|

|

|

|

|

|

|

|

Young Families»

Who wants to be a millionaire?

Ron and Janet were typical new Canadians, arriving in the country in 1983, and looking to a create a life of opportunity for themselves and eventually their children. Having arrived at a time when it was difficult to acquire employment in their fields of study, Ron settled for a labourer job while Janet stayed at home. Ron and Janet were typical new Canadians, arriving in the country in 1983, and looking to a create a life of opportunity for themselves and eventually their children. Having arrived at a time when it was difficult to acquire employment in their fields of study, Ron settled for a labourer job while Janet stayed at home.

Ron and Janet were wise and ambitious. Having come from homes of meager means, they understood the value of a dollar and did not waste a penny of Ron's income. Determined to save and invest half of Ron's earnings, they maintained a relatively frugal lifestyle. Although, they watched their pennies, they never went without. They were diligent about only purchasing for their needs, rarely succumbing to the temptation of their wants. It was difficult, but they continued this lifestyle for the next 2 years until 1985, when Meaghan was born.

Rarely do you hear people say that children help reduce monthly living expenses. Ron and Janet's situation was no exception, however, Ron continued to work at his job, earn a paycheck and set aside savings. Predating The Wealthy Barber by a couple of years, Ron had already adopted a sort of pay yourself first mentality. With every paycheck he received, he immediately took a percentage and invested it before any other expense. They continued living this way for another couple of years until Ron Jr. came along. Here were Ron and Janet, fairly new to the country, two young children, yet starting to accumulate wealth through diligent saving and expense control.

With each passing year, they see their portfolio value fluctuate in the short-term, but show a consistent long-term growth trend. The very reason their portfolio will grow over the long-term is also causing short-term anxiety, yet Ron & Janet do not waiver and continue their investment strategy.

As Ron's employment income increased, so did his savings. Any additional income earned (i.e. overtime, performance bonus, etc.) went to their investments. Fast forward to 2017 and 34 years of disciplined investing later, Ron and Janet have broken the $1M threshold. For many, a million dollar portfolio is a pipe dream, only realized by the fortunate and inherited rich. But Ron and Janet are an example of how regular, uninterrupted investments, into an appropriate market portfolio, can make millionaires out of the patient, disciplined investor.

Michelle Moniz,

Associate Financial Advisor

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

|

DFA»

Investment Shock Absorbers

Ever ridden in a car with worn-out shock absorbers? Every bump is jarring, every corner

stomach-churning, and every red light an excuse to assume the brace position.

Owning an

undiversified portfolio can trigger similar reactions. In a motor vehicle, the suspension system keeps the tires in

contact with the road and provides a smooth ride for passengers

by offsetting the forces of gravity, propulsion, and inertia.

You can drive a car with a broken suspension system, but it

will be an extremely uncomfortable ride and the vehicle will

be much harder to control, particularly in difficult conditions.

Throw in the risk of a breakdown or running off the road

altogether and there's a real chance you may not reach

your destination.

CLICK HERE TO READ MORE...

|

|

|

Management Expense Ratio »

A Class vs. F Class, what does that even mean?

Even with the new regulations for "CRM2" (the investment industry's answer to transparency of fees and rate of return) in place, are many of you still unsure of how your advisor is compensated and what you are paying in total fees? Even with the new regulations for "CRM2" (the investment industry's answer to transparency of fees and rate of return) in place, are many of you still unsure of how your advisor is compensated and what you are paying in total fees?

If so, then don't worry, you are not alone. I will provide you the difference between these two classes of mutual funds, which has entirely to do with advisor compensation, and nothing else.

A Class

- Management expense ratio ("MER")

- Advisor will receive a commission payment upon client investment (i.e. front end, deferred sales charge, low load)

Front End:

- Advisor and client negotiate an upfront commission between 0% - 5% of investment amount

- Client investment is net amount, after commission is paid to advisor

Deferred Sales Charge:

- Advisor receives a commission from mutual fund company upon client investment (typically 5% of investment amount)

- Client must keep their money with that mutual fund company for a period of time (typically 7 years); if they withdraw any money within that time frame, then they pay a fee to the mutual fund company (client is reimbursing the mutual fund company for the commission that was originally paid to the advisor upon initial investment)

Low Load:

