If you read our last Educated Investor article, you may have noticed that I’m fond of translating what can otherwise be complex financial theory into digestible batches of three – such as three kinds of investors and three kinds of savers/spenders. Today, as we continue to explore the insights I’ve found most important in my 25 years as a financial professional, I’d like to share what I call the Three T’s of Successful Investing.

Insight #3: The road to investment success is paved with Three T’s: Training, Temperament and Time.

Success Strategy Number 1: Training

Training is only the first step in knowing your way around the Canadian and global markets, but it’s an important one.

With formal training, comes understanding and insight into how our markets operate – in theory as well as in evidence-based practice. When training is missing from an investor’s trading activities, it tends to be replaced by guesswork and gut reaction. This leaves you forever in doubt, vulnerable to chasing breaking news, tips from friends and neighbors, and pitches from financial salespeople who may not have your best interests at heart.

If you’re lucky, you may still make money anyway. But luck is not much of an investment strategy. The never-ending stress inherent to such an approach is both unpleasant and unnecessary. With training, it’s considerably easier to bring calm clarity to your financial decisions.

To address this first “T” to successful investing, we offer our own seasoned training by employing our Registered Financial Planner (RFP), CERTIFIED FINANCIAL PLANNER (CFP®) and additional credentials. We also emphasize financial literacy as a cornerstone of our client experience, so our clients can be equal, informed partners in their financial success.

Success Strategy Number 2: Temperament

While adequate training can go a long way toward strengthening frazzled financial nerves, you also are best served when you have the temperament to ignore the daily distractions that impede your path to success, focusing instead on sticking to a solid, long-term plan.

The truth is, investing can bring out our worst impulsive tendencies. Even though we may know that staying a prudent course is the most rational approach for building long-term wealth, the temptation to “do something” in turbulent markets is hard to overcome.

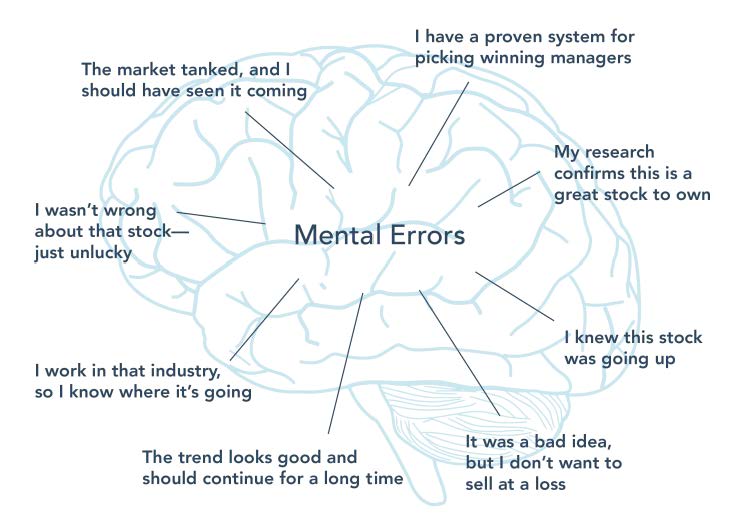

In fact, these tendencies are not only strong, they’re so ingrained that our own brains can trick us into believing we’re making entirely rational decisions when we are in fact being overpowered by ill-placed, “survival of the fittest” instincts.

Behavioural finance studies this relationship between our heads and our financial health. Wall Street Journal columnist and author Jason Zweig provides a guided tour on the subject in his book, “Your Money and Your Brain*,” describing the biased behaviours themselves as well as what happens to generate them. To name a couple of the most obvious examples:

- When markets tumble – Your brain’s amygdala floods your bloodstream with corticosterone. Fear clutches at your stomach and every instinct points the needle to “Sell!”

- When markets soar – Your brain’s reflexive nucleus accumbens fires up within the nether regions of your frontal lobe. Greed grabs you by the collar, convincing you that you had best act soon if you want to seize the day. “Buy!”

Humans Are Not Wired for Disciplined Investing

Fortunately, we believe that a patient temperament can be an acquired skill, even if it doesn’t come naturally. By heeding the available evidence, you can learn to identify when you are falling prey to your own biases, so you can shift the odds back in your favour. It also helps to have an objective third party to point out the ones you might be missing. This is another way we seek to enhance our clients’ financial well-being.

Success Strategy Number 3: Time

Last but not least, even efficient investing takes time. It takes time to create a personalized plan that reflects your unique financial goals and risk tolerances. It takes time to translate those best-laid plans into a well-managed portfolio, optimized to offer your greatest odds for success. It takes time to keep that portfolio adherent to your disciplined plan. When your personal goals or circumstances change, it takes still more time to adjust your plan and your portfolio accordingly.

Thus, even for investors who are willing and able to tackle Training and Temperament on their own, there’s a valid question to consider: Don’t you have better things to do with your time?

If you enjoy spending time building and managing your financial future while adhering to the tenets of evidence-based investing, that’s great. If you could use assistance with any or all of the Three T’s of Successful Investing … that’s what we’re here for.

Rob McClelland

Senior Financial Planner and Branch Owner

The McClelland Financial Group of Assante Capital Management Ltd.