|

|

|

|

|

|

McClelland University

Big Speakers Big Ideas!

Eagles Nest Golf and Country Club

Friday, April 27, 2018

Registration 8:00am

Continental Breakfast and Lunch Buffett

|

Erin Bury

Managing Director Eighty-Eight creative communications, technology guru, weekly tech commentator on CTV news and regular column in the Financial Post. |

|

Julie Daniluk

As featured on “The Social” Julie Daniluk RHN is a leading nutritionist and the co-host of Healthy Gourmet, a reality cooking show on OWN (the Oprah Winfrey Network). For twelve years, she was a co-operative owner and the Chief instore Nutritionist for one of Canada's largest health food stores, The Big Carrot Natural Food Market.

|

|

Jamie Cohen

The Handwriting expert. What does your handwriting say about you...find out.

Featured in Forbes, TEDX and resident expert on “The Social”.

He is The Recipient of the TED-Huffington post international teaching award and Dale Carnegie award for public speaking. Jamie brings this entertaining and intriguing subject to life. |

|

Rob McClelland

Rob is the founder of The McClelland Financial Group and a Senior Financial Planner and Co-Branch Manager of Assante Capital Management Ltd. Rob McClelland holds an Honours degree in Business Administration University of Western Ontario’s Richard Ivey School of Business.

A prolific speaker and finance educator, Winner of the Wealth Professional Top Advisor Award ranking 7th in Canada. Rob has been a featured guest on ‘Report on Business’ and has written for the Canadian-acclaimed newspaper, the Financial Post. |

|

Christian Newton

Christian Newton helps financial advisors leverage Dimensional's capital markets research and its application to portfolio and practice management.

Previously, Christian spent 10 years in Dimensional's Marketing group, serving variously as art director, head of interactive, and vice president of marketing, with a focus on creating materials for financial advisors.

Christian experienced the first wave of internet growth working at consulting conglomerate USWeb/CKS. He holds a BA in history from the University of Massachusetts at Amherst. His online writing has been profiled in the New York Times and Entertainment Weekly. |

RSVP

[email protected]

Call 905-771-5200 x229

|

|

|

The End Of Cryptocurrency

For those of you who know me, know that I love the study of economics, not economists, but the science behind how the world works, financially. This being the case, I get many questions about cryptocurrency, Bitcoin and Blockchain. Firstly, let me brief you on the terminology. Cryptocurrency is a general term for any of the electronically traded currencies that have now become part of the mainstream. Bitcoin is the first and most recognizable of them. Note, there are many more and new ones that continue to be created. Generally speaking, Blockchain is the electronic accountant ledger procedure that allows these currencies to exist. I won’t go into too much detail about how this works as it takes some time to wrap your mind around. What I want to address is the future of the cryptocurrency.

Let’s start with the main advantage of cryptocurrency. Anonymity. Cryptocurrency transactions happen in a world of numbers, not names. This can keep governments out of all transactions. Making it an obvious choice for funding many illegal activities; Ransomware, drug transactions and arms trading can exist in a world where governments cannot follow a paper trail. The second main advantage for using cryptocurrency is to avoid paying taxes. The governments do not see the financial transactions, and therefore have no way to collect tax on these transactions. Supporters of cryptocurrency will claim that it is necessary to keep financial institutions out of financial transactions, but I tend to believe that it is more the former.

Let’s take a scientific approach to the future of cryptocurrencies. Instead of looking at what happens if they don’t work, let’s look at what would happen if they do. The best way to test a hypothesis is to expand it and look for cracks. For this exercise we will assume the world has embraced the idea of cryptocurrencies and would rather transact on this level rather than using government-issued currencies. So, what is the problem?

The problem is that governments all over the world have no way to raise tax revenue. All financial transactions are now invisible. No taxes may sound ideal but it also means no hospitals, no police, no firemen, no governments, no money for the democratic process of elections and no military. Countries would be controlled by dictators with the most power. Does this sound like a good future? China and South Korea have already outlawed the use of cryptocurrencies and as time goes on, other governments will follow suit.

In my opinion, cryptocurrency is the biggest pyramid scheme of the decade and like all pyramid schemes, they are based on the biggest loser. Simply put, an individual hopes to profit off someone that is willing to pay more, before passing it off. The cycle continues until you finally run out of people on the losing end of the transaction. It is like a giant game of musical chairs. At one point the music will stop and there will be no chairs left. My advice to clients has been, and always will be, to not get involved because you don’t want to be the one left standing when the music stops.

|

|

|

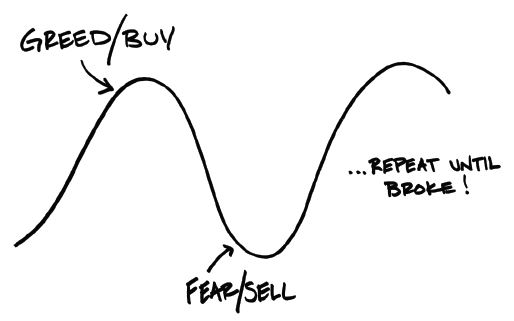

Hop Off Investing's Emotional Rollercoaster

Investors are the same. Regardless of tax bracket, gender, political affiliation or race, we all share one thing in common: we become emotional when the market is volatile.

Everyone who went through (and financially survived) the 2008/2009 global market meltdown can attest to having their faith in the market and discipline in their plan, tested. We all have our own story of how that period of time either made us weaker or stronger.

Click here for the story of an individual whom, through the help of a good financial advisor, has transformed his view on investing and how he navigates through market uncertainty.

|

|

|

Are You Filing Your Own Tax Return?

It is beneficial for any individual to know and understand Canada’s tax system. We believe and encourage all our clients, especially our newest tax paying clients, to gain an understanding of the tax system. A great place to start is by taking CRA’s online course “Learning About Taxes.” The earlier you learn, the earlier you can start taking advantage of all the various tax credits and deductions that are available to you.

Although we do encourage our clients to educate themselves, we also recommend using a tax professional. A tax professional keeps up to date with the ever changing and complex tax system, and can help you with some tips and tricks that you may not have been aware of. Some may shy away from using a tax professional thinking that their situation is quite simple and thus do not warrant the expense of a professional. Using a tax preparer does not need to be costly and in fact, could improve the results of your return.

If you are not already working with a trusted professional, we suggest contacting our office to learn more about TMFG Tax Service. Here at The McClelland Financial Group, we work with a third-party tax preparer who has 32+ years of experience in tax preparation services. Over the past several years of working with Mark, we are confident in his expertise of tax laws and liabilities, as well as his ability to complete returns as timely and accurately as possible. Our tax coordinator Gala Pazin is the first point of contact for our clients using the tax service. She meets with clients to ensure all their needs have been communicated, and that all pertinent tax information i.e. income slips, medical receipts, and donations have been included in their tax package. Once this information is passed along to Mark, he completes the returns in the best interest of our clients. Our goal is to ensure your happiness with our services, because at The McClelland Financial Group, your success is our success.

If you are interested in learning more about TMFG Tax Service, please do not hesitate to contact Gala Pazin at [email protected], or 905-771-5200 ext. 231.

|

|

|

This Tax Season Let Us

Simplify and Enhance Your Life

TMFG Tax Service

Contact Gala Pazin

905-771-5200 ext. 231

[email protected] |

|

|

In Case You Missed It..

Watch The Video

Paul McVean

BAccS, CPA, CGA, CFP, TEP

Discusses "Tips and Tricks" for this upcoming tax season and new legislation for corporate tax.

Watch The Video |

|

|

|

|

|

Assante Capital Management Ltd. is a member of the Canadian Investor Protection Fund and is registered with the Investment Industry Regulatory Organization of Canada. This material is provided for general information and is subject to change without notice. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please make sure to see me for individual financial advice based on your personal circumstances. Insurance products and services are provided through Assante Estate and Insurance Services Inc.

Commissions, trailing commissions, management fees and expenses, may all be associated with mutual fund investments. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. Please read the Fund Facts and consult your Assante Advisor before investing.

Certain employees of (TMFG Tax Service) maintain a relationship with Assante Capital Management Ltd. (“Assante”) through which they sell investment products. The relationship that they have with Assante does not include tax preparation services which (TMFG Tax Service) is solely responsible. (TMFG Tax Service) is not associated in any way with Assante, and Assante has no responsibility for the tax preparation services offered by (TMFG Tax Service).

*Please note that a live recording may be conducted at our workshops. Consent will be obtained, should you be captured in the video.

**All personal information will only be used in accordance with your consent, and in compliance with Assante's Privacy Policy.

Let's keep communicating. We value our relationship with you and want to stay in touch, whether it's regarding events or newsletters. In brief, The McClelland Financial Group aims to provide you with information that is relevant to you. As you are likely aware, on July 1, 2014 Canada's Anti-Spam Legislation (CASL) came into force which requires your consent to receive electronic communications.

If we do not receive an unsubscribe email from you we will continue e-communications under the implied consent provisions under CASL. **

|

|

|