- Same form of commission as the Deferred Sales Charge, but commission upfront to advisor is less (typically 2%) and holding period is shorter (typically 3 years instead of 7)

- Advisor will receive an ongoing "trailing" commission as long as the client's money stays with the mutual fund company (portion of the MER)

F Class

- Management expense ratio ("MER")

- Advisor does not receive commission upon client investment

- Advisor does not receive an ongoing "trailing" commission from the mutual fund company

Advisor is paid by the client directly (typically as a percentage of the assets under management)

Under CRM2, investment dealers are only obligated to disclose the dollar amount that is for advisor compensation, whether it be from the client directly or the mutual fund company. With A Class mutual funds, the "trailing" commission paid to the advisor is the amount that will appear on your ongoing statements from your investment dealer. With F Class mutual funds, the amount that the advisor receives from your account directly will appear on your ongoing statements from the investment dealer.

There is still a portion of the fees that you pay that are not obligated to be disclosed under CRM2. This is the part of the MER that goes directly to the mutual fund company as their compensation for managing the mutual fund. We believe that this shortcoming of CRM2, and its goal of total fee disclosure, will be addressed shortly.

Carlo Cansino,

FMA, FCSI, CFP

Senior Financial Advisor

The McClelland Financial Group of Assante Capital Management Ltd.

|

|

|

Financial Post»

As the RRSP deadline looms, here's what all the procrastinators need to know

Despite the blitz of media articles and advertising reminding investors of the looming RRSP deadline (it's Wednesday, March 1, 2017), you just haven't got around to making this year's contribution. Come to think of it, it's been a few years now since you did so, which means you have a ton of contribution room available. Despite the blitz of media articles and advertising reminding investors of the looming RRSP deadline (it's Wednesday, March 1, 2017), you just haven't got around to making this year's contribution. Come to think of it, it's been a few years now since you did so, which means you have a ton of contribution room available.

While RRSP room is not a "use it or lose it" proposition — you can always carry forward unused room to another year — what you are losing out on is the chance to lower your taxable income each calendar year; and it also means you are not maximizing the opportunity to compound your investments tax free.

CLICK HERE TO READ MORE...

Jonathan Chevreau is founder of the Financial Independence Hub and co-author of Victory Lap Retirement.

|

|

|

Financial Planning »

Are your retirement goals a dream or a reality?

CLICK HERE TO WATCH 2 MIN VIDEO CLICK HERE TO WATCH 2 MIN VIDEO

Creating a financial plan is the first step in securing a successful retirement. Similar to constructing a home, the end result is achieved when a blueprint is created and followed to completion. Your retirement is no different. Start with determining what you want retirement to look like, create the plan and then follow the steps to get there.

Speak with one of our

Certified Financial Planner Professionals today

by contacting Michelle Moniz at [email protected] or

calling 905 771 5200. |

|

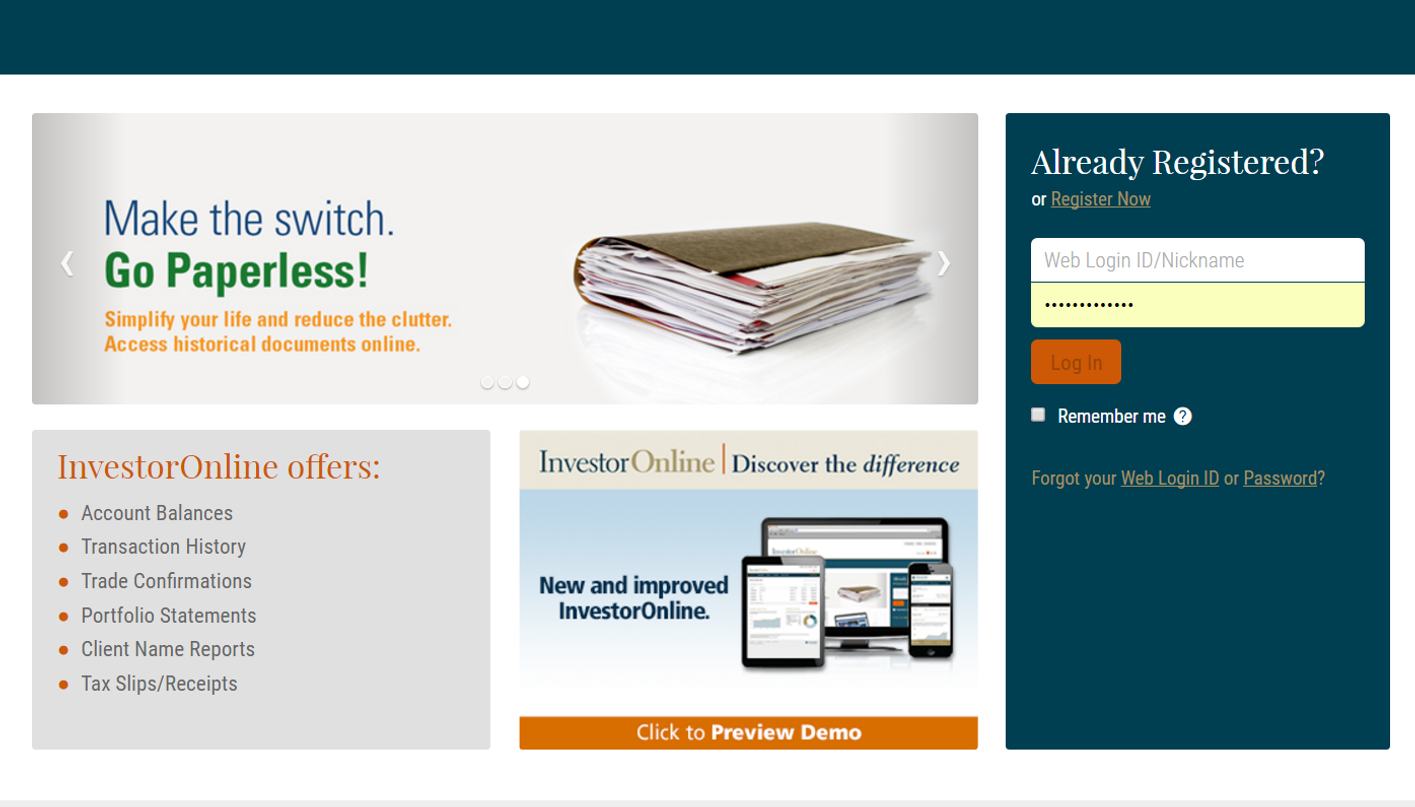

Assante Investor Online»

Get your

documents online...

CLICK HERE TO READ MORE... CLICK HERE TO READ MORE...

InvestorOnline offers:

- Account Balances

- Transaction History

- Trade Confirmations

- Portfolio Statements

- Client Name Reports

- Tax Slips/Receipts

Socheata Chea

905 771 5200.

|

|

|

|

Financial Advice »

The Value Of

Financial Advice

Why should you hire a financial planner? What makes The McClelland Financial Group stand out from the crowd?

Co-owners of The McClelland Financial Group, Rob McClelland and Mike Connon, outline why our clients hire us, continue to work with us and the environment we create for them.

Not a client of

The McClelland

Financial Group?

|

|

Tax Free Savings Account»

2017 Contribution

limit is $5,500

Contribute to your Tax Free Savings Account early to thrive from tax free growth

Click here to learn how you can contribute.

Michelle Moniz

905 771 5200.

|

|

|

|

|

|

|

Assante Capital Management Ltd. is a member of the Canadian Investor Protection Fund and is registered with the Investment Industry Regulatory Organization of Canada. This material is provided for general information and is subject to change without notice. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please make sure to see me for individual financial advice based on your personal circumstances. Insurance products and services are provided through Assante Estate and Insurance Services Inc.

Commissions, trailing commissions, management fees and expenses, may all be associated with mutual fund investments. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. Please read the Fund Facts and consult your Assante Advisor before investing.

*Please note that a live recording may be conducted at our workshops. Consent will be obtained, should you be captured in the video.

**All personal information will only be used in accordance with your consent, and in compliance with Assante's Privacy Policy.

Let's keep communicating. We value our relationship with you and want to stay in touch, whether it's regarding events or newsletters. In brief, The McClelland Financial Group aims to provide you with information that is relevant to you. As you are likely aware, on July 1, 2014 Canada's Anti-Spam Legislation (CASL) came into force which requires your consent to receive electronic communications.

If we do not receive an unsubscribe email from you we will continue e-communications under the implied consent provisions under CASL. **

|

|