provisions under CASL. **

|

|

|