2022 will be remembered as the year of rising interest rates in our economy. Canada has led the charge globally, increasing its interest rates at a torrid pace. The reason for this interest rate increase stems from our inflation issue. Inflation in Canada at its highest point was 8.1%, approximately 4X higher than it has been on average in recent history.

Inflationary issues originated with the pandemic, and our response to it, from quarantines and government benefits to supporting our population during this time. The supply of goods and services was low due to quarantines and the lack of a workforce to manufacture these goods. While at the same time demand for these goods was high because government benefits injected more money into the economy. When dealing with high demand and low supply, that is the perfect environment for inflation. How can we curb demand in our economy? We raise interest rates, so the average household may spend less on “wants” because more of their budget is allocated to debt repayment.

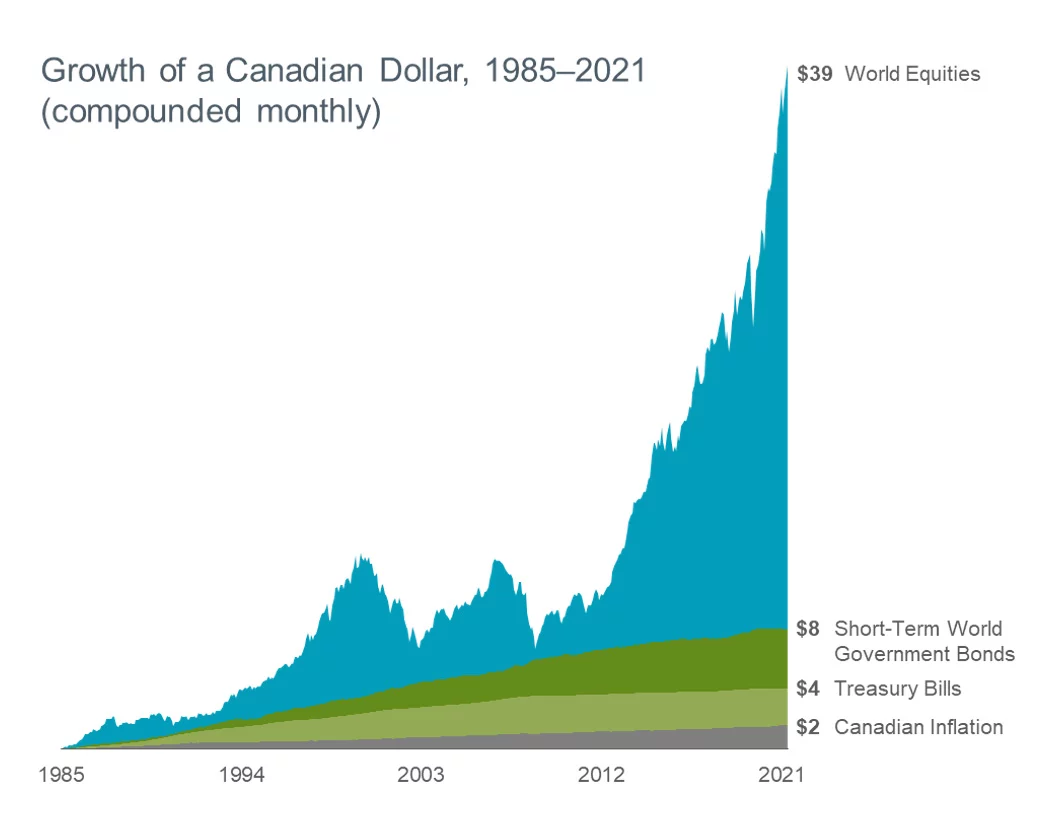

With interest rates on the rise, major stock markets worldwide are experiencing negative returns, but what has begun to be more attractive to investors is fixed-term investments like GICs. GICs pay based on the available interest rates, so their projected returns are higher than we have seen in recent history. So those who have been nervous about stock market volatility may think they can find comfort in a GIC investment. That would be a mistake. When investing, our goal is not just getting the highest return possible but choosing the investment that will exceed inflation in the long term. That has always been investing in the stock market.

We have experienced market downturns today should not be seen as the wrong time to invest. Instead, it has been the exact opposite. Basic financial principles have always told us we want to buy low and sell high; when stock markets are down like they are, that will make it the ideal time to invest. Our history tells us these periods of negative markets do not last long, so therefore this opportunity will not present itself forever. The recovery will happen; it is just a matter of “when” if you are invested in a globally diversified portfolio.

Investing in a globally diversified portfolio, made up of thousands of companies in different countries and industries worldwide, is the only way to guarantee we will stay ahead of inflation. Choosing the correct investment is not difficult; however, staying disciplined during the stock market swings is. That is why you work with professionals like us. We look beyond the headlines and the fears of the day-to-day but instead stay focused on your long-term goals.