Advisor.ca:

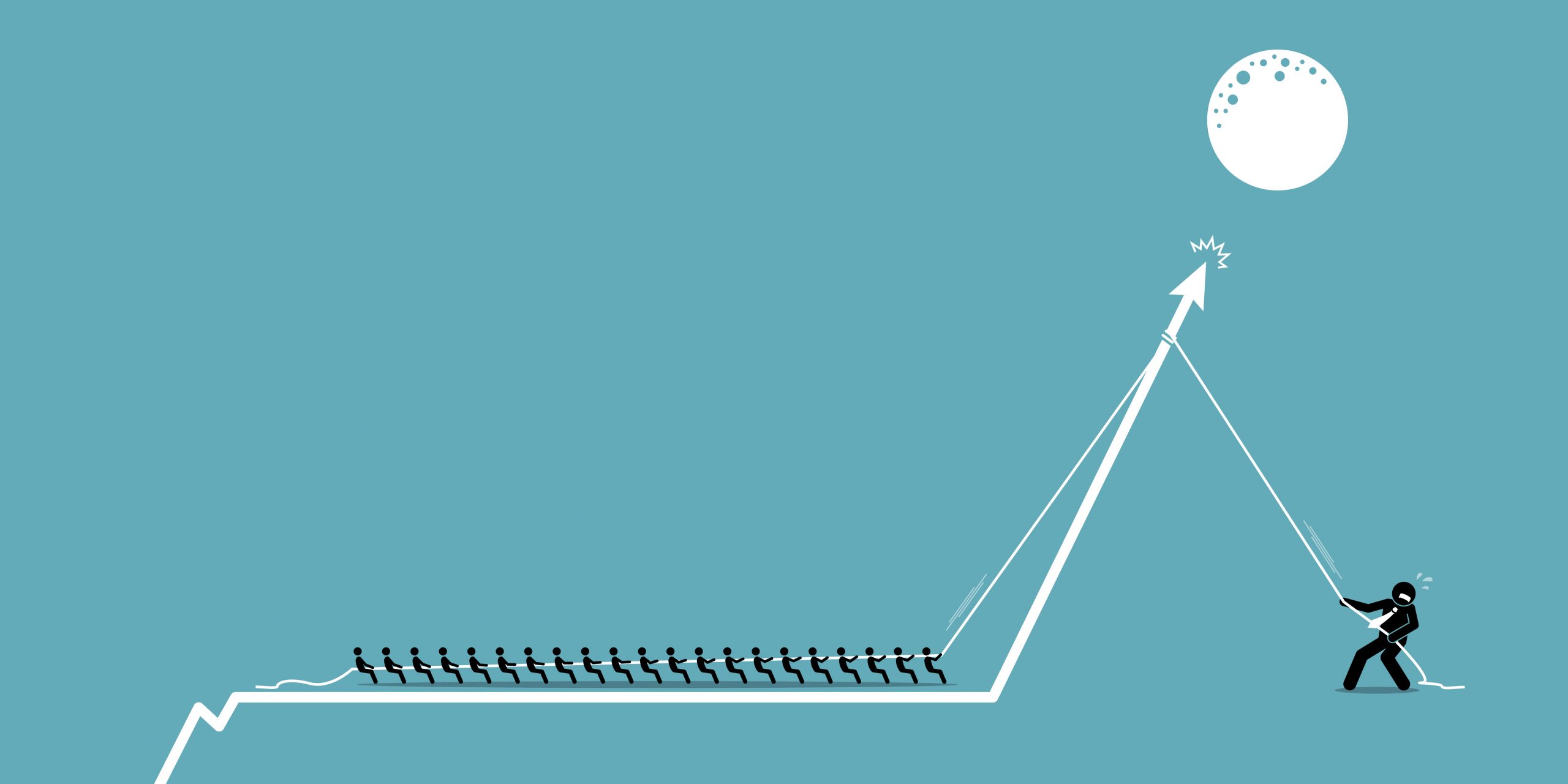

“The Russell 2000 Index has more than tripled the gains of S&P 500 in the last three months.

Small stocks are delivering the biggest punch on Wall Street.

Over the last three months, an index that tracks 2,000 of the smallest stocks in the U.S. market has more than tripled the gains of the big-cap S&P 500. The rally for the Russell 2000 got going Nov. 9 as a swell of optimism for the economy rose after Pfizer reported resoundingly encouraging data for its coronavirus vaccine and Joe Biden’s White House victory sparked hopes for more stimulus for the economy.

It marks at least a temporary return to form for smaller stocks, which have historically provided bigger returns than large-cap stocks over the long term.

The Russell 2000 currently includes stocks like Bank7, a community bank based in Oklahoma with a market value earlier this week of about $150 million, and fuel-cell maker PlugPower, whose market value shot from less than $6 billion in October to more than $33 billion earlier this week. The median company in the large-cap S&P 500 has a market value of about $26 billion.